-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

TaxSpoc.com

Taxspoc is your Single Point of Contact for global and local tax news, providing clear, logical, and well-organized tax information.

We deliver timely updates and expert analysis on tax regulations worldwide, ensuring you stay informed and compliant.

Whether you are a professional, an organization, or an individual, Taxspoc is dedicated to being your trusted resource for all things tax-related.

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Brazil Introduces OECD Pillar Two Rules with Provisional Measure

Translation to English Available to Download Here!

-

UK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

UAE Implements Revisions to VAT Executive Regulations

Set to take effect on November 15, 2024

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Brazil Introduces OECD Pillar Two Rules with Provisional Measure

Translation to English Available to Download Here!

-

UK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

UAE Implements Revisions to VAT Executive Regulations

Set to take effect on November 15, 2024

Brazil Tax Reform

Brazil’s sweeping tax reform is approaching, with a transition period set from 2026 to 2032. Corporate tax professionals at multinational companies should address the complexity and scale of these changes immediately, collaborate across functions, and implement the right technology solutions.

-

Kamala Harris Plans Increase of Corporate Tax Rate to 28%

Unveiled during the Democratic National Convention in Chicago

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax framework remains complex

-

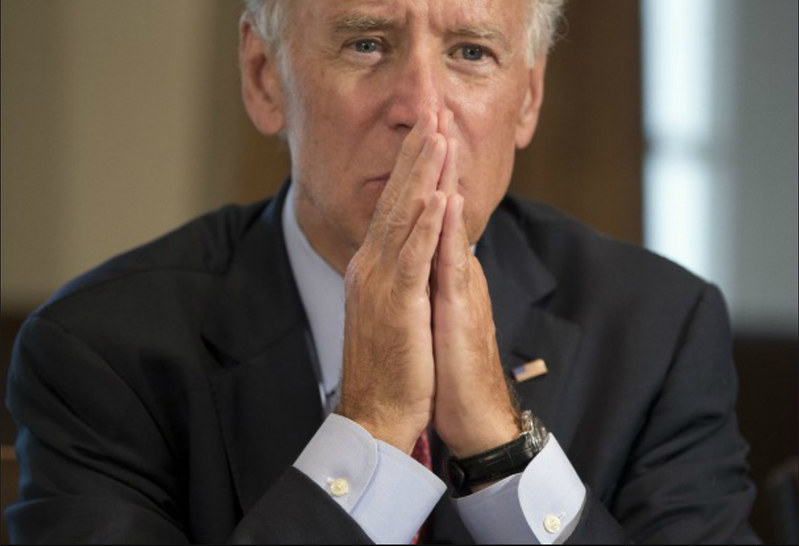

Controversy Surrounds Biden’s Billionaire Tax Rate Assertion

President’s 8.2% tax rate claim for billionaires sparks debate among experts and draws criticism from political opponents

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and vehicle tax adjustments in comprehensive fiscal overhaul

Tax Trainings

Enhance your tax preparation skills with our tax training videos. Explore topics like desktop software, cloud-based software & more with our courses.

-

Unveiled during the Democratic National Convention in Chicago Watch video

-

A path to a universally accepted and effective international tax… Watch video

-

President’s 8.2% tax rate claim for billionaires sparks debate among… Watch video

-

Ministry of Finance proposes VAT hikes, small business relief, and… Watch video