NA

-

PwC to Cut 1,500 U.S. Jobs Amid Prolonged Low Attrition and Strategic Restructuring

Job Cuts Hit Recently Hired and Promotion-Eligible Staff as PwC…

-

Trump Targets Global Cinema with 100% Tariff on Foreign-Made Films, Citing Hollywood’s “Fast Death”

Donald Trump announces sweeping new tariffs on international movie imports,…

-

EU Extends Suspension of Tariffs on U.S. Products Until April 14, 2025

The European Commission extends tariff suspension on U.S. imports until…

-

KPMG Announces Major Global Restructuring

The overhaul will reduce the number of the firm’s “economic…

-

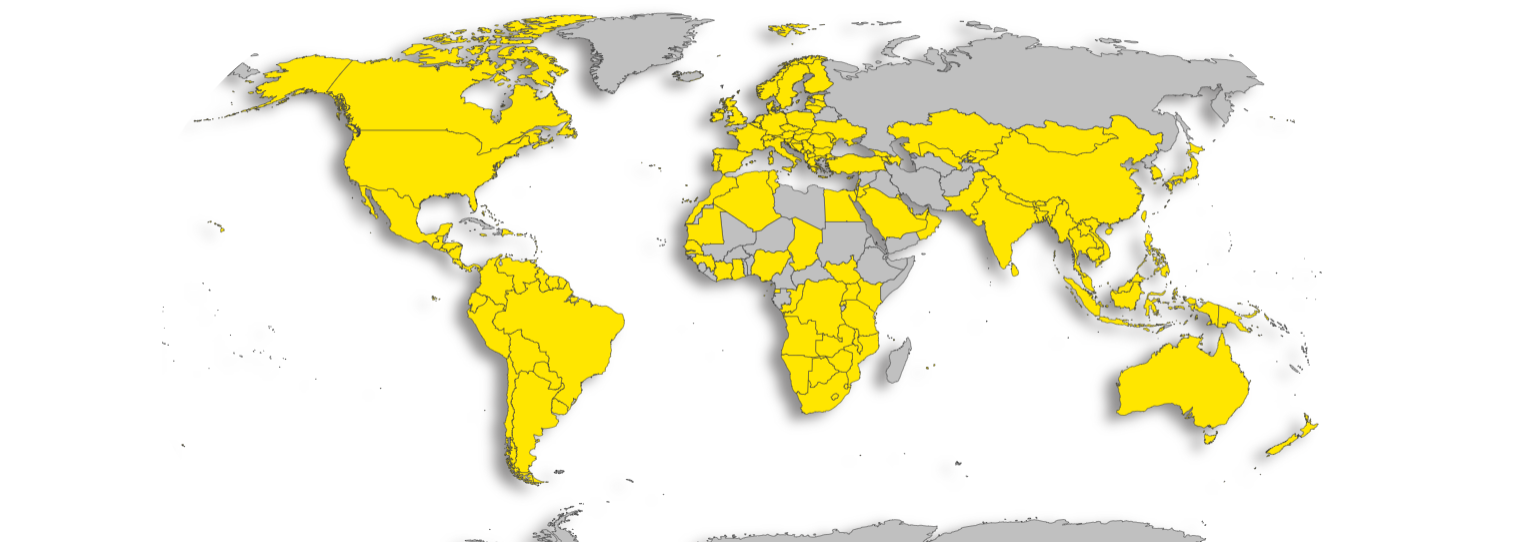

EU-US Trade: How Tariffs Could Impact Europe

European Parliament publishes key insights into EU-US trade relations and…

-

Italian Authorities Investigate Amazon Over Alleged €1.2 Billion VAT Fraud

The investigation, led by the Milan Prosecutor’s Office, could impact…

-

US: Trump Administration Cuts 6,700 IRS Jobs Amid Tax Season

Many of the eliminated positions are associated with tax compliance…

-

US Weighs Tariff Response to Foreign Digital Services Taxes

DSTs imposed by France, Austria, Italy, Spain, Turkey, the UK,…

-

Prominent US Lawmakers Back Automated Tax Filings Saving $11 Billion Annually and Disrupting Tax Preparation Industry

US Lawmakers Advocate for Expansion of IRS Direct File Program…

-

Mexico and U.S. Reach Last Minute Deal on Tariffs

Agreement to Delay Tariffs for 1 month Amid Border Security…

-

U.S. Announces New Tariffs on Canada