UPDATE: As per the developing news, tariffs were postponed by 30 days.

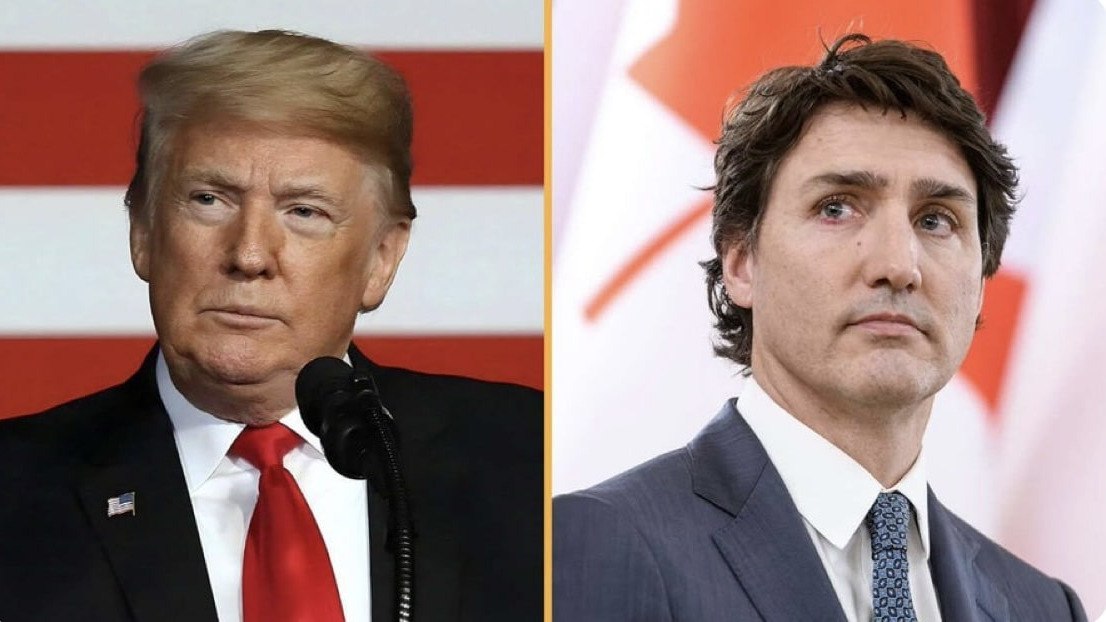

U.S. TARIFFS ON CANADA: KEY DEVELOPMENTS

-

Tariff Implementation: The U.S. administration has officially signed an order imposing tariffs on Canadian imports. The measures include a 25% tariff across all sectors, 10% tariff on energy products, with no exemptions.

-

Effective Date: The duties will take effect on Tuesday and will be formally published in the U.S. Federal Register.

-

Legal Basis: The tariffs are being implemented under the International Emergency Economic Powers Act (IEEPA), justified by a national border emergency related to fentanyl.

-

Duration: These tariffs will remain in place until Canada addresses alleged drug trade concerns, despite limited evidence supporting such claims.

-

No Duty Drawback: Unlike typical trade policies where businesses can apply for duty refunds on re-exported goods, this measure explicitly prohibits duty drawbacks – adding further costs for American companies.

-

Potential Escalation: The order includes a retaliation clause, warning that if Canada responds with countermeasures, U.S. tariffs could be increased further.

CANADA’S RESPONSE: RETALIATORY TARIFFS AND TRADE MEASURES

-

Retaliatory Tariffs Announced: The Canadian government has introduced 25% retaliatory tariffs on $155 billion worth of U.S. goods, with $30 billion taking effect immediately on Tuesday and an additional $125 billion within 21 days. Products targeted include:

-

First Wave (Immediate Tariffs): American beer, wine, peanut butter, bourbon, tires, jewelry, fruit juices, apparel, appliances, lumber, plastics, and more.

-

Second Wave (After 21-Day Consultation): Vehicles (including EVs), trucks, steel, aluminum, aerospace products, fruits, vegetables, beef, pork, dairy, RVs, and boats.

-

Provincial Retaliation: Some Canadian provinces have introduced additional trade restrictions, including banning U.S. contractors from procurement contracts and removing U.S. alcohol from retail shelves.

-

Official Tariff List Published: The Canadian government has released an official U.S. surtax order detailing the tariff codes for affected products.

-

Remission Application Process: Canada has introduced a remission application process, allowing businesses to apply for relief from tariff payments or refunds for duties already paid.

BEYOND TARIFFS: ADDITIONAL TRADE MEASURES UNDER CONSIDERATION

Beyond tariff measures, the Canadian government is reportedly exploring non-tariff restrictions in areas such as government procurement policies and critical minerals exports. These measures could further impact trade dynamics between the two countries.