EMEA

-

Tax Transparency in Latin America: A 2024 Breakthrough Against Evasion and Illicit Flows

How Regional Cooperation and Exchange of Information (EOI) are Driving…

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

EU Extends Suspension of Tariffs on U.S. Products Until April 14, 2025

The European Commission extends tariff suspension on U.S. imports until…

-

Turkey Decides Not to Implement OECD’s Amount B for Now

Amount B will not be applied to transactions involving distributors,…

-

PwC Faces Advisory Ban in Saudi Arabia Until 2026

The ban could lead Saudi authorities to implement stricter compliance…

-

Council Reaches Political Agreement on DAC9

MNEs will be required to submit their first top-up tax…

-

Key Priorities of the European Commission in Taxation

Focus on Green Transition, Addressing the VAT gap, and Commitment…

-

KPMG Announces Major Global Restructuring

The overhaul will reduce the number of the firm’s “economic…

-

EU-US Trade: How Tariffs Could Impact Europe

European Parliament publishes key insights into EU-US trade relations and…

-

Italian Authorities Investigate Amazon Over Alleged €1.2 Billion VAT Fraud

The investigation, led by the Milan Prosecutor’s Office, could impact…

-

Pillar One Amount B: Key Update on Marketing and Distribution Activities

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B…

-

UAE Ministry of Finance’s eInvoicing Consultation Closes on 27 February

Businesses and stakeholders have until 27 February to submit feedback…

-

Belgium: Circular Letter Provides Guidance on “VAT Chain” Reform

Important Changes to Belgian VAT Filing and Payment Rules

-

Egypt’s New Tax Incentive Law: A Catalyst for SME Growth and Economic Prosperity

A Bold Move Towards a More Dynamic Business Landscape

-

European Union: FASTER Directive Published in the EU Official Journal

Digital Tax Certificates, Fast-Track Refund Systems, and New Financial Intermediary…

