EMEA

-

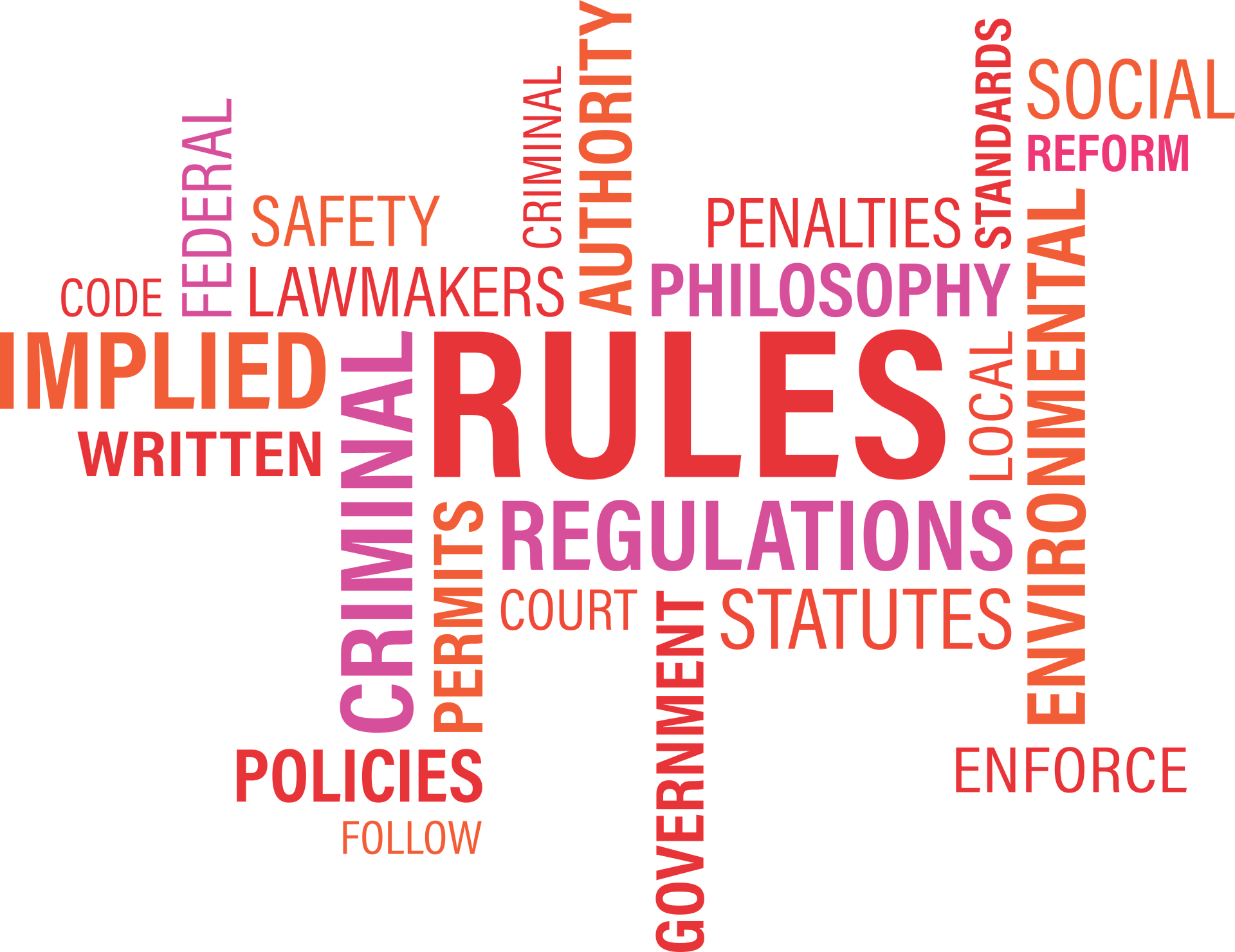

Bahrain Introduces Domestic Minimum Top-up Tax for Multinational Enterprises

The first member of the Gulf Cooperation Council (GCC) to…

-

Swiss Federal Council Adopts Partial Revision of Swiss VAT Ordinance

Swiss VAT updates to streamline compliance and tax calculations, effective…

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and…

-

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

UK: Reporting Rules for Digital Platforms

HMRC published Rules for Digital platforms that let users sell…

-

United Nations Framework Convention on International Tax Cooperation, The Second Session is in progress

