-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

-

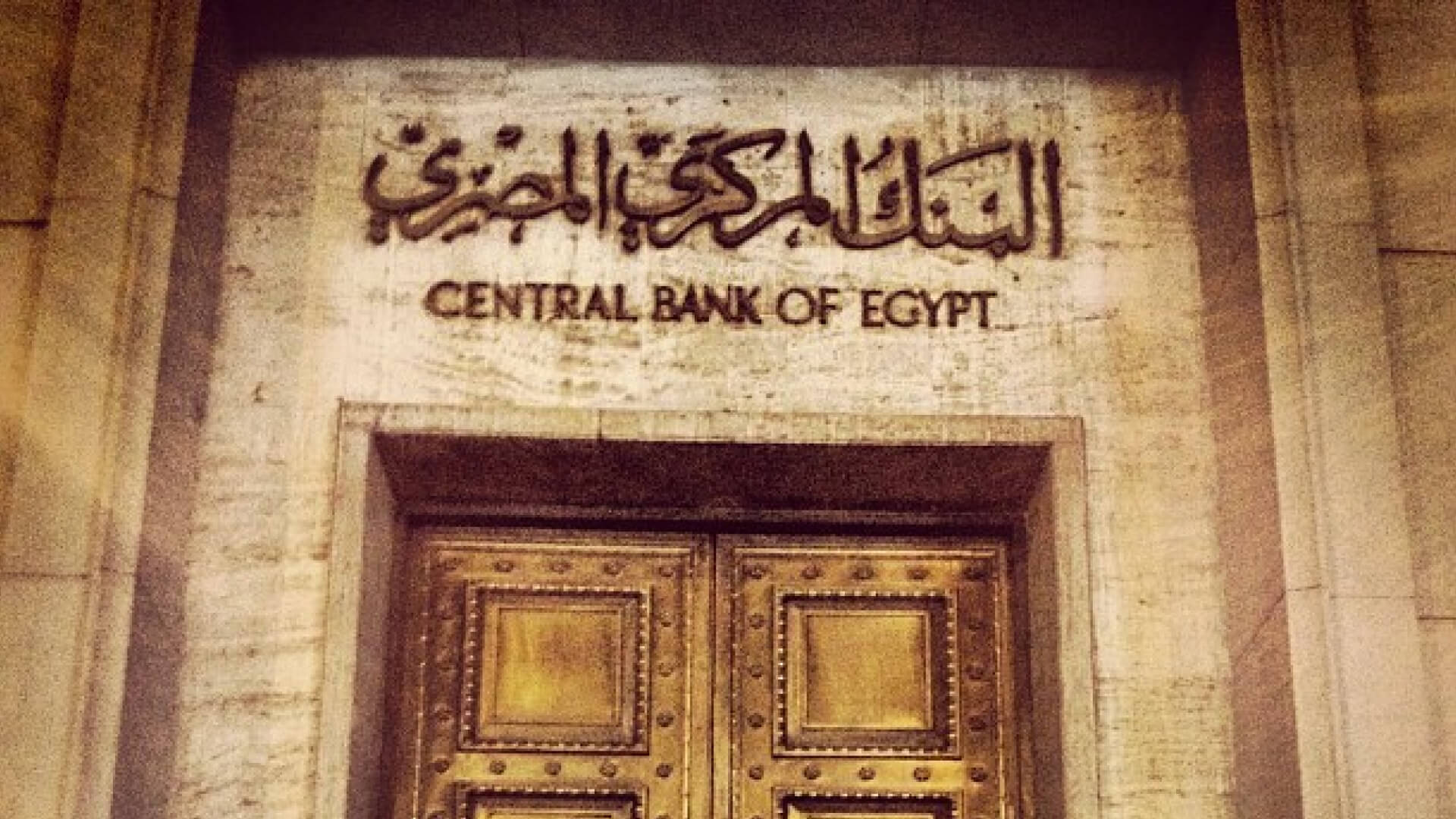

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

TaxSpoc.com

Taxspoc is your Single Point of Contact for global and local tax news, providing clear, logical, and well-organized tax information.

We deliver timely updates and expert analysis on tax regulations worldwide, ensuring you stay informed and compliant.

Whether you are a professional, an organization, or an individual, Taxspoc is dedicated to being your trusted resource for all things tax-related.

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

America First Trade Policy: A New Strategy for Economic Growth and Security

White House publishes memorandum that sets deadlines for various investigations…

-

Egypt And The Sultanate Of Oman Convention For The Elimination Of Double Taxation And The Prevention Of Tax Evasion With Respect To Taxes On Income.

Ensuring Tax Fairness and Promoting Stronger Economic Ties Between the…

-

US: IRS Commissioner Resigns on Trump´s Inauguration Date, Democrats Raise Concerns Over IRS Nominee

As IRS Commissioner Danny Werfel steps down, Trump´s Candidate Billy…

-

President-Elect Trump Announces Creation of ‘External Revenue Service’ to Collect Tariffs

President´s Inauguration date, January 20, 2025 will be the birth…

-

America First Trade Policy: A New Strategy for Economic Growth and Security

White House publishes memorandum that sets deadlines for various investigations…

-

Egypt And The Sultanate Of Oman Convention For The Elimination Of Double Taxation And The Prevention Of Tax Evasion With Respect To Taxes On Income.

Ensuring Tax Fairness and Promoting Stronger Economic Ties Between the…

-

US: IRS Commissioner Resigns on Trump´s Inauguration Date, Democrats Raise Concerns Over IRS Nominee

As IRS Commissioner Danny Werfel steps down, Trump´s Candidate Billy…

-

President-Elect Trump Announces Creation of ‘External Revenue Service’ to Collect Tariffs

President´s Inauguration date, January 20, 2025 will be the birth…

Brazil Tax Reform

Brazil’s sweeping tax reform is approaching, with a transition period set from 2026 to 2032. Corporate tax professionals at multinational companies should address the complexity and scale of these changes immediately, collaborate across functions, and implement the right technology solutions.

-

The EU has ABSTAINED in the vote on UN Resolution on Tax Cooperation

EU Released Statement calling out “serious outstanding reservations” on UN General Assembly 2nd Committee Resolution on Tax Cooperation

-

OECD Tax Revenue Trends and Insights for 2023

Recent OECD reports show average tax-to-GDP ratio among OECD countries largely stable in 2023, growing role of VAT revenues and ongoing reforms

-

France´s Electronic Invoicing Reform: Updated Guidelines from the DGFIP

Revised factsheets on the transition to mandatory electronic invoicing in France

-

Germany’s New Transfer Pricing Compliance Rules for 2025

Stricter deadlines, higher penalties effective January 1, 2015

-

European Union: ECJ Confirms that Relocating Production to Evade Tariffs Could Not Be Deemed “Economically Justified”

A Landmark Case Amidst Anticipated Tariff Turmoil: Shift to Material and Component Origin

Tax Trainings

Enhance your tax preparation skills with our tax training videos. Explore topics like desktop software, cloud-based software & more with our courses.

-

EU Released Statement calling out “serious outstanding reservations” on UN General… Watch video

-

Recent OECD reports show average tax-to-GDP ratio among OECD countries… Watch video

-

Revised factsheets on the transition to mandatory electronic invoicing in… Watch video

-

Stricter deadlines, higher penalties effective January 1, 2015 Watch video

-

A Landmark Case Amidst Anticipated Tariff Turmoil: Shift to Material… Watch video