admin

-

U.S. Tariff Threats Force Immigration Agreement with Colombia

Drafted tariffs and sanctions have been placed on hold

-

Uncertainty Looms Over IRS as Trump Speaks about Terminating or Repurposing 88,000 IRS Workers

We’re in the process of developing a plan to either…

-

China’s 2025 Business Climate Survey Highlights Shifting Sentiments Among US Companies in China

As US and Chinese companies prepare for the potential impact…

-

HMRC Under Fire for Poor Customer Service and Widening Tax Gap

UK House of Commons Committee Report Highlights Concerns with HMRC’s…

-

EU Criticizes Trump Administration’s Withdrawal from Global Tax Deal

Highlighting the need for fair taxation and advancing climate initiatives…

-

U.S. Administration Rejects OECD Global Tax Deal to Reassert Sovereignty

Any commitments made by the previous administration regarding the Global…

-

US: IRS Commissioner Resigns on Trump´s Inauguration Date, Democrats Raise Concerns Over IRS Nominee

As IRS Commissioner Danny Werfel steps down, Trump´s Candidate Billy…

-

President-Elect Trump Announces Creation of ‘External Revenue Service’ to Collect Tariffs

President´s Inauguration date, January 20, 2025 will be the birth…

-

EU Trade Relations with the United States: Facts and Figures

With rising trade uncertainty between the US and its closest…

-

Overview of China’s Value-Added Tax (VAT) Law

VAT Law is Available to Download in English Here!

-

Accenture Secures Landmark Victory in the Danish Supreme Court

First Ruling Favoring a Taxpayer in a Transfer Pricing Case

-

China’s New VAT Law is Set to Take Effect January 1, 2026

Adopted end of December 2024, it aims aligning China´s VAT…

-

US: IRS Outlines Plans on Simplified Approach for Pricing Controlled Transactions Involving Marketing and Distribution activities

Notice 2025-4 Aligns with OECD Report on Amount B of…

-

Canada Braces for Possible Trump Tariffs with Retaliatory Measures

Expected 25% tariff on all Canada- US imports, Canada is…

-

European Union: Council Adopts New Withholding Tax Procedures via FASTER Directive

New rules take effect from January 1, 2030: Introducing Digital…

-

UAE Implements Domestic Minimum Top Up Tax

Ministry of Finance Announces Updates to Corporate Tax Law Affecting…

-

EU Adopts 15th Package of Restrictive Measures on Russia

Limiting Russia’s access to resources by enhancing trade restrictions, targeting…

-

European Union: Council Introduces Electronic VAT Exemption Certificate

Modernizing Tax Procedures, replacing paper VAT exemption certificates for Embassies,…

-

US Tightens Controls to Restrict China’s Access to Advanced Semiconductor Technology

Strategic export controls to “address national security threats”

-

China´s New Export Control Regulations

Overview of the New Regulations on Export Control of Dual-Use…

-

The EU has ABSTAINED in the vote on UN Resolution on Tax Cooperation

EU Released Statement calling out “serious outstanding reservations” on UN General…

-

OECD Tax Revenue Trends and Insights for 2023

Recent OECD reports show average tax-to-GDP ratio among OECD countries…

-

France´s Electronic Invoicing Reform: Updated Guidelines from the DGFIP

Revised factsheets on the transition to mandatory electronic invoicing in…

-

Germany’s New Transfer Pricing Compliance Rules for 2025

Stricter deadlines, higher penalties effective January 1, 2015

-

European Union: ECJ Confirms that Relocating Production to Evade Tariffs Could Not Be Deemed “Economically Justified”

A Landmark Case Amidst Anticipated Tariff Turmoil: Shift to Material…

-

Trump’s Tariff Proposals: A Controversial Economic Strategy

Talk of the Town on the Thanksgiving Holiday: Sweeping US…

-

OECD 2023 MAP & APA Awards: Discover the Fastest, Most Efficient amongst OECD Countries

Announced at the 2024 OECD Tax Certainty Day, celebrating jurisdictions…

-

European Commission Refers Germany to Court of Justice Over Discriminatory Tax Treatment

