-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

TaxSpoc.com

Taxspoc is your Single Point of Contact for global and local tax news, providing clear, logical, and well-organized tax information.

We deliver timely updates and expert analysis on tax regulations worldwide, ensuring you stay informed and compliant.

Whether you are a professional, an organization, or an individual, Taxspoc is dedicated to being your trusted resource for all things tax-related.

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

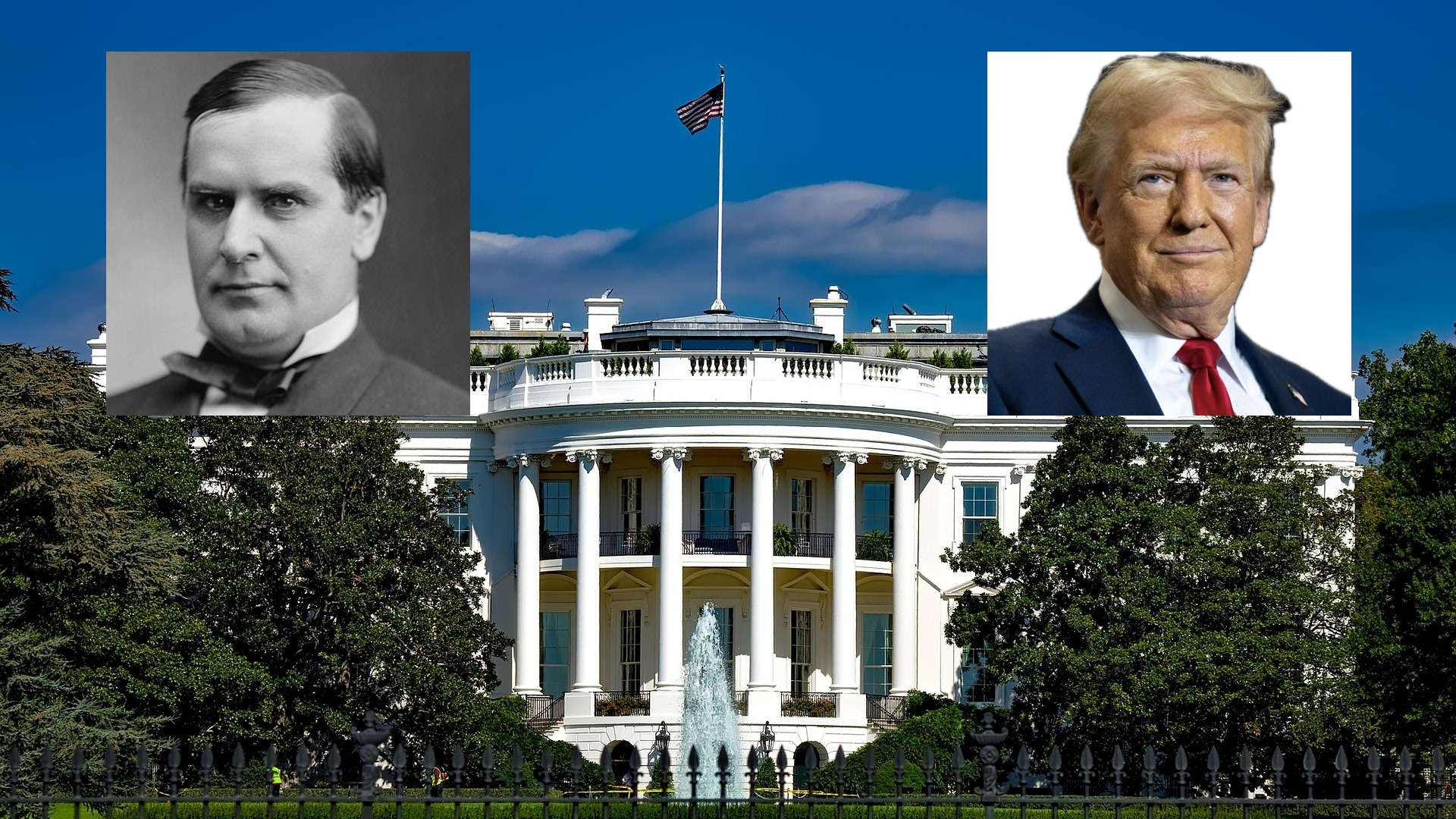

William McKinley’s Economic Policy Evolution: Lessons for Trump’s Second Term

William McKinley began with a strong stance on high tariffs…

-

Breaking News: European Union Finally Adopts VIDA Package to Modernize VAT System

Real-Time Digital Reporting and E-Invoicing will become mandatory in the…

-

Deep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

US IRS Announces Inflation Adjustments for Tax Year 2025

Details on adjustments and modifications to over 60 tax provisions…

-

William McKinley’s Economic Policy Evolution: Lessons for Trump’s Second Term

William McKinley began with a strong stance on high tariffs…

-

Breaking News: European Union Finally Adopts VIDA Package to Modernize VAT System

Real-Time Digital Reporting and E-Invoicing will become mandatory in the…

-

Deep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

US IRS Announces Inflation Adjustments for Tax Year 2025

Details on adjustments and modifications to over 60 tax provisions…

Brazil Tax Reform

Brazil’s sweeping tax reform is approaching, with a transition period set from 2026 to 2032. Corporate tax professionals at multinational companies should address the complexity and scale of these changes immediately, collaborate across functions, and implement the right technology solutions.

-

European Commission to Register Imports Under Trade Defence Investigations

Further Measures to Combat Unfair Competition

-

Lithuania launches Pilot Program for Real-Time VAT Return Assessments

Real time data comparison between E-Invoicing System and VAT returns requires continuous monitoring also by the Tax Payer

-

UK: Upcoming Consultation on E-invoicing for B2B and B2G; Digital Transformation Roadmap will be released in Spring 2025

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s Agenda

-

German E-Invoices: Email Inbox Now Sufficient for Receipt

Significant Flexibility on the Requirement to Receive AP Invoices by January 2025

Tax Trainings

Enhance your tax preparation skills with our tax training videos. Explore topics like desktop software, cloud-based software & more with our courses.

-

Further Measures to Combat Unfair Competition Watch video

-

Real time data comparison between E-Invoicing System and VAT returns… Watch video

-

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s… Watch video

-

Significant Flexibility on the Requirement to Receive AP Invoices by… Watch video