US Feedback on the Zero Draft Terms of Reference for…

-

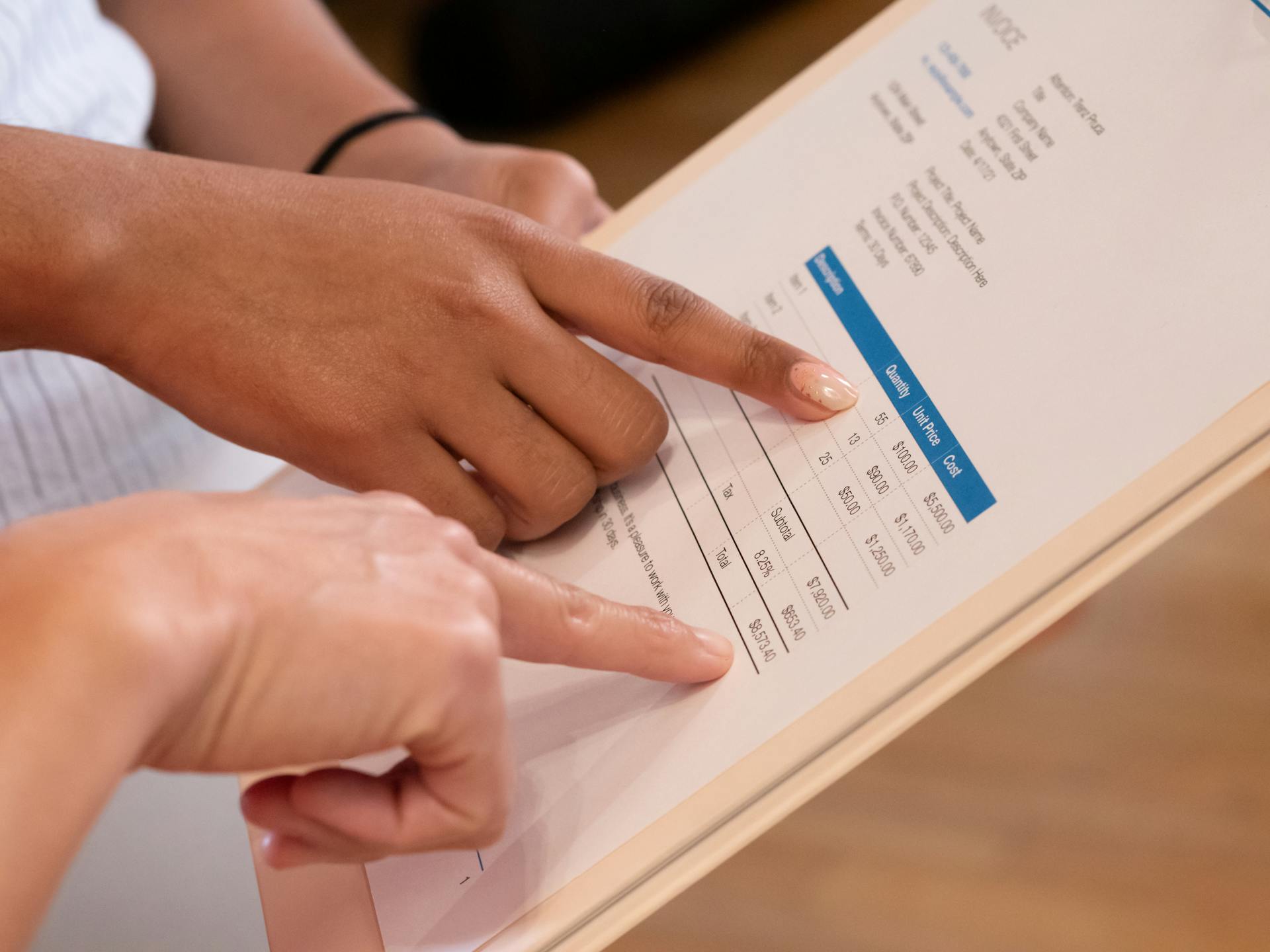

Transparency and Reporting tops as currently having the most impact on Tax Leaders Worldwide

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals…

-

European Union: Draft Regulation on Corporate Income Tax Reporting establishes Common Template and Electronic Formats

