admin

-

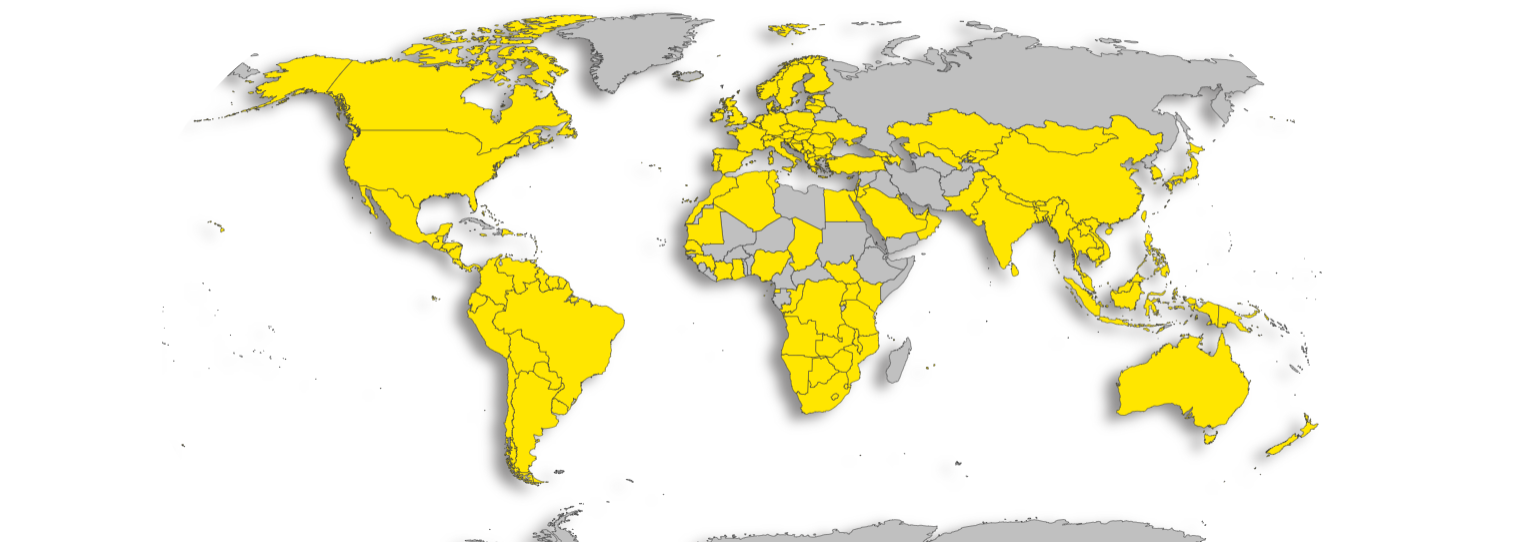

Australia: Public Country-by-Country Reporting Legislation Introduced to the Parliament

If approved, public CbC reporting will be effective for reporting…

-

UK: Rishi Sunak´s led UK Conservative Party´s 2024 Manifesto is All About Reducing Taxes

Promises to Lower taxes and calling to vote for Tories…

-

Saudi Arabia: ZATCA Extends Tax Amnesty until end of June

Initiative, originally set to end on December 31, 2023, will…

-

US: Direct File Pilot for Federal Tax Returns from the IRS

After the successful pilot, IRS plans to make Direct File…

-

-

France: Update on E-invoicing

Technical specifications expected June 19, 2024, Go Live deadlines maintained

-

US Efforts to Preserve Global Corporate Tax Deal Face Challenges

Pillar 1 encounters roadblocks

-

Inclusive Framework on BEPS Targets Multilateral Convention Signature by End of June

Advancing towards a final agreement on Pillar One, the anticipated…

-

Spanish E-Invoicing: Expected Delay

Rumor has it Spanish e-invoicing will be deferred to mid…

-

EU: European Commission releases Guidance Document on CBAM Implementation for Importers of Goods into the EU

Non- binding document on Carbon Border Adjustment Mechanism

-

OECD Releases Report on Designing a National Strategy Against Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation…

-

EU Council Decision to Open Negotiations for amendment of the Agreements concerning the automatic exchange of financial account information to improve international tax compliance

Concerns negotiations between European Union and the Swiss Confederation, the…

-

Italy: PLASTIC TAX postponed to July 1st, 2026!

Postponed again!

-

Latvia e-invoicing: Draft law Published, Public Consultation Opened

E-invoicing is planned to become mandatory January of 2026 for…

-

The Netherlands: New Coalition Government Unveils Ambitious Tax Plans

Tax Plans concern mainly VAT, Fly Tax, Plastic Packaging Tax

-

Belgium: Practicalities on Notification Requirement for In-Scope Groups Under Belgian Pillar Two Rules

Registration to obtain number from the Belgian Trade Register

-

Belgium: Pillar Two Mandatory Notification for MNEs and Large Domestic Groups

On May 21, 2024, the Belgian tax administration released new…

-

European Union: 13th Directive VAT Refund Deadline is fast approaching!