-

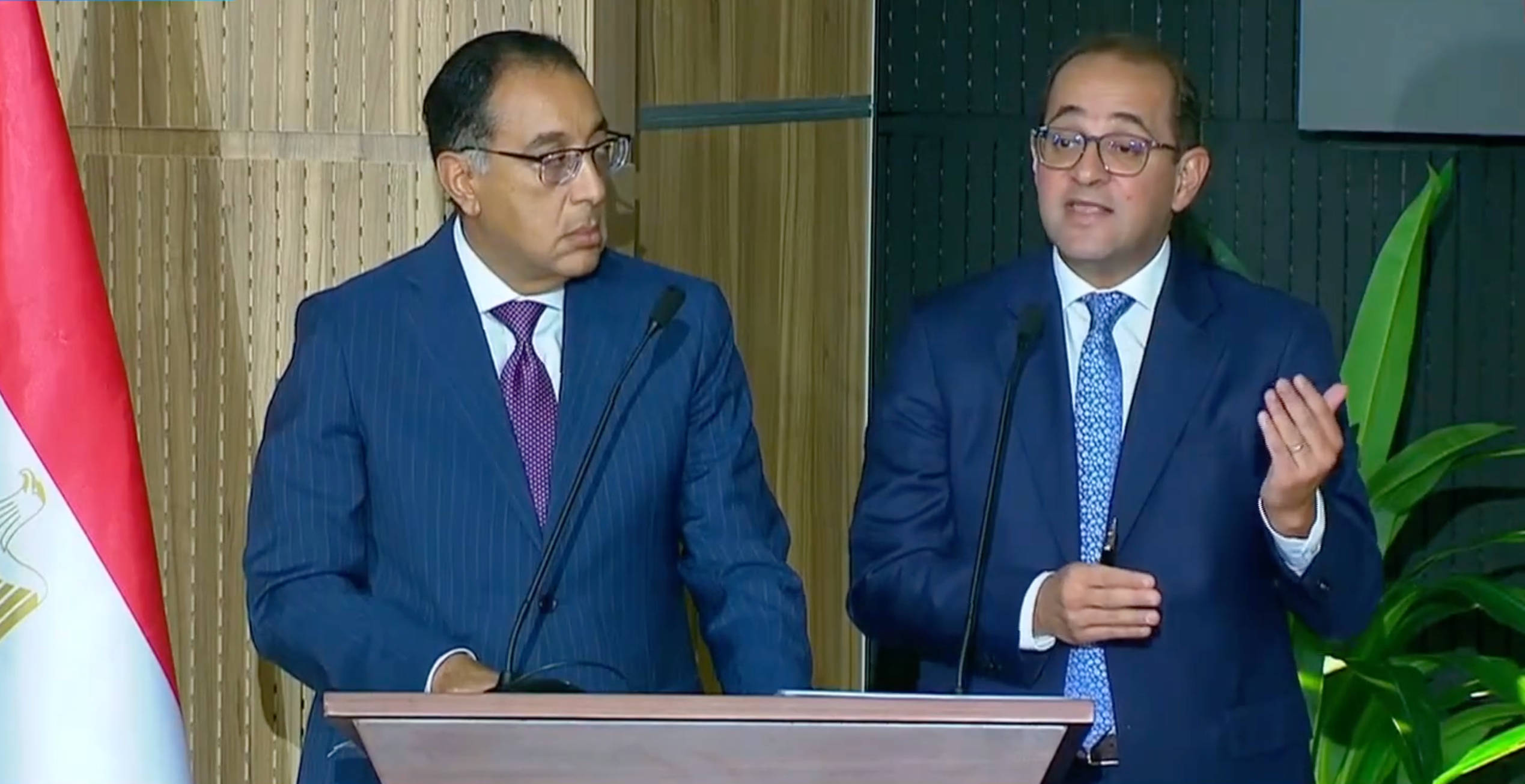

Egypt 2025: Launching the Strategic Committee for Digital Economy and Entrepreneurship

A Pivotal Step Towards Enhancing Innovation and Economic Growth in…

-

HMRC Under Fire for Poor Customer Service and Widening Tax Gap

UK House of Commons Committee Report Highlights Concerns with HMRC’s…

-

EU Criticizes Trump Administration’s Withdrawal from Global Tax Deal

Highlighting the need for fair taxation and advancing climate initiatives…

-

Egypt And The Sultanate Of Oman Convention For The Elimination Of Double Taxation And The Prevention Of Tax Evasion With Respect To Taxes On Income.

Ensuring Tax Fairness and Promoting Stronger Economic Ties Between the…

-

EU Trade Relations with the United States: Facts and Figures

With rising trade uncertainty between the US and its closest…

-

Accenture Secures Landmark Victory in the Danish Supreme Court

First Ruling Favoring a Taxpayer in a Transfer Pricing Case

-

Spain Prioritizes Football Once Again with Madrid’s “Mbappé Law” Benefiting Star Player´s Personal Income Tax

This isn’t the first instance of Spanish Personal Income Tax…

-

Transfer Pricing and Tax Compliance in Morocco: Navigating the Evolving Landscape

An In-depth Exploration of Morocco’s Transfer Pricing Regulations, OECD Alignment,…

-

European Union: Council Adopts New Withholding Tax Procedures via FASTER Directive

New rules take effect from January 1, 2030: Introducing Digital…

-

UAE Implements Domestic Minimum Top Up Tax

Ministry of Finance Announces Updates to Corporate Tax Law Affecting…

-

EU Adopts 15th Package of Restrictive Measures on Russia

Limiting Russia’s access to resources by enhancing trade restrictions, targeting…

-

European Union: Council Introduces Electronic VAT Exemption Certificate

Modernizing Tax Procedures, replacing paper VAT exemption certificates for Embassies,…

-

The EU has ABSTAINED in the vote on UN Resolution on Tax Cooperation

EU Released Statement calling out “serious outstanding reservations” on UN General…

-

France´s Electronic Invoicing Reform: Updated Guidelines from the DGFIP

Revised factsheets on the transition to mandatory electronic invoicing in…

-

Germany’s New Transfer Pricing Compliance Rules for 2025

Stricter deadlines, higher penalties effective January 1, 2015

-

European Union: ECJ Confirms that Relocating Production to Evade Tariffs Could Not Be Deemed “Economically Justified”

A Landmark Case Amidst Anticipated Tariff Turmoil: Shift to Material…

-

Egypt: Enhanced VAT Compliance Measures for Digital Services

Egypt enforces stricter VAT rules for non-resident digital service providers,…

-

EU VAT: new ruling on EV charging – key insights for CPOs and eMSPs

CJEU ruling clarifies EU VAT treatment for EV charging value…

-

European Commission Refers Germany to Court of Justice Over Discriminatory Tax Treatment

November Infringement Package contains discriminatory tax practices related to reinvested…

