LATAM

-

Tax Transparency in Latin America: A 2024 Breakthrough Against Evasion and Illicit Flows

How Regional Cooperation and Exchange of Information (EOI) are Driving…

-

KPMG Announces Major Global Restructuring

The overhaul will reduce the number of the firm’s “economic…

-

Pillar One Amount B: Key Update on Marketing and Distribution Activities

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B…

-

Mexico and U.S. Reach Last Minute Deal on Tariffs

Agreement to Delay Tariffs for 1 month Amid Border Security…

-

U.S. Announces New Tariffs on Canada, Mexico, and China

President Trump issued Executive Orders imposing new tariffs on imports…

-

U.S. Tariff Threats Force Immigration Agreement with Colombia

Drafted tariffs and sanctions have been placed on hold

-

Argentina Announces Dissolution of Federal Tax Authority (AFIP) and Creation of New Agency

Collections and Customs Control Agency (ARCA) will be established with…

-

OECD Examines Tax Arbitrage in Closely Held Businesses

OECD Taxation Working Papers No 70 Released

-

Colombian 2024 Tax Reform Bill Submitted to Congress

Impact on Corporate and Capital Gains Rates

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

Argentina’s Implementation of the Large-Investment Regime Bill

Decree 749/2024 Aims at Attracting Investors

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

Introduction of Dual VAT in Brazil: A VAT Law!

Draft VAT Law is available to download here!

-

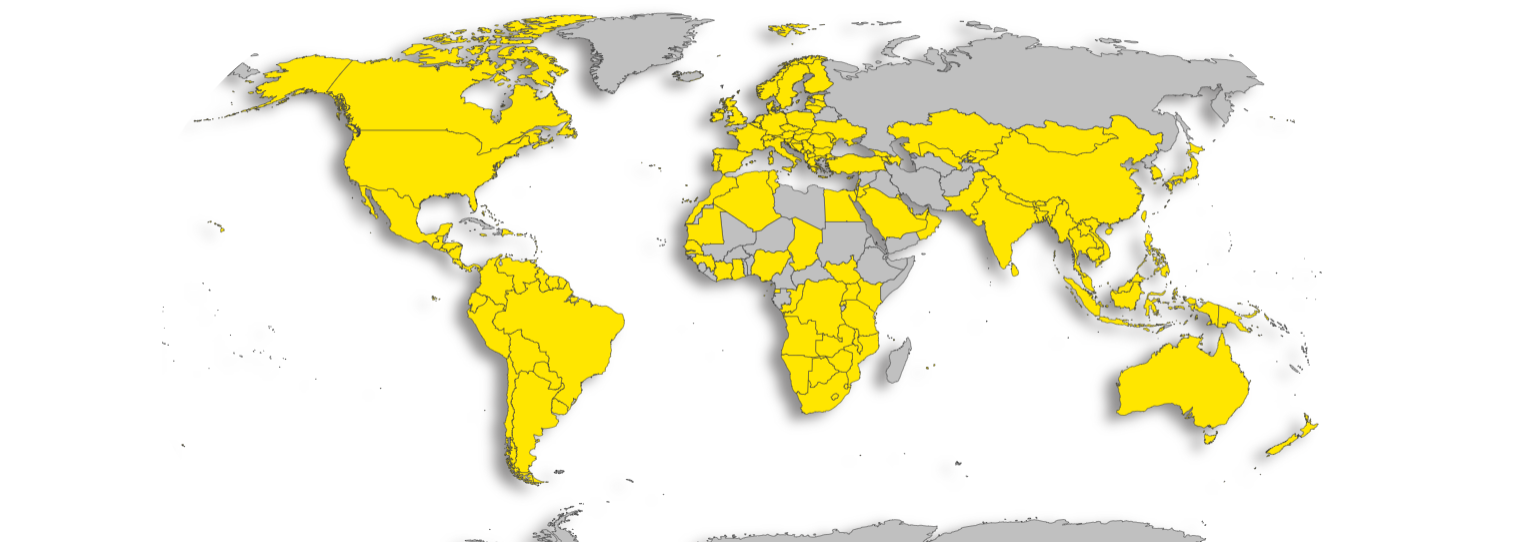

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Chile´s Government Proposes New Amendments to the Tax Compliance Bill

Fine-tuning the bill with further amendments expected

-

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

Coca-Cola to Pursue Appeal Following Tax Court Decision

$16 billion of Potential Incremental Tax and Interest Liabilities

-

United Nations Framework Convention on International Tax Cooperation, The Second Session is in progress

US Feedback on the Zero Draft Terms of Reference for…

-

Transparency and Reporting tops as currently having the most impact on Tax Leaders Worldwide

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals…

-

Renewal of Qualified Maquiladora Approach Agreement Between U.S. and Mexico in 2024

This is the second renewal of the agreement, preserving the…

-

G20 Rio de Janeiro Ministerial Declaration on International Tax Cooperation

Historic declaration on international tax cooperation

-

OECD Participates in G20 Finance Ministers and Central Bank Governors Meeting in Rio de Janeiro

Key reports on international tax cooperation, digital economy challenges, and…

-

Argentina: President Javier Milei Reconfirms Commitment to Tax Reform and Opening up to International Trade

Signature of Historic May Pact, symbolic declaration, centered around Tax.

-

New Transfer Pricing Framework Introduced in Brazil

Aligned with OECD Guidelines

-

-

Inclusive Framework on BEPS Targets Multilateral Convention Signature by End of June

Advancing towards a final agreement on Pillar One, the anticipated…

-

OECD Releases Report on Designing a National Strategy Against Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation…

-

OECD Publishes Taxing Wages 2024 Report

Annual publication provides details of taxes paid on wages in…

-

OECD publishes 334 pages Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023)

Tax Challenges Arising from the Digitalisation of the Economy.

-

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

Brazil: expected VAT Rate Revealed!

First version of Tax Reform Proposal by Brazil´s Finance Minister…

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

G20 Considers Global Minimum Tax on Billionaires

Brazil and France at the forefront in bringing forward the…

-

Brazil’s VAT Reform Progress: April 2024

Legislators roll up their sleeves preparing for Brazil´s VAT implementation