November Infringement Package contains discriminatory tax practices related to reinvested…

-

Australian Parliamentary Committee´s Report Recommends Limiting partnerships to 400 partners, PwC Australia to be barred from tendering for government contracts

Report on Ethics and Accountability in the Audit and Consultancy…

-

UK Companies to Receive £700 Million Windfall After European Court of Justice Reverses Tax Ruling

Repayment obligation on the UK government at a time of…

-

Australia: Insights on Tax Settlements and Compliance in 2023–24 for Public and Multinational Businesses

Litigation resulted in favorable outcome for ATO in 53% of…

-

China’s $1.4 Trillion Debt Plan and Trump’s Return

China’s Economic Stimulus Amid Rising Global Tensions

-

Germany: How the end of Governing Coalition impacts Tax

While Numerous Legislative Projects are Expected to be delayed, Minority…

-

US: Republicans Positioned to Control Congress and Push Tax Cuts

Republicans are Set to Tackle Key Agenda Amid Federal Debt…

-

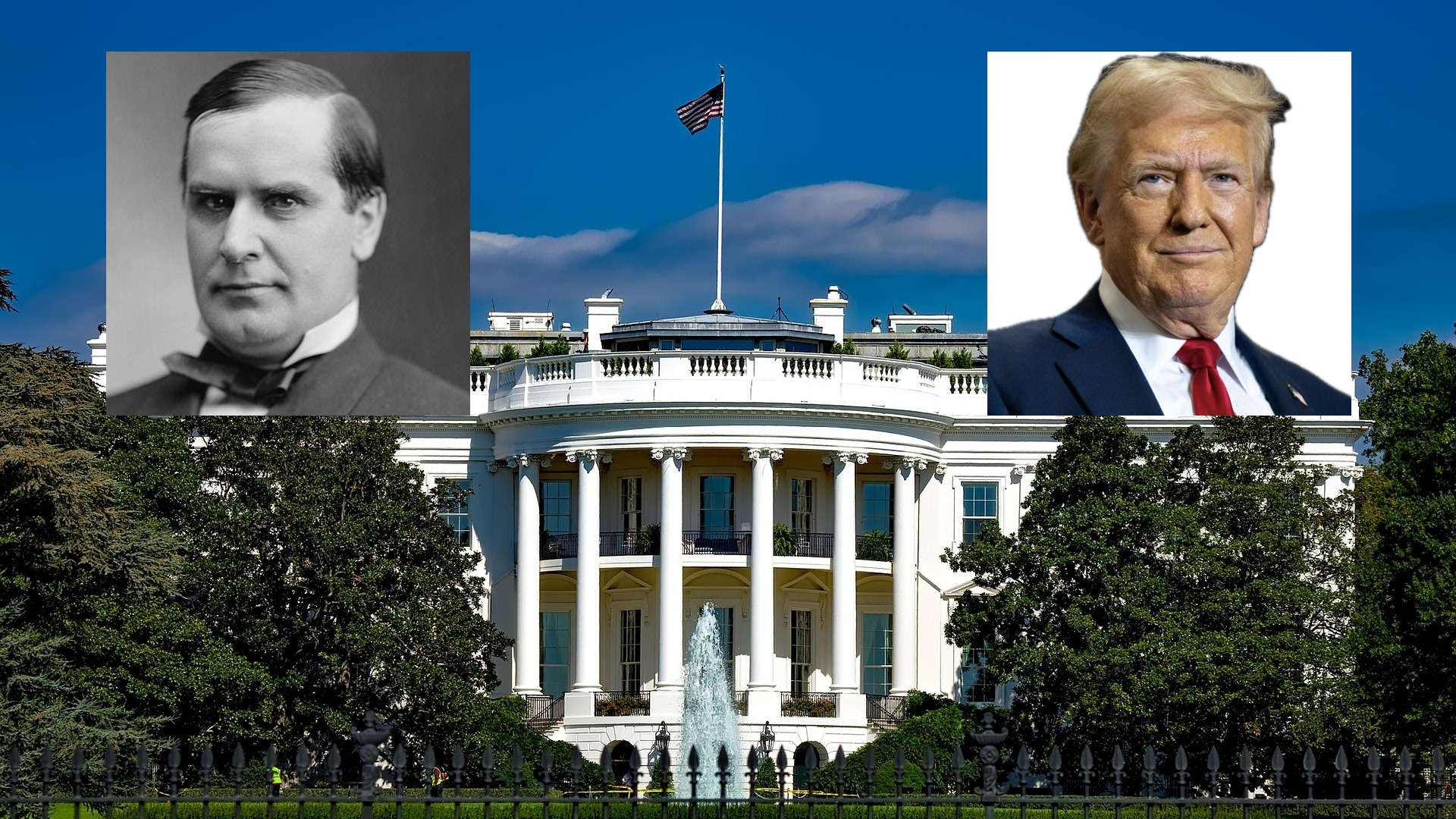

William McKinley’s Economic Policy Evolution: Lessons for Trump’s Second Term

William McKinley began with a strong stance on high tariffs…

-

Breaking News: European Union Finally Adopts VIDA Package to Modernize VAT System

Real-Time Digital Reporting and E-Invoicing will become mandatory in the…

-

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