Non- EU business eligible to file VAT refund claim in…

-

European Union: ViDA and Withholding Taxes Take a Central Stage in the Upcoming ECOFIN Meeting Agenda

ECOFIN Council Meeting of May 14, 2024 has 2 Tax…

-

Belgian Parliament Adopts New Pillar Two Law with Key Modifications

Rectification of prior legislative oversights identified in the original December…

-

Sneak Peak to Revised ViDA draft up for Vote May 14, 2024

Digital Reporting Requirements, Platforms, Single VAT Registration

-

European Union – New Zealand Free Trade Agreement Came into Effect on May 1, 2024

Most goods will have tariffs removed upon the FTA’s commencement

-

Proposal for Modernizing VAT Rules in the Digital Age: VIDA Directive

A look at Explanatory Memorandum to the Council Directive amending…

-

UAE CIT Registration: When to Register

CIT Registration Dates are fast approaching

-

Poland: New E-Invoicing Timeline

Detailed Analysis of the KSeF Audit: Unveiling Flaws and Planned…

-

OECD Publishes Taxing Wages 2024 Report

Annual publication provides details of taxes paid on wages in…

-

OECD publishes 334 pages Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023)

Tax Challenges Arising from the Digitalisation of the Economy.

-

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

PWC US Sanctioned due to violations related to maintaining independence

PricewaterhouseCoopers LLP (PwC) has been censured by the Public Company…

-

Brazil: expected VAT Rate Revealed!

First version of Tax Reform Proposal by Brazil´s Finance Minister…

-

Spain Priorities: Football it is!