New regulation aims to enhance tax transparency and comparability across…

-

UK Update on Corporate Criminal Offences Legislation to Combat Tax Evasion

HMRC reports 11 active probes, 28 cases under review. Aims…

-

European Court of Justice: Upholding the EU Directive on Tax Reporting Obligations

CJEU upholds EU directive on tax reporting for cross-border arrangements.…

-

UAE Publishes Guide on Determination of Taxable Income for Corporate Income Tax

107-page document clarifying key concepts under UAE Corporate Tax Law.…

-

European Union: Evaluation of the Anti-Tax Avoidance Directive In Progress

Have Your Say on the Directive aimed to fight aggressive…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

Finland’s VAT Rate Increase: Comprehensive Guide to the 2024 Tax Change

Key details and practical implications for various business scenarios under…

-

G20 Rio de Janeiro Ministerial Declaration on International Tax Cooperation

Historic declaration on international tax cooperation

-

OECD Participates in G20 Finance Ministers and Central Bank Governors Meeting in Rio de Janeiro

Key reports on international tax cooperation, digital economy challenges, and…

-

Constitutional Court Rules Mandatory Disclosure Rules (MDR) Unconstitutional

What a month for Mandatory Disclosure Rules (MDR) in Poland!

-

-

United States Announces Suspension of 1992 Tax Convention with Russia

Mutual agreement on Suspension

-

UK Under Labor Government: Expected Renewed Focus on Large Business and Wealthy Individuals

A Review of Labour Party’s Manifesto on Taxation

-

Oman Set to Introduce Personal Income Tax

A Gulf First, Expected to be in Single Digits. What…

-

UAE: Voluntary Disclosure Program for Customs in Dubai

The program allows businesses to correct past customs declaration errors,…

-

Dutch Customs: Genuine Mistakes no longer lead to Criminal Prosecution, Import of Medicines Requires Specific Details

Changes in Dutch Customs Regulations

-

Belgium: Administrative Tolerance for 2024 Moves Registration Requirement under Pillar 2 Regulations

Only applicable to groups that will not make Belgian advance…

-

Italy: New Rules on Administrative and Criminal Tax Sanctions

Changes Affect Penalties Regarding Income Tax, VAT, and Withholding Tax…

-

Saudi Arabia Extends Tax Amnesty Initiative to End of 2024

Additional time to correct any discrepancies in their tax records…

-

Stalemate at the ECOFIN Meeting: Estonia Blocks ViDA Initiative

Stalemate at the ECOFIN Meeting: Estonia Blocks ViDA Initiative

-

UK: HMRC publishes Tax Gap Analysis for 2022- 2023

Tax Gap Estimated at 39,8 billion GBP for one year

-

Bulgaria: Implementing SAF-T Reporting: Expected Scope, Requirements, SAF-T Format Published

Expected Scope, Requirements, and SAF-T format documentation in English are…

-

Germany: Draft Administrative Guidelines on E-Invoicing made available by the Germany Tax Authorities

Our Article Includes an English translation of Guidelines Available to…

-

European Union: European Commission Targets China’s Electric Vehicle Sector

Investigation Reveals Unfair Subsidies in China. Provisional Duties to be…

-

European Union: Judgement on VAT Fixed Establishment ECJ case Adient C-533/22

The ECJ provides clarification on the concept of a VAT…

-

European Union: ECJ Judgement In Case C-696/22, C SPRL

VAT Liability does not necessarily require actually receiving remuneration

-

Poland: E-invoicing Officially Postponed to 2026

President Signs Bill Postponing Mandatory KSeF Implementation

-

PwC Implements Quiet Layoffs in the UK with Strict Communication Guidelines

“Silent layoffs” across its UK offices targeting the consulting, risk,…

-

UK: Rishi Sunak´s led UK Conservative Party´s 2024 Manifesto is All About Reducing Taxes

Promises to Lower taxes and calling to vote for Tories…

-

Saudi Arabia: ZATCA Extends Tax Amnesty until end of June

Initiative, originally set to end on December 31, 2023, will…

-

-

France: Update on E-invoicing

Technical specifications expected June 19, 2024, Go Live deadlines maintained

-

Inclusive Framework on BEPS Targets Multilateral Convention Signature by End of June

Advancing towards a final agreement on Pillar One, the anticipated…

-

Spanish E-Invoicing: Expected Delay

Rumor has it Spanish e-invoicing will be deferred to mid…

-

EU: European Commission releases Guidance Document on CBAM Implementation for Importers of Goods into the EU

Non- binding document on Carbon Border Adjustment Mechanism

-

OECD Releases Report on Designing a National Strategy Against Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation…

-

EU Council Decision to Open Negotiations for amendment of the Agreements concerning the automatic exchange of financial account information to improve international tax compliance

Concerns negotiations between European Union and the Swiss Confederation, the…

-

Italy: PLASTIC TAX postponed to July 1st, 2026!