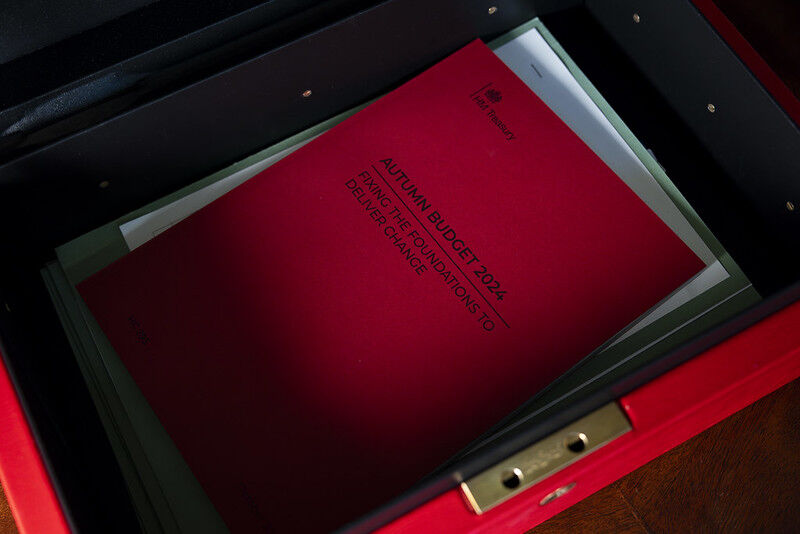

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

US IRS Announces Inflation Adjustments for Tax Year 2025

Details on adjustments and modifications to over 60 tax provisions…

-

Spain Introduces New Technical Specifications for Approved Invoicing Software: VERI*FACTU

English translation available to download here!

-

UK Prime Minister’s Definition of “Working People” Sparks Debate as Labour Faces Scrutiny Over Upcoming Budget

Awaiting for Labour´s First UK Budget in 14 years, to…

-

EU Commission Proposes DAC9 to Simplify Compliance for Businesses under Pillar 2 Directive

Enhanced Administrative Cooperation in Taxation: update is aimed at simplifying…

-

Mark Your Calendar: EU´s November 5 ECOFIN Meeting to Feature Key Developments on ViDA

Full Agreement expected at the next November 5th EU Economic…

-

Argentina Announces Dissolution of Federal Tax Authority (AFIP) and Creation of New Agency

Collections and Customs Control Agency (ARCA) will be established with…

-

France’s 2025 Budget: Tax Hikes targeting the Rich and Spending Cuts to Address Deficit

2025 Budget Plan: €20 billion is expected to be sourced…

-

Australia: Changes to Country-by-Country Local File Reporting

Effective from 1 January 2025, most significant change to CbC …

-

EY Reports Global Revenue of US$51.2 Billion for FY24, Highlights Strong Tax Performance