-

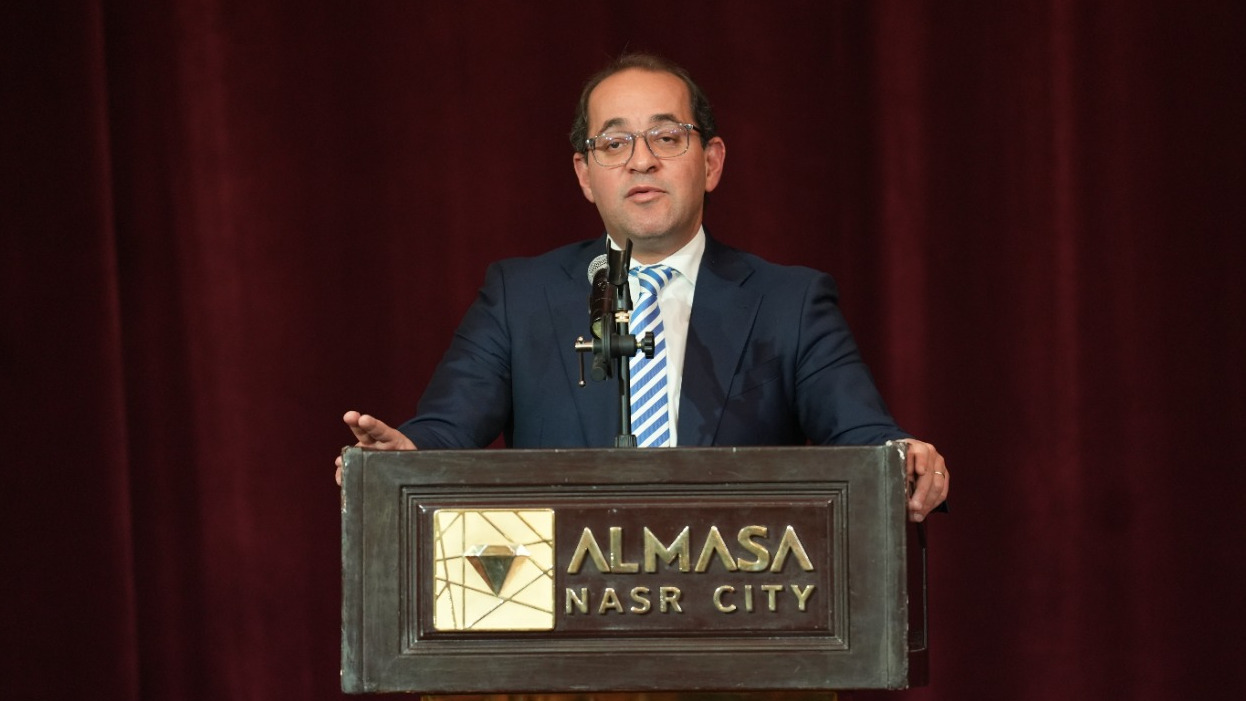

Egyptian Minister of Finance Inspects the E-Commerce Tax Unit Pavilion at Cairo ICT for Middle East and Africa 2024

E-Commerce Tax Unit Showcases Leadership in Digital Taxation at Cairo…

-

UK Companies to Receive £700 Million Windfall After European Court of Justice Reverses Tax Ruling

Repayment obligation on the UK government at a time of…

-

Germany: How the end of Governing Coalition impacts Tax

While Numerous Legislative Projects are Expected to be delayed, Minority…

-

Breaking News: European Union Finally Adopts VIDA Package to Modernize VAT System

Real-Time Digital Reporting and E-Invoicing will become mandatory in the…

-

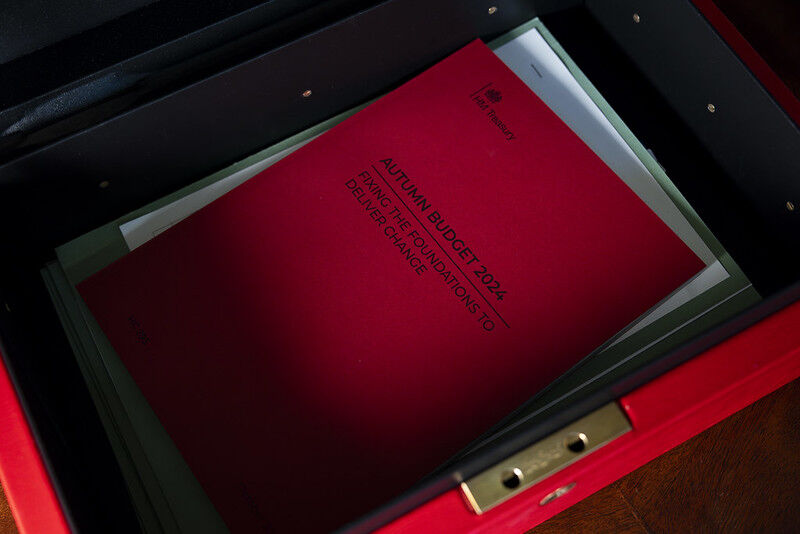

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

Spain Introduces New Technical Specifications for Approved Invoicing Software: VERI*FACTU

English translation available to download here!

