United Kingdom

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

HMRC Under Fire for Poor Customer Service and Widening Tax Gap

UK House of Commons Committee Report Highlights Concerns with HMRC’s…

-

UK Companies to Receive £700 Million Windfall After European Court of Justice Reverses Tax Ruling

Repayment obligation on the UK government at a time of…

-

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

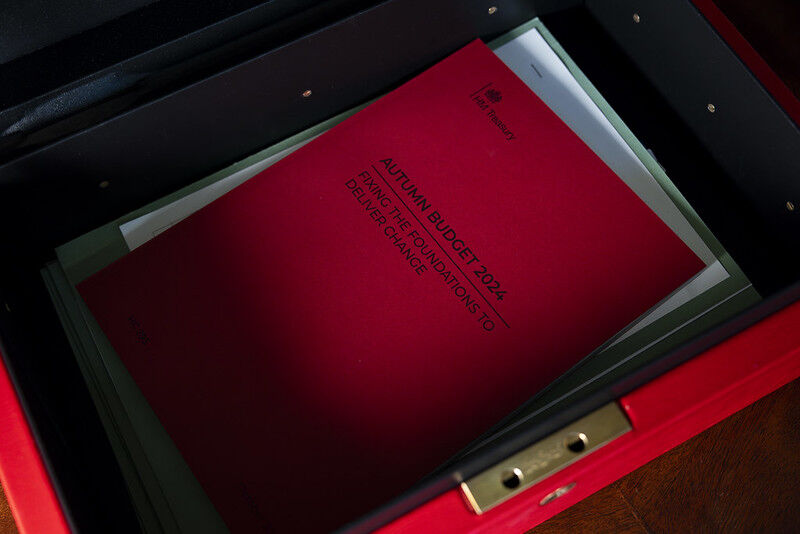

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

UK Prime Minister’s Definition of “Working People” Sparks Debate as Labour Faces Scrutiny Over Upcoming Budget

Awaiting for Labour´s First UK Budget in 14 years, to…

-

EY Reports Global Revenue of US$51.2 Billion for FY24, Highlights Strong Tax Performance

Sharp decline vs last year overall

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

UK´s HMRC is Hiring in Tax in Large Numbers!

HMRC Launches Recruitment Campaigns, 5,000 new compliance staff are expected…

-

UK: Upcoming Consultation on E-invoicing for B2B and B2G; Digital Transformation Roadmap will be released in Spring 2025

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s…

-

HMRC Issues New VAT Compliance Guidelines

HMRC’s expectations around VAT accounting

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and…

-

PwC UK Will Track In- Office Presence

Adjusts Hybrid Work Model Increasing In-Person Expectations

-

EY Reduces Pay Rises and Bonuses for UK Staff Amid Market Challenges

Impact on Tax Advisory Division

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

UK: Reporting Rules for Digital Platforms

HMRC published Rules for Digital platforms that let users sell…

-

UK Update on Corporate Criminal Offences Legislation to Combat Tax Evasion

HMRC reports 11 active probes, 28 cases under review. Aims…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

UK Under Labor Government: Expected Renewed Focus on Large Business and Wealthy Individuals

A Review of Labour Party’s Manifesto on Taxation

-

UK: HMRC publishes Tax Gap Analysis for 2022- 2023

Tax Gap Estimated at 39,8 billion GBP for one year

-

PwC Implements Quiet Layoffs in the UK with Strict Communication Guidelines

“Silent layoffs” across its UK offices targeting the consulting, risk,…

-

UK: Rishi Sunak´s led UK Conservative Party´s 2024 Manifesto is All About Reducing Taxes

Promises to Lower taxes and calling to vote for Tories…

-

Italy and UK reaches reciprocity Agreement on VAT Refund Claims

The agreement will have retrospective effect from 1 January 2021