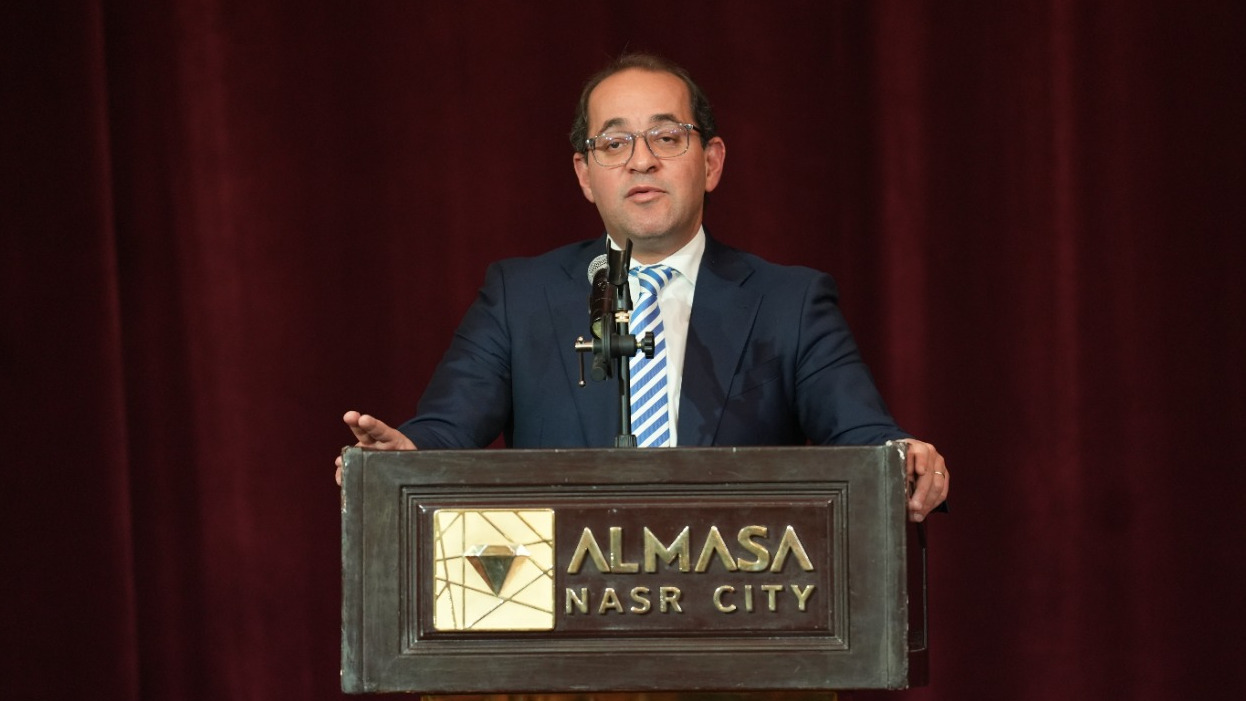

Ahmed Kouchouk, Egypt’s Minister of Finance, affirmed that the government is extending “a hand of trust, partnership, and support” to the tax community in the best interest of the country. He emphasized that the top priority is “taxpayer satisfaction” by delivering fair and incentivizing tax services for all.

Egypt’s Commitment to Taxpayer-Centric Tax Reform

During an open dialogue with tax leadership and executive members across tax offices nationwide, Kouchouk stated: “I have unlimited confidence in your ability to achieve continuous progress and to improve the tax system for the better.” He highlighted that the meticulous implementation of tax facilitation measures serves as the first step in building trust with the business community.

Supporting Egyptian Tax Authority Staff to Improve Service Delivery

Addressing Egyptian Tax Authority employees, he added: “I will be with you and among you in all centers and tax offices to overcome any on-ground challenges,” stressing that investing strongly in human capital is key to enhancing the efficiency of the tax system.

Positive Developments in Egypt’s Tax Authority Perception

Sherif El-Kilany, Deputy Minister for Tax Policies, noted that perceptions of the Egyptian Tax Authority have started shifting positively. He explained that the first package of tax facilitation measures has created a sense of optimism among the business community.

Elevating Egypt’s Tax System to Global Standards

Rami Youssef, Assistant Minister for Tax Policies, pointed out that Egypt has a real opportunity to elevate

its tax system to global standards. He stated that efforts will focus on enhancing the capabilities of tax employees based on the latest international expertise.

Leadership Engagement in the Egyptian Tax Workforce

Rasha Abdel Aal, Head of the Egyptian Tax Authority, expressed her pride in the enthusiasm of her colleagues from leadership and staff toward development. She emphasized the importance of building a tax system rooted in strong partnerships with both existing and new taxpayers.

Addressing Practical Challenges in Egypt’s Tax System

Adel Abdel Fadil, Chairman of the Manpower Committee in the House of Representatives and President of the General Syndicate of Finance, Tax, and Customs Workers, commended the Minister of Finance for his dedication to engaging with all levels of employees within the Egyptian Tax Authority. He stressed that understanding the daily challenges faced by tax professionals is essential in driving progress, fostering change, and strengthening partnerships, trust, and confidence in the tax system.

Opinion: A Strategic Step Toward Transparency and Stability

The Egyptian Ministry of Finance’s approach to open dialogue with tax officials reflects a strategic commitment to fostering transparency and collaboration. By prioritizing taxpayer satisfaction and investing in human capital, the government is setting the stage for a more efficient and business-friendly tax environment. If these measures are effectively implemented, they could play a crucial role in reshaping the tax landscape and strengthening economic stability in Egypt.