Sara Abdelfattah

-

Tax Transparency in Latin America: A 2024 Breakthrough Against Evasion and Illicit Flows

How Regional Cooperation and Exchange of Information (EOI) are Driving…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

Egypt’s New Tax Incentive Law: A Catalyst for SME Growth and Economic Prosperity

A Bold Move Towards a More Dynamic Business Landscape

-

Egypt 2025: Launching the Strategic Committee for Digital Economy and Entrepreneurship

A Pivotal Step Towards Enhancing Innovation and Economic Growth in…

-

Egypt And The Sultanate Of Oman Convention For The Elimination Of Double Taxation And The Prevention Of Tax Evasion With Respect To Taxes On Income.

Ensuring Tax Fairness and Promoting Stronger Economic Ties Between the…

-

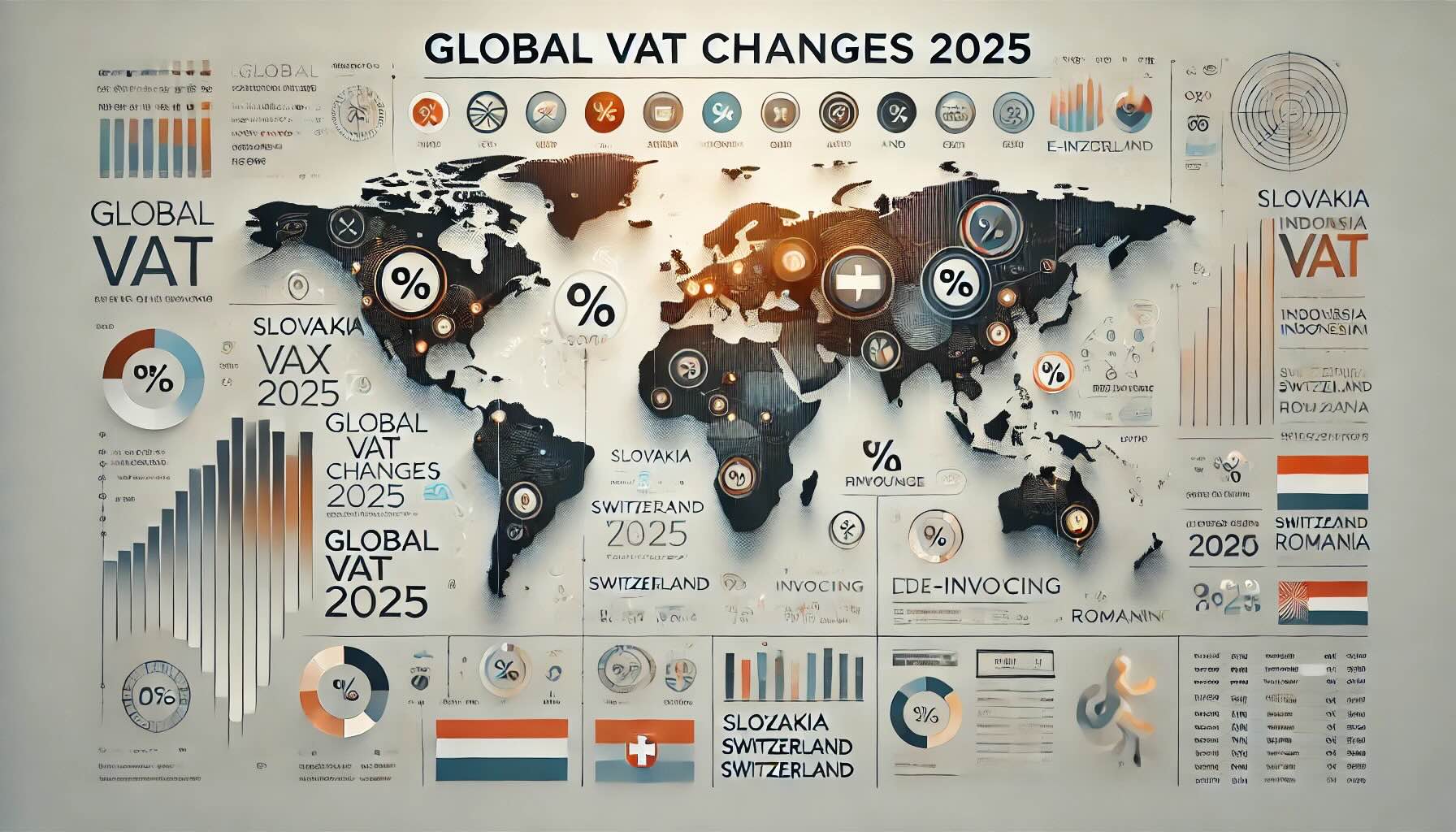

Global VAT Changes for 2025: What You Need to Know at the start of the New Year

From new tax rates to mandatory e-invoicing and digital economy…

-

Egypt: Enhanced VAT Compliance Measures for Digital Services

Egypt enforces stricter VAT rules for non-resident digital service providers,…

-

Egyptian Minister of Finance Inspects the E-Commerce Tax Unit Pavilion at Cairo ICT for Middle East and Africa 2024

E-Commerce Tax Unit Showcases Leadership in Digital Taxation at Cairo…