”Mbappe Law” follows a precedent set by Real Madrid with…

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

Australia Big 4: Tough times at PWC Australia Following Tax Scandal

Job Cuts, Penalties

-

Saudi Arabia Guidelines for Regional Headquarters Tax and Zakat Rules

Saudi Arabia unveiled a 30-year tax incentive for multinational companies…

-

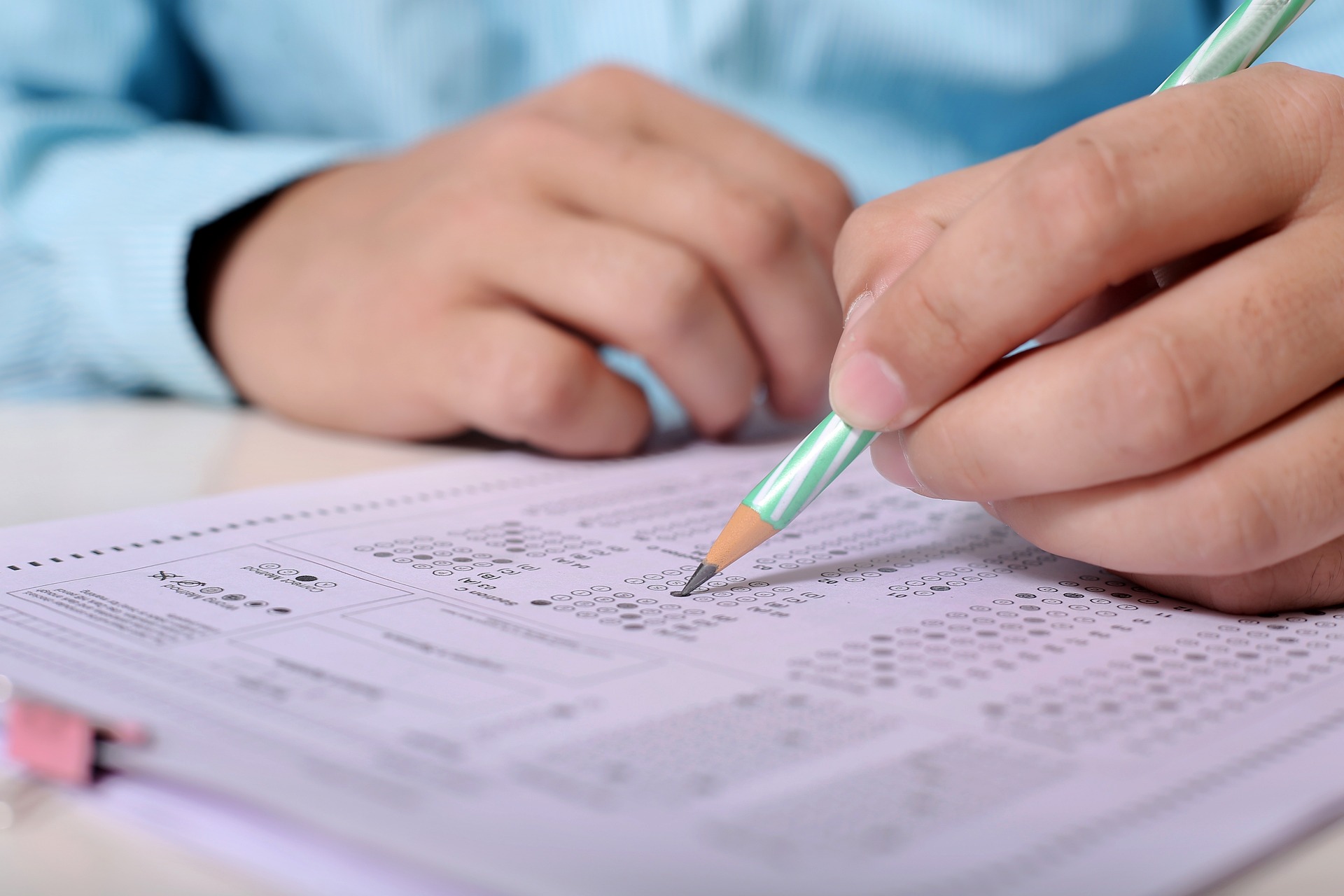

KPMG’s Record Penalty for Exam Cheating Scandal

Historic $25 million fine on KPMG Netherlands for pervasive cheating…

-

G20 Considers Global Minimum Tax on Billionaires

Brazil and France at the forefront in bringing forward the…

-

Philippines´ Issue Guidelines in the filing of Annual Income Tax Return (AITR) for Calendar Year (CY) 2023

Details on Return filing and payments

-

European Union: Proposal on Transfer Pricing Adjustments: Understanding Primary, Corresponding, and Compensating Adjustments

Explanatory Memorandum on the Proposal of Council Directive on Transfer…

-

Singapore and New Zealand Prime Ministers Announce eInvoicing Memorandum of Agreement

Further steps in promoting eInvoicing adoption in the Asia-Pacific (APAC)…

-

Enhancing Tax Transparency: Australia’s New Requirements for Disclosure of Subsidiaries in Financial Reports

Aiming at greater transparency and accountability in corporate tax matters

-

India’s Advance Pricing Agreement (APA) Programme: The Comprehensive Procedural Framework

A structured and proactive approach to transfer pricing certainty

-

Canada´s Budget for 2024 Exclaims Tax Fairness

“The government is asking the wealthiest Canadians to pay their…

-

Finland: Government will raise VAT to 25.5 percent aiming to collect one billion euros a year more

The government is considering implementing the VAT rise before year…

-

Italy and UK reaches reciprocity Agreement on VAT Refund Claims

The agreement will have retrospective effect from 1 January 2021

-

The US Internal Revenue Service (IRS) has concluded the 2024 tax filing season

Delivers Strong 2024 Tax Filing Season; Expands Services for Millions

-

Implementation of e-Invoice in Malaysia: Frequently Asked Questions (FAQs)

Failure to issue e-Invoice may result in penalties or imprisonment…

-

Singapore E-invoicing: Phased adoption starting November 2025, Peppol standard

Implementation of InvoiceNow for GST-Registered Businesses and Free InvoiceNow Services…

-

Oman Automatic Exchange of Information (AEOI) System Update

Automatic Exchange of Information (AEOI) system is now available for…

-

Indian Court’s Ruling on Profit Attribution for Singapore Company’s Indian Operations

No further profit attribution if an associated enterprise is remunerated…

-

Indian Tribunal’s Decision on Physical Presence Requirement for Service PE

Physical presence of employees in India is indeed a prerequisite…

-

European Union: VAT Expert Group Deliberates on Key VAT Policy and Implementation Measures

The VAT Expert Group (VEG) recently convened in Brussels for…

-

European Union: ViDA is priority for the Belgian Presidency, expectations of reaching an agreement potentially in May or June

Latest update from VAT Expert Group discussions

-

European Union: Progress on the EU Council Directive on Transfer Pricing

The directive should apply from 1 January 2025 (instead of…

-

Saudi Arabia: VAT Refund Procedures for Non-Residents

A reminder of the key points regarding the VAT refund…

-

Polish Government Adopts DAC7 Bill to Enhance Tax Transparency

The enactment of this act is anticipated to greatly improve…

-

Canada: Retroactive Amendments Regarding Software Taxability in British Columbia

Proposed Budget Changes in British Columbia (BC), Canada, contain retroactive…

-

Brazil’s VAT Reform Progress: April 2024

Legislators roll up their sleeves preparing for Brazil´s VAT implementation

-

Italy’s Plastic Tax planned to come into effect on July 1, 2024 expected to be postponed again

Expected postponement for the 7th time until July 1 2026.…

-

Australia: Changes to Thin Capitalization Rules Finally Pass Both Houses of Parliament

Making Multinationals Pay Their Fair Share—Integrity and Transparency Bill 2023…