admin

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and…

-

PwC China Audit Unit Faces Temporary Ban and Fines Over Evergrande Collapse

The toughest ever penalty received by a Big Four accounting…

-

US: IRS Recovers $172 Million from 21,000 Non-Filing Wealthy Taxpayers in First Six Months of New Initiative

This initiative marks a turning point in IRS enforcement, as…

-

PwC US to Lay Off 1,800 Employees in First Major Cuts Since 2009

New leadership continues restructuring at the US Firm

-

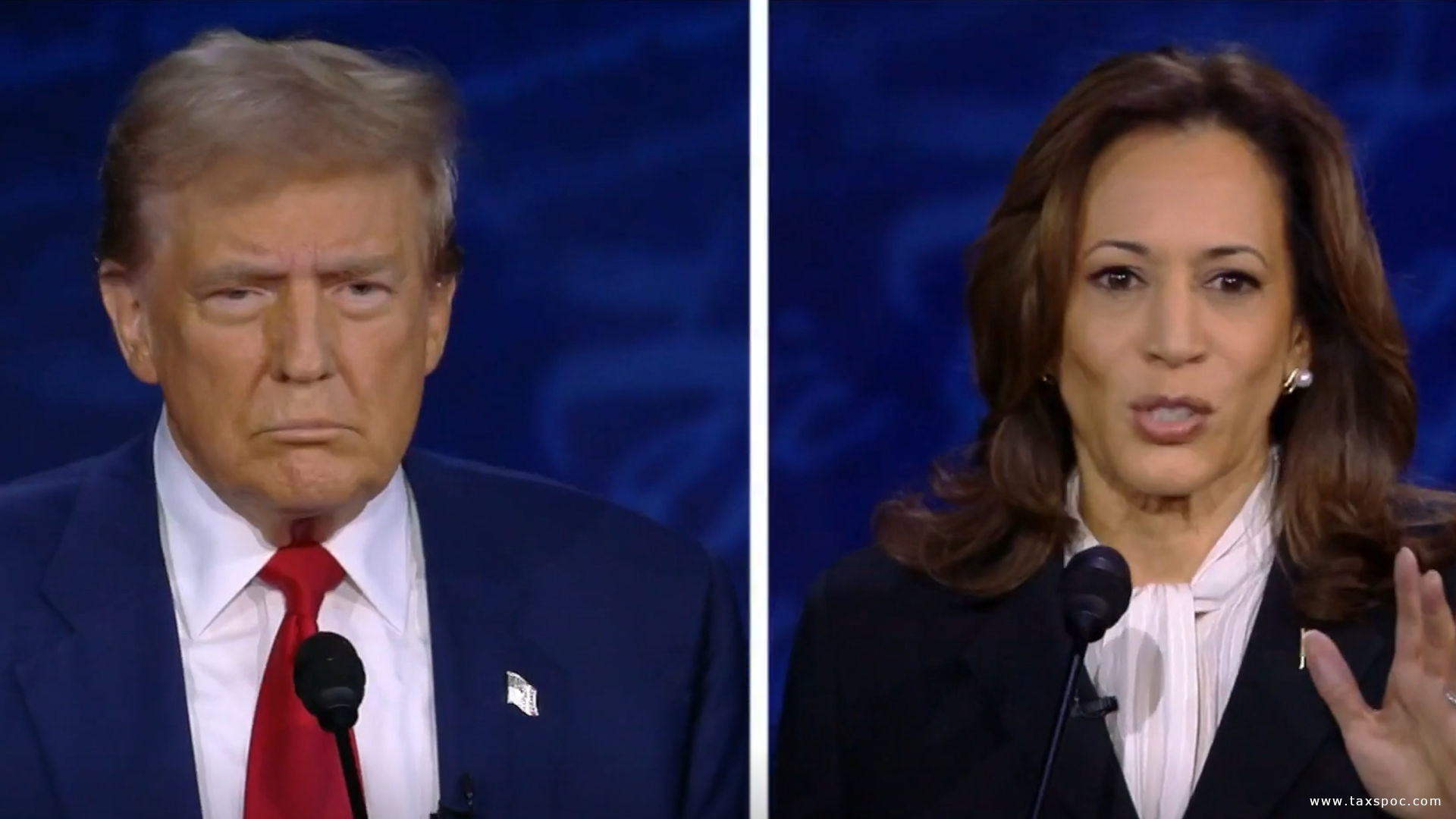

Highly anticipated US Presidential Debate started with Taxes

Taxes at the Forefront of the US Presidential Elections with…

-

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

European Union: ECJ rules Ireland to recover 13 bln EUR granted to Apple!

