-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

TaxSpoc.com

Taxspoc is your Single Point of Contact for global and local tax news, providing clear, logical, and well-organized tax information.

We deliver timely updates and expert analysis on tax regulations worldwide, ensuring you stay informed and compliant.

Whether you are a professional, an organization, or an individual, Taxspoc is dedicated to being your trusted resource for all things tax-related.

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

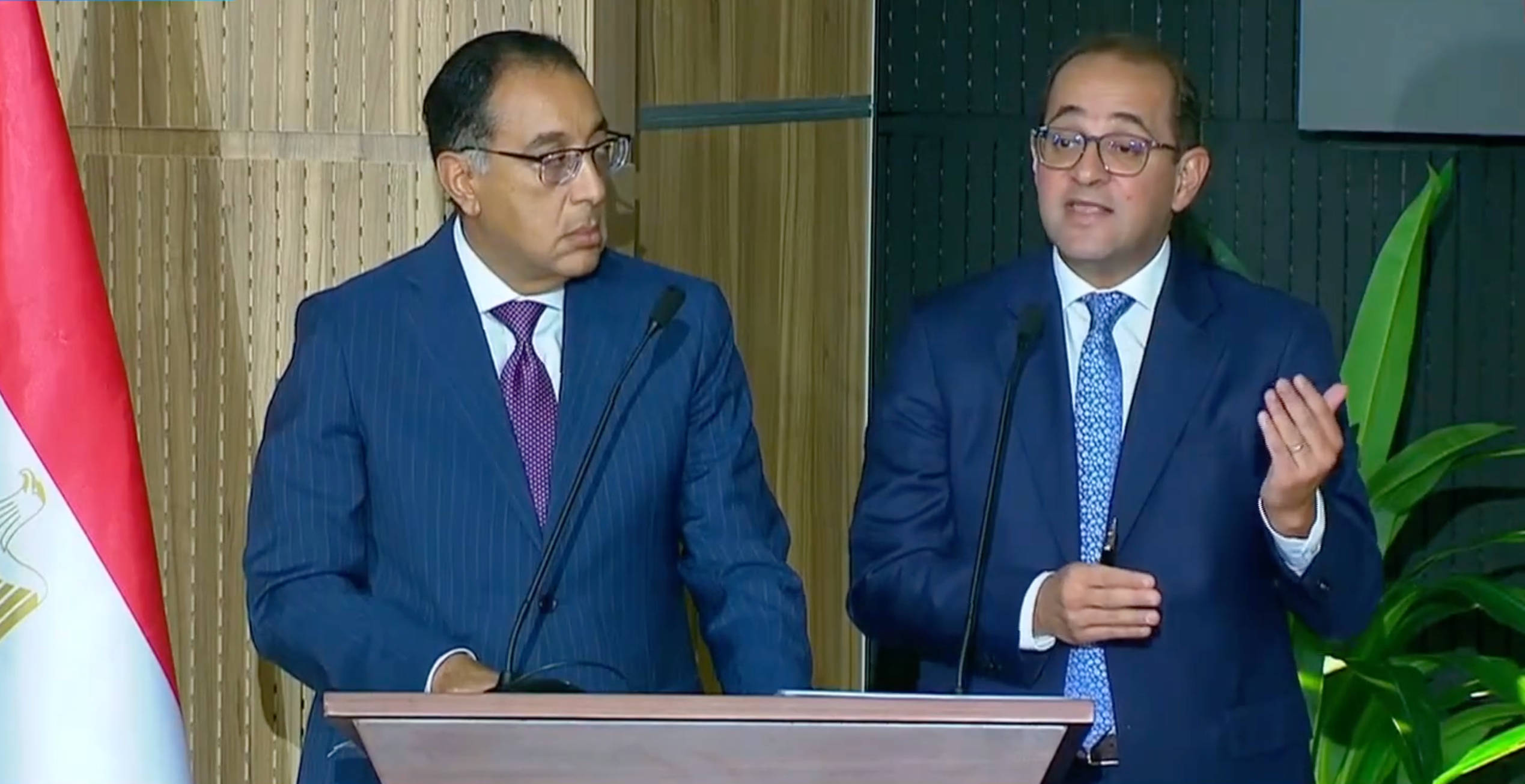

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

EY Reports Global Revenue of US$51.2 Billion for FY24, Highlights Strong Tax Performance

Sharp decline vs last year overall

-

Australia: Changes to Country-by-Country Local File Reporting

Effective from 1 January 2025, most significant change to CbC …

-

EU Deforestation Law: Council Extends Application Timeline by 12 Months

The regulation will still require that products placed on or…

-

EY Reports Global Revenue of US$51.2 Billion for FY24, Highlights Strong Tax Performance

Sharp decline vs last year overall

-

Australia: Changes to Country-by-Country Local File Reporting

Effective from 1 January 2025, most significant change to CbC …

-

EU Deforestation Law: Council Extends Application Timeline by 12 Months

The regulation will still require that products placed on or…

Brazil Tax Reform

Brazil’s sweeping tax reform is approaching, with a transition period set from 2026 to 2032. Corporate tax professionals at multinational companies should address the complexity and scale of these changes immediately, collaborate across functions, and implement the right technology solutions.

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will take several months to complete

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and avoid common mistakes

-

PwC China Audit Unit Faces Temporary Ban and Fines Over Evergrande Collapse

The toughest ever penalty received by a Big Four accounting firm in China, accusations of aiding in the concealment of fraud, exodus of clientele and layoffs at the firm

-

PwC US to Lay Off 1,800 Employees in First Major Cuts Since 2009

New leadership continues restructuring at the US Firm

-

US: IRS Recovers $172 Million from 21,000 Non-Filing Wealthy Taxpayers in First Six Months of New Initiative

This initiative marks a turning point in IRS enforcement, as it strengthens the agency’s ability to recover unpaid taxes and boost compliance among the wealthiest.

Tax Trainings

Enhance your tax preparation skills with our tax training videos. Explore topics like desktop software, cloud-based software & more with our courses.

-

Transferring the assets in the Escrow Fund to Ireland will… Watch video

-

Best practice approaches to Transfer Pricing to lower risk and… Watch video

-

The toughest ever penalty received by a Big Four accounting… Watch video

-

New leadership continues restructuring at the US Firm Watch video

-

This initiative marks a turning point in IRS enforcement, as… Watch video