Sharp decline vs last year overall

-

EU Deforestation Law: Council Extends Application Timeline by 12 Months

The regulation will still require that products placed on or…

-

Australia´s Administrative Review Tribunal Begins Operations

New Pathway for Taxation Disputes

-

OECD Examines Tax Arbitrage in Closely Held Businesses

OECD Taxation Working Papers No 70 Released

-

Deloitte Reports FY2024 Revenue of $67.2 Billion, Expands Workforce to 460,000

Tax & Legal achieved the fastest growth benefiting from Changing…

-

China Imposes Tariffs on European Brandy

A levy of up to 39% in Response to EU´s…

-

EY US Partners Face Deferred Compensation

Financial Struggles and Leadership Criticism

-

Egypt introduces the First Package of Tax Reforms aimed at Driving Economic Transformation and Attracting Investment

20 Key Measures to Build Trust with Taxpayers and Streamline…

-

The EY 2024 Tax and Finance Operations Survey: Managing Transformation Amid Cost Pressures and Talent Shortages, with GenAI Still Underutilized

Companies struggle with “Doing More with Less” in Ever More…

-

EU Approves Tariffs on Chinese Electric Vehicles Following Anti-Subsidy Probe

Additional tariffs on Chinese-made EVs up to 35.3% for five…

-

EU Reaffirms Commitment to Inclusive and Effective International Tax Cooperation

EU has approved its official position concerning UN Framework Convention…

-

Brazil Introduces OECD Pillar Two Rules with Provisional Measure

Translation to English Available to Download Here!

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

UAE Implements Revisions to VAT Executive Regulations

Set to take effect on November 15, 2024

-

US IRS Updates on Transfer Pricing Penalties

Stricter Enforcement and Documentation Standards

-

European Commission Takes Legal Action on Taxation Matters Across Member States

October Infringements Package on Taxation and Customs Union: Hungary, Malta,…

-

New Rules on Jurisdiction Transfer Between the Court of Justice and the General Court Now in Effect

Cases on VAT, excise duties, the Customs Code, tariff classification…

-

US International Tax Policy Update: Harris Supports Biden Reforms while Trump Proposes Tariff Changes

Democrats are drafting legislation in case Harris wins, Trump proclaims…

-

UK´s HMRC is Hiring in Tax in Large Numbers!

HMRC Launches Recruitment Campaigns, 5,000 new compliance staff are expected…

-

European Commission to Register Imports Under Trade Defence Investigations

Further Measures to Combat Unfair Competition

-

Lithuania launches Pilot Program for Real-Time VAT Return Assessments

Real time data comparison between E-Invoicing System and VAT returns…

-

UK: Upcoming Consultation on E-invoicing for B2B and B2G; Digital Transformation Roadmap will be released in Spring 2025

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s…

-

German E-Invoices: Email Inbox Now Sufficient for Receipt

Significant Flexibility on the Requirement to Receive AP Invoices by…

-

European Union: Reminder of the September 30 VAT Refund Deadline

Applicable for EU and Most of Non-EU Businesses Refunds

-

The Netherlands: Budget Day 2025 and Tax Changes Announced

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

-

HMRC Issues New VAT Compliance Guidelines

HMRC’s expectations around VAT accounting

-

New European Commission and the apparent downscaling of Taxation from the priorities

Taxation sits in an unlikely portfolio with Climate, Net Zero,…

-

Colombian 2024 Tax Reform Bill Submitted to Congress

Impact on Corporate and Capital Gains Rates

-

Poland: Rules for the Digitization of Accounting Documentation in CIT

Mandating the use of structured electronic formats for accounting records

-

US: Biden-Harris Administration Introduces Measures aimed at E-Commerce

Tackling Unsafe De Minimis Shipments

-

US IRS: September 16 Deadline for Third-Quarter Estimated Tax Payments

Millions of taxpayers across the U.S. are reminded to make…

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will…