Overturns General Court Decision on Apple’s Tax Rulings in Ireland

-

Apple Tax Case: A Look Back at the Decade of Dispute

as ECJ Gives Final Judgement in the Matter

-

Argentina’s Implementation of the Large-Investment Regime Bill

Decree 749/2024 Aims at Attracting Investors

-

PwC UK Will Track In- Office Presence

Adjusts Hybrid Work Model Increasing In-Person Expectations

-

-

South Africa: Highlights from the 2024 Draft Taxation Laws and Draft Tax Administration Laws Amendment Bills

Available for Public Comment

-

EY Reduces Pay Rises and Bonuses for UK Staff Amid Market Challenges

Impact on Tax Advisory Division

-

The Anticipation of Donald Trump’s Latest Tax Returns

So far, deviating from the practice followed by other major…

-

Bahrain Introduces Domestic Minimum Top-up Tax for Multinational Enterprises

The first member of the Gulf Cooperation Council (GCC) to…

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

Australian Taxation Office Releases Annual Corporate Plan

Focus on new high-risk tax areas for multinationals, Improvement of…

-

Swiss Federal Council Adopts Partial Revision of Swiss VAT Ordinance

Swiss VAT updates to streamline compliance and tax calculations, effective…

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

Introduction of Dual VAT in Brazil: A VAT Law!

Draft VAT Law is available to download here!

-

Kamala Harris Plans Increase of Corporate Tax Rate to 28%

Unveiled during the Democratic National Convention in Chicago

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and…

-

Controversy Surrounds Biden’s Billionaire Tax Rate Assertion

President’s 8.2% tax rate claim for billionaires sparks debate among…

-

Chile´s Government Proposes New Amendments to the Tax Compliance Bill

Fine-tuning the bill with further amendments expected

-

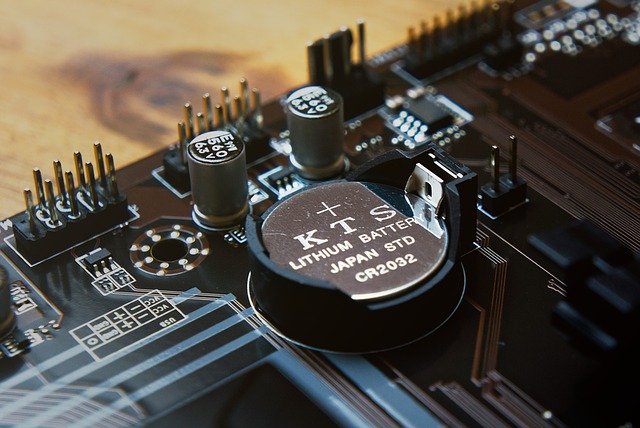

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

UK: Reporting Rules for Digital Platforms

HMRC published Rules for Digital platforms that let users sell…

-

Coca-Cola to Pursue Appeal Following Tax Court Decision

$16 billion of Potential Incremental Tax and Interest Liabilities

-

United Nations Framework Convention on International Tax Cooperation, The Second Session is in progress

US Feedback on the Zero Draft Terms of Reference for…

-

Vertex, Inc. Acquires ecosio to Enhance E-Invoicing and Compliance Solutions

Adding EDI and E-invoicing Capabilities

-

Transparency and Reporting tops as currently having the most impact on Tax Leaders Worldwide

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals…

-

KPMG LLP Forms Strategic Alliances with Cryptio, Dataiku, and Avalara to Enhance Digital Capabilities

Increased focus on AI adoption, Crypto asset accounting and tax…

-

European Union: Draft Regulation on Corporate Income Tax Reporting establishes Common Template and Electronic Formats

New regulation aims to enhance tax transparency and comparability across…

-

UK Update on Corporate Criminal Offences Legislation to Combat Tax Evasion

HMRC reports 11 active probes, 28 cases under review. Aims…

-

Renewal of Qualified Maquiladora Approach Agreement Between U.S. and Mexico in 2024

This is the second renewal of the agreement, preserving the…

-

European Court of Justice: Upholding the EU Directive on Tax Reporting Obligations

CJEU upholds EU directive on tax reporting for cross-border arrangements.…

-

UAE Publishes Guide on Determination of Taxable Income for Corporate Income Tax

107-page document clarifying key concepts under UAE Corporate Tax Law.…

-

European Union: Evaluation of the Anti-Tax Avoidance Directive In Progress

Have Your Say on the Directive aimed to fight aggressive…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

Finland’s VAT Rate Increase: Comprehensive Guide to the 2024 Tax Change

Key details and practical implications for various business scenarios under…

-

G20 Rio de Janeiro Ministerial Declaration on International Tax Cooperation

Historic declaration on international tax cooperation

-

OECD Participates in G20 Finance Ministers and Central Bank Governors Meeting in Rio de Janeiro

Key reports on international tax cooperation, digital economy challenges, and…

-

India: Lower Rates for Foreign Companies, IFSC Concessions, and New Penalties

Union Budget 2024-25 on International Tax

-

PwC Faces Major Overhaul in China Amid Evergrande Fallout

Leaving Clients, Staff reductions, Pay cuts, Fines

-

India’s Digital Shift: Withdrawal of the E-commerce Levy

Union Budget 2024- 2025

-

US: Anticipated Tax Plan Under Trump

Intentions for a Potential Second Term

-

Kamala Harris Tax Returns

Candidate for US President has a history of Transparency

-

Constitutional Court Rules Mandatory Disclosure Rules (MDR) Unconstitutional

What a month for Mandatory Disclosure Rules (MDR) in Poland!

-

-

United States Announces Suspension of 1992 Tax Convention with Russia

Mutual agreement on Suspension

-

UK Under Labor Government: Expected Renewed Focus on Large Business and Wealthy Individuals

A Review of Labour Party’s Manifesto on Taxation

-

The End of the Chevron Doctrine: US Supreme Court’s Loper Bright Decision

Courts will now employ traditional statutory construction tools to interpret…

-

Oman Set to Introduce Personal Income Tax

A Gulf First, Expected to be in Single Digits. What…

-

US Treasury and IRS Issue Final Regulations on Excise Tax for Stock Repurchases

Guidance for complying with the new excise tax on stock…

-

Australia´s New Code to Enhance Professional Standards for Tax Practitioners

Aims to Restore Public Trust in Tax Profession

-

Global Corporate Tax Rates Stabilize, OECD Reports

The OECD’s latest report provides extensive data on over 160…

-

Chance to be heard: OECD invites comments on a draft User Guide for the GloBE Information return XML Schema

Comments are expected by 19 August 2024 latest

-

Argentina: President Javier Milei Reconfirms Commitment to Tax Reform and Opening up to International Trade

Signature of Historic May Pact, symbolic declaration, centered around Tax.

-

Dutch Customs: Genuine Mistakes no longer lead to Criminal Prosecution, Import of Medicines Requires Specific Details

Changes in Dutch Customs Regulations

-

UAE: Voluntary Disclosure Program for Customs in Dubai

The program allows businesses to correct past customs declaration errors,…

-

Belgium: Administrative Tolerance for 2024 Moves Registration Requirement under Pillar 2 Regulations

Only applicable to groups that will not make Belgian advance…

-

Italy: New Rules on Administrative and Criminal Tax Sanctions

Changes Affect Penalties Regarding Income Tax, VAT, and Withholding Tax…

-

Saudi Arabia Extends Tax Amnesty Initiative to End of 2024

Additional time to correct any discrepancies in their tax records…

-

New Transfer Pricing Framework Introduced in Brazil

Aligned with OECD Guidelines

-

-

Stalemate at the ECOFIN Meeting: Estonia Blocks ViDA Initiative

Stalemate at the ECOFIN Meeting: Estonia Blocks ViDA Initiative

-

UK: HMRC publishes Tax Gap Analysis for 2022- 2023

Tax Gap Estimated at 39,8 billion GBP for one year

-

Bulgaria: Implementing SAF-T Reporting: Expected Scope, Requirements, SAF-T Format Published

Expected Scope, Requirements, and SAF-T format documentation in English are…

-

Germany: Draft Administrative Guidelines on E-Invoicing made available by the Germany Tax Authorities

Our Article Includes an English translation of Guidelines Available to…

-

European Union: European Commission Targets China’s Electric Vehicle Sector

Investigation Reveals Unfair Subsidies in China. Provisional Duties to be…

-

European Union: Judgement on VAT Fixed Establishment ECJ case Adient C-533/22

The ECJ provides clarification on the concept of a VAT…

-

European Union: ECJ Judgement In Case C-696/22, C SPRL

VAT Liability does not necessarily require actually receiving remuneration

-

EY Announces $1 Billion Investment to Elevate Early Career Opportunities in Accounting

Increasing early career compensation and development, Integrating AI in Tax…

-

Poland: E-invoicing Officially Postponed to 2026

President Signs Bill Postponing Mandatory KSeF Implementation

-

PwC Implements Quiet Layoffs in the UK with Strict Communication Guidelines

“Silent layoffs” across its UK offices targeting the consulting, risk,…

-

Vertex Acquires AI Capabilities from Ryan, LLC

Aims at Enhancing Tax Technology Solutions and Accelerating AI Innovation