-

UK Prime Minister’s Definition of “Working People” Sparks Debate as Labour Faces Scrutiny Over Upcoming Budget

Awaiting for Labour´s First UK Budget in 14 years, to…

-

EU Commission Proposes DAC9 to Simplify Compliance for Businesses under Pillar 2 Directive

Enhanced Administrative Cooperation in Taxation: update is aimed at simplifying…

-

Mark Your Calendar: EU´s November 5 ECOFIN Meeting to Feature Key Developments on ViDA

Full Agreement expected at the next November 5th EU Economic…

-

France’s 2025 Budget: Tax Hikes targeting the Rich and Spending Cuts to Address Deficit

2025 Budget Plan: €20 billion is expected to be sourced…

-

EY Reports Global Revenue of US$51.2 Billion for FY24, Highlights Strong Tax Performance

Sharp decline vs last year overall

-

EU Deforestation Law: Council Extends Application Timeline by 12 Months

The regulation will still require that products placed on or…

-

OECD Examines Tax Arbitrage in Closely Held Businesses

OECD Taxation Working Papers No 70 Released

-

China Imposes Tariffs on European Brandy

A levy of up to 39% in Response to EU´s…

-

Egypt introduces the First Package of Tax Reforms aimed at Driving Economic Transformation and Attracting Investment

20 Key Measures to Build Trust with Taxpayers and Streamline…

-

EU Approves Tariffs on Chinese Electric Vehicles Following Anti-Subsidy Probe

Additional tariffs on Chinese-made EVs up to 35.3% for five…

-

EU Reaffirms Commitment to Inclusive and Effective International Tax Cooperation

EU has approved its official position concerning UN Framework Convention…

-

Brazil Introduces OECD Pillar Two Rules with Provisional Measure

Translation to English Available to Download Here!

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

UAE Implements Revisions to VAT Executive Regulations

Set to take effect on November 15, 2024

-

European Commission Takes Legal Action on Taxation Matters Across Member States

October Infringements Package on Taxation and Customs Union: Hungary, Malta,…

-

New Rules on Jurisdiction Transfer Between the Court of Justice and the General Court Now in Effect

Cases on VAT, excise duties, the Customs Code, tariff classification…

-

UK´s HMRC is Hiring in Tax in Large Numbers!

HMRC Launches Recruitment Campaigns, 5,000 new compliance staff are expected…

-

European Commission to Register Imports Under Trade Defence Investigations

Further Measures to Combat Unfair Competition

-

Lithuania launches Pilot Program for Real-Time VAT Return Assessments

Real time data comparison between E-Invoicing System and VAT returns…

-

UK: Upcoming Consultation on E-invoicing for B2B and B2G; Digital Transformation Roadmap will be released in Spring 2025

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s…

-

German E-Invoices: Email Inbox Now Sufficient for Receipt

Significant Flexibility on the Requirement to Receive AP Invoices by…

-

European Union: Reminder of the September 30 VAT Refund Deadline

Applicable for EU and Most of Non-EU Businesses Refunds

-

The Netherlands: Budget Day 2025 and Tax Changes Announced

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

-

HMRC Issues New VAT Compliance Guidelines

HMRC’s expectations around VAT accounting

-

New European Commission and the apparent downscaling of Taxation from the priorities

Taxation sits in an unlikely portfolio with Climate, Net Zero,…

-

Poland: Rules for the Digitization of Accounting Documentation in CIT

Mandating the use of structured electronic formats for accounting records

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will…

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and…

-

Apple Tax Case: A Look Back at the Decade of Dispute

as ECJ Gives Final Judgement in the Matter

-

European Union: ECJ rules Ireland to recover 13 bln EUR granted to Apple!

Overturns General Court Decision on Apple’s Tax Rulings in Ireland

-

South Africa: Highlights from the 2024 Draft Taxation Laws and Draft Tax Administration Laws Amendment Bills

Available for Public Comment

-

PwC UK Will Track In- Office Presence

Adjusts Hybrid Work Model Increasing In-Person Expectations

-

EY Reduces Pay Rises and Bonuses for UK Staff Amid Market Challenges

Impact on Tax Advisory Division