-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

TaxSpoc.com

Taxspoc is your Single Point of Contact for global and local tax news, providing clear, logical, and well-organized tax information.

We deliver timely updates and expert analysis on tax regulations worldwide, ensuring you stay informed and compliant.

Whether you are a professional, an organization, or an individual, Taxspoc is dedicated to being your trusted resource for all things tax-related.

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The entry-level experience is undergoing a major shift. Traditional early-career pathways—once defined by repetitive tasks and manual analysis—are being replaced by…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

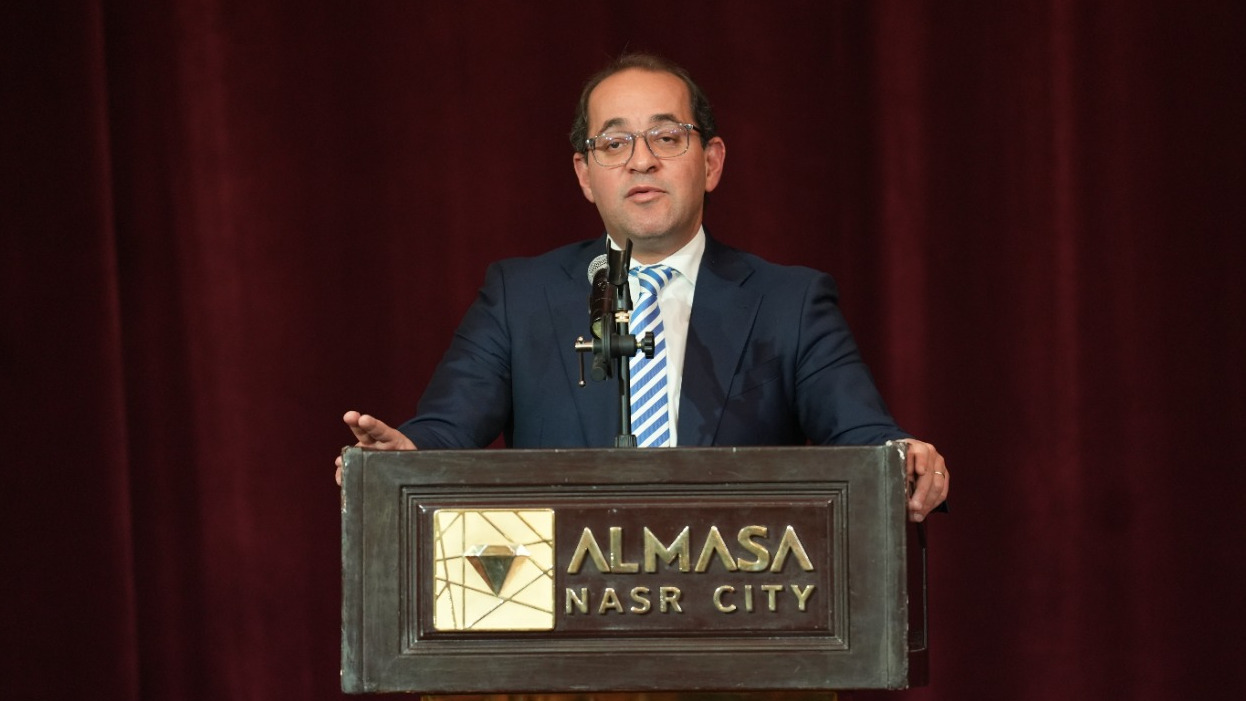

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

EU Extends Suspension of Tariffs on U.S. Products Until April 14, 2025

The European Commission extends tariff suspension on U.S. imports until…

-

Turkey Decides Not to Implement OECD’s Amount B for Now

Amount B will not be applied to transactions involving distributors,…

-

PwC Faces Advisory Ban in Saudi Arabia Until 2026

The ban could lead Saudi authorities to implement stricter compliance…

-

EU Extends Suspension of Tariffs on U.S. Products Until April 14, 2025

The European Commission extends tariff suspension on U.S. imports until…

-

Turkey Decides Not to Implement OECD’s Amount B for Now

Amount B will not be applied to transactions involving distributors,…

-

PwC Faces Advisory Ban in Saudi Arabia Until 2026

The ban could lead Saudi authorities to implement stricter compliance…

Brazil Tax Reform

Brazil’s sweeping tax reform is approaching, with a transition period set from 2026 to 2032. Corporate tax professionals at multinational companies should address the complexity and scale of these changes immediately, collaborate across functions, and implement the right technology solutions.

-

Council Reaches Political Agreement on DAC9

MNEs will be required to submit their first top-up tax information return by 30 June 2026, tax authorities will need to exchange this information by 31 December 2026

-

Key Priorities of the European Commission in Taxation

Focus on Green Transition, Addressing the VAT gap, and Commitment to Global Tax Reform are some of the priorities

-

KPMG Announces Major Global Restructuring

The overhaul will reduce the number of the firm’s “economic units” to 32

-

EU-US Trade: How Tariffs Could Impact Europe

European Parliament publishes key insights into EU-US trade relations and the EU’s potential responses to a trade conflict

-

Italian Authorities Investigate Amazon Over Alleged €1.2 Billion VAT Fraud

The investigation, led by the Milan Prosecutor’s Office, could impact e-commerce taxation and international trade relations

-

Pillar One Amount B: Key Update on Marketing and Distribution Activities

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B approach for relevant transactions starting from fiscal years commencing on or after January 1, 2025

Tax Trainings

Enhance your tax preparation skills with our tax training videos. Explore topics like desktop software, cloud-based software & more with our courses.

-

MNEs will be required to submit their first top-up tax… Watch video

-

Focus on Green Transition, Addressing the VAT gap, and Commitment… Watch video

-

The overhaul will reduce the number of the firm’s “economic… Watch video

-

European Parliament publishes key insights into EU-US trade relations and… Watch video

-

The investigation, led by the Milan Prosecutor’s Office, could impact… Watch video

-

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B… Watch video