-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

-

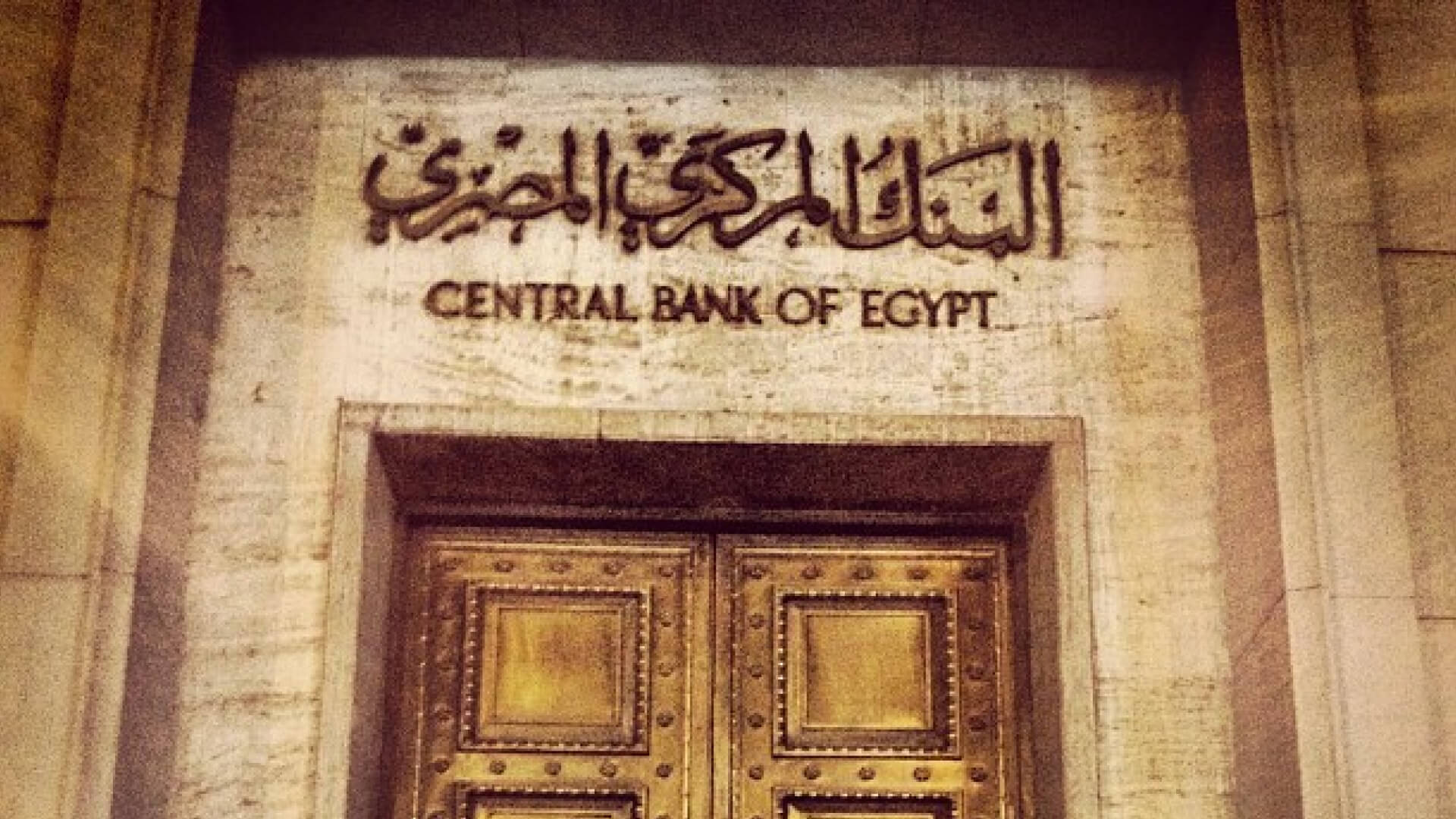

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

TaxSpoc.com

Taxspoc is your Single Point of Contact for global and local tax news, providing clear, logical, and well-organized tax information.

We deliver timely updates and expert analysis on tax regulations worldwide, ensuring you stay informed and compliant.

Whether you are a professional, an organization, or an individual, Taxspoc is dedicated to being your trusted resource for all things tax-related.

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

European Union: ECJ Confirms that Relocating Production to Evade Tariffs Could Not Be Deemed “Economically Justified”

A Landmark Case Amidst Anticipated Tariff Turmoil: Shift to Material…

-

Trump’s Tariff Proposals: A Controversial Economic Strategy

Talk of the Town on the Thanksgiving Holiday: Sweeping US…

-

Egypt: Enhanced VAT Compliance Measures for Digital Services

Egypt enforces stricter VAT rules for non-resident digital service providers,…

-

European Union: ECJ Confirms that Relocating Production to Evade Tariffs Could Not Be Deemed “Economically Justified”

A Landmark Case Amidst Anticipated Tariff Turmoil: Shift to Material…

-

Trump’s Tariff Proposals: A Controversial Economic Strategy

Talk of the Town on the Thanksgiving Holiday: Sweeping US…

-

Egypt: Enhanced VAT Compliance Measures for Digital Services

Egypt enforces stricter VAT rules for non-resident digital service providers,…

Brazil Tax Reform

Brazil’s sweeping tax reform is approaching, with a transition period set from 2026 to 2032. Corporate tax professionals at multinational companies should address the complexity and scale of these changes immediately, collaborate across functions, and implement the right technology solutions.

-

EY Reports Global Revenue of US$51.2 Billion for FY24, Highlights Strong Tax Performance

Sharp decline vs last year overall

-

Australia: Changes to Country-by-Country Local File Reporting

Effective from 1 January 2025, most significant change to CbC reporting to-date

-

EU Deforestation Law: Council Extends Application Timeline by 12 Months

The regulation will still require that products placed on or exported from the EU market are deforestation-free

Tax Trainings

Enhance your tax preparation skills with our tax training videos. Explore topics like desktop software, cloud-based software & more with our courses.

-

Sharp decline vs last year overall Watch video

-

Effective from 1 January 2025, most significant change to CbC … Watch video

-

The regulation will still require that products placed on or… Watch video