Postponed again!

-

The Netherlands: New Coalition Government Unveils Ambitious Tax Plans

Tax Plans concern mainly VAT, Fly Tax, Plastic Packaging Tax

-

Belgium: Practicalities on Notification Requirement for In-Scope Groups Under Belgian Pillar Two Rules

Registration to obtain number from the Belgian Trade Register

-

Belgium: Pillar Two Mandatory Notification for MNEs and Large Domestic Groups

On May 21, 2024, the Belgian tax administration released new…

-

European Union: 13th Directive VAT Refund Deadline is fast approaching!

Non- EU business eligible to file VAT refund claim in…

-

Belgian Parliament Adopts New Pillar Two Law with Key Modifications

Rectification of prior legislative oversights identified in the original December…

-

Sneak Peak to Revised ViDA draft up for Vote May 14, 2024

Digital Reporting Requirements, Platforms, Single VAT Registration

-

European Union – New Zealand Free Trade Agreement Came into Effect on May 1, 2024

Most goods will have tariffs removed upon the FTA’s commencement

-

Proposal for Modernizing VAT Rules in the Digital Age: VIDA Directive

A look at Explanatory Memorandum to the Council Directive amending…

-

European Union: ViDA and Withholding Taxes Take a Central Stage in the Upcoming ECOFIN Meeting Agenda

ECOFIN Council Meeting of May 14, 2024 has 2 Tax…

-

Poland: New E-Invoicing Timeline

Detailed Analysis of the KSeF Audit: Unveiling Flaws and Planned…

-

OECD Publishes Taxing Wages 2024 Report

Annual publication provides details of taxes paid on wages in…

-

UAE CIT Registration: When to Register

CIT Registration Dates are fast approaching

-

OECD publishes 334 pages Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023)

Tax Challenges Arising from the Digitalisation of the Economy.

-

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

Spain Priorities: Football it is!

”Mbappe Law” follows a precedent set by Real Madrid with…

-

Saudi Arabia Guidelines for Regional Headquarters Tax and Zakat Rules

Saudi Arabia unveiled a 30-year tax incentive for multinational companies…

-

KPMG’s Record Penalty for Exam Cheating Scandal

Historic $25 million fine on KPMG Netherlands for pervasive cheating…

-

G20 Considers Global Minimum Tax on Billionaires

Brazil and France at the forefront in bringing forward the…

-

European Union: Proposal on Transfer Pricing Adjustments: Understanding Primary, Corresponding, and Compensating Adjustments

Explanatory Memorandum on the Proposal of Council Directive on Transfer…

-

Finland: Government will raise VAT to 25.5 percent aiming to collect one billion euros a year more

The government is considering implementing the VAT rise before year…

-

Italy and UK reaches reciprocity Agreement on VAT Refund Claims

The agreement will have retrospective effect from 1 January 2021

-

Oman Automatic Exchange of Information (AEOI) System Update

Automatic Exchange of Information (AEOI) system is now available for…

-

European Union: VAT Expert Group Deliberates on Key VAT Policy and Implementation Measures

The VAT Expert Group (VEG) recently convened in Brussels for…

-

European Union: ViDA is priority for the Belgian Presidency, expectations of reaching an agreement potentially in May or June

Latest update from VAT Expert Group discussions

-

European Union: Progress on the EU Council Directive on Transfer Pricing

The directive should apply from 1 January 2025 (instead of…

-

Saudi Arabia: VAT Refund Procedures for Non-Residents

A reminder of the key points regarding the VAT refund…

-

Polish Government Adopts DAC7 Bill to Enhance Tax Transparency

The enactment of this act is anticipated to greatly improve…

-

Italy’s Plastic Tax planned to come into effect on July 1, 2024 expected to be postponed again

Expected postponement for the 7th time until July 1 2026.…

-

Germany: E-Invoicing Approved

Parliament Approves Legislation Introducing E-Invoicing Mandate