TAXSPOC News Desk

-

The New Entry Level: Why AI Is Transforming Career Pathways

AI Is Transforming the First Step in a Career The…

-

PwC to Cut 1,500 U.S. Jobs Amid Prolonged Low Attrition and Strategic Restructuring

Job Cuts Hit Recently Hired and Promotion-Eligible Staff as PwC…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

EU Extends Suspension of Tariffs on U.S. Products Until April 14, 2025

The European Commission extends tariff suspension on U.S. imports until…

-

Turkey Decides Not to Implement OECD’s Amount B for Now

Amount B will not be applied to transactions involving distributors,…

-

PwC Faces Advisory Ban in Saudi Arabia Until 2026

The ban could lead Saudi authorities to implement stricter compliance…

-

Council Reaches Political Agreement on DAC9

MNEs will be required to submit their first top-up tax…

-

Key Priorities of the European Commission in Taxation

Focus on Green Transition, Addressing the VAT gap, and Commitment…

-

KPMG Announces Major Global Restructuring

The overhaul will reduce the number of the firm’s “economic…

-

EU-US Trade: How Tariffs Could Impact Europe

European Parliament publishes key insights into EU-US trade relations and…

-

Italian Authorities Investigate Amazon Over Alleged €1.2 Billion VAT Fraud

The investigation, led by the Milan Prosecutor’s Office, could impact…

-

Pillar One Amount B: Key Update on Marketing and Distribution Activities

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B…

-

US: Trump Administration Cuts 6,700 IRS Jobs Amid Tax Season

Many of the eliminated positions are associated with tax compliance…

-

US Weighs Tariff Response to Foreign Digital Services Taxes

DSTs imposed by France, Austria, Italy, Spain, Turkey, the UK,…

-

UAE Ministry of Finance’s eInvoicing Consultation Closes on 27 February

Businesses and stakeholders have until 27 February to submit feedback…

-

India Unveils Union Budget 2025 with Tax Reforms reinforcing ambition to become a global investment and financial hub

New Income Tax Bill on the horizon, push for certainty…

-

Prominent US Lawmakers Back Automated Tax Filings Saving $11 Billion Annually and Disrupting Tax Preparation Industry

US Lawmakers Advocate for Expansion of IRS Direct File Program…

-

Belgium: Circular Letter Provides Guidance on “VAT Chain” Reform

Important Changes to Belgian VAT Filing and Payment Rules

-

European Union: FASTER Directive Published in the EU Official Journal

Digital Tax Certificates, Fast-Track Refund Systems, and New Financial Intermediary…

-

Mexico and U.S. Reach Last Minute Deal on Tariffs

Agreement to Delay Tariffs for 1 month Amid Border Security…

-

U.S. Announces New Tariffs on Canada, Mexico, and China

President Trump issued Executive Orders imposing new tariffs on imports…

-

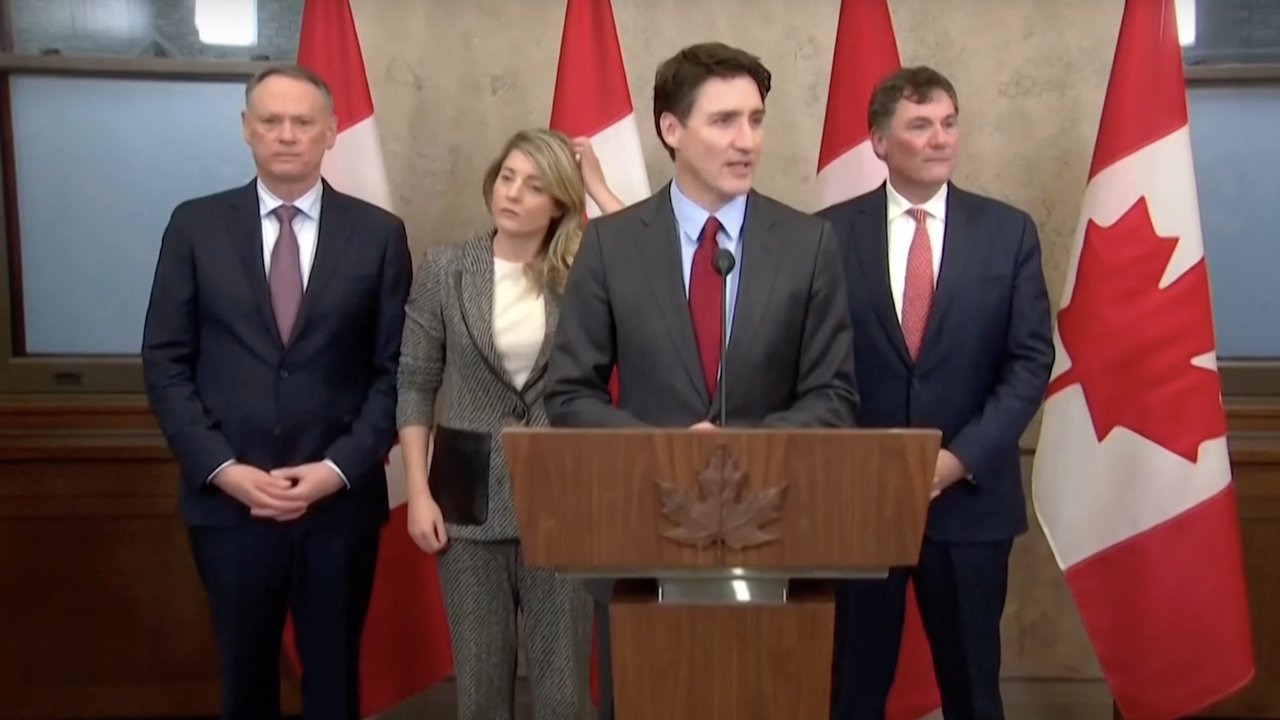

Canada Imposes 25% Tariffs on $30 Billion Worth of U.S. Goods

Access The List!

-

Escalating Trade Tensions: U.S. Tariffs on Canada and Canada’s Retaliatory Measures

Update on the latest U.S. tariff measures against Canada and…

-

America First Trade Policy: A New Strategy for Economic Growth and Security

White House publishes memorandum that sets deadlines for various investigations…

-

Spain Prioritizes Football Once Again with Madrid’s “Mbappé Law” Benefiting Star Player´s Personal Income Tax

This isn’t the first instance of Spanish Personal Income Tax…

-

Impact of India’s Goods and Services Tax (GST) on Intragroup Guarantees

The imposition of GST on intragroup guarantees represents a significant…

-

Germany: E-Invoicing Approved

Parliament Approves Legislation Introducing E-Invoicing Mandate