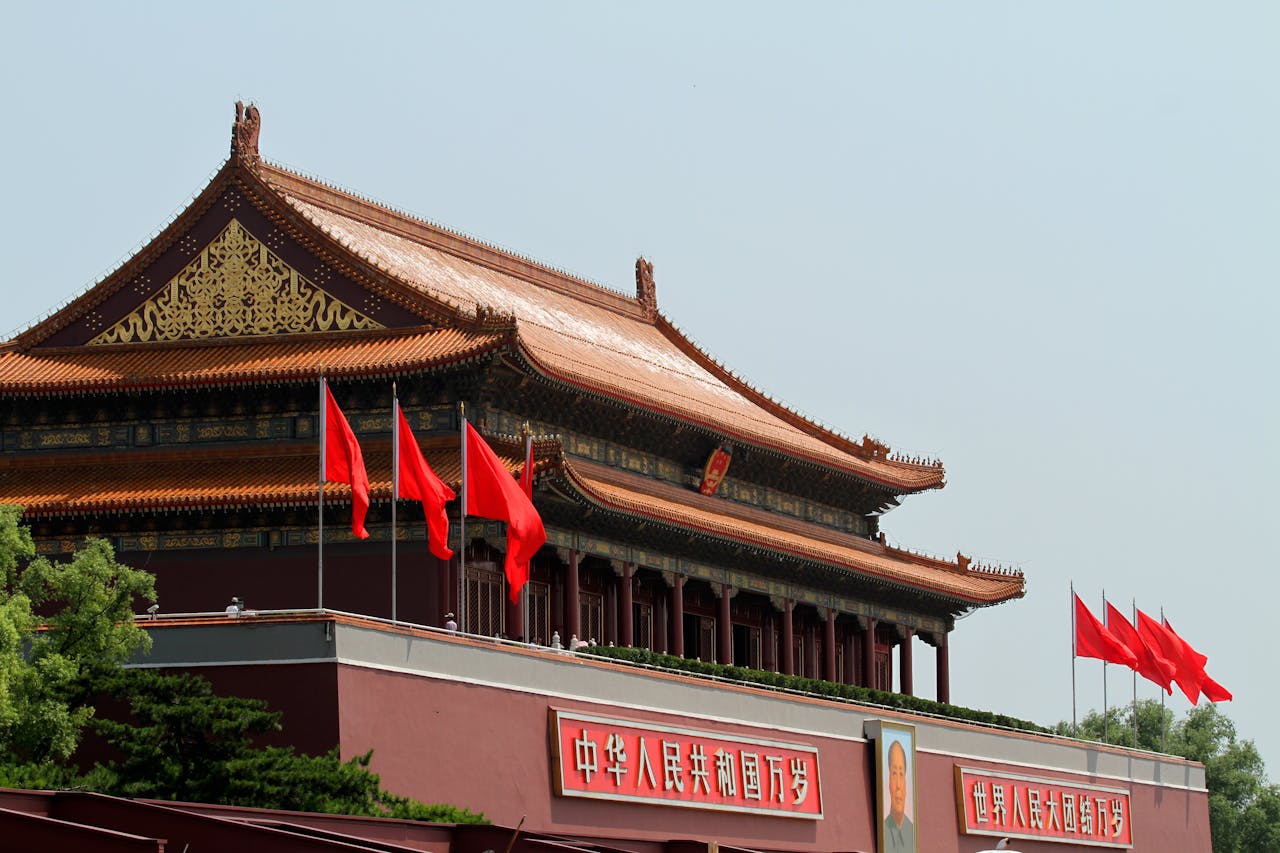

| Tiananmen in Beijing by Ramaz Bluashvili

Photo by Ramaz Bluashvili from Pexels: https://www.pexels.com/photo/tiananmen-in-beijing-6989329/

Effective January 1, 2026, the new VAT law in China outlines the taxable transactions, tax rates, deduction rules, exemptions, and administrative procedures. The key aspects of this law are summarized below:

TAXABLE TRANSACTIONS

VAT applies to transactions within China’s territory under these circumstances:

-

Sale of Goods: When goods are sold, and the departure or location is within China.

-

Real Estate and Natural Resources: Sales, leases, or transfers within China.

-

Financial Products: Sales issued in China or by domestic entities or individuals.

-

Services and Intangible Assets: Consumed within China or sold by domestic entities or individuals.

VAT RATES

-

13%: For most goods, processing services, leasing services for tangible movable property, and imports.

-

9%: For transportation, postal, basic telecommunications, construction, real estate leasing services, and certain goods like agricultural products and publications.

-

6%: For other services and intangible assets.

-

0%: For export goods and certain cross-border services and intangible assets.

-

3%: Simplified calculation method.

TAX ADMINISTRATION

-

Withholding Agents: For overseas entities, the purchaser acts as the withholding agent unless a domestic agent is declared.

-

Tax Deduction: Input VAT can be deducted from output VAT using the prescribed vouchers.

-

Verification: Tax authorities can verify sales amounts if unjustifiably low or high.

-

Refund or Carry Forward: Excess input VAT over output VAT can be carried forward or refunded.

NON-DEDUCTIBLE VAT

-

Simplified tax calculation items, VAT-exempt items, abnormal loss items, and items for personal consumption, among others, are non-deductible.

VAT EXEMPTIONS

Certain items and services are exempt, including:

-

Self-produced agricultural products, medical services, old books, scientific equipment, and services for the disabled.

-

Education, cultural activities, childcare, and funeral services.

VAT LIABILITY AND PAYMENT

-

Occurrence: VAT liability arises on the date sales proceeds are received or when an invoice is issued.

-

Payment Location: Based on the taxpayer’s premises or where the taxable transaction occurs.

-

Reporting Period: Can be 10 days, 15 days, one month, or one quarter.

EXPORT AND CROSS-BORDER TRANSACTIONS

-

Taxpayers exporting goods or providing cross-border services can apply for tax refunds or exemptions.

VAT INVOICES

-

Both paper and electronic invoices are valid, with electronic invoices actively promoted.

IMPLEMENTATION

-

Effective Date: January 1, 2026.

-

Repeal: The previous “Provisional Regulations of the People’s Republic of China on Value-Added Tax” will be repealed.

China VAT Law´s Unofficial Translation to English is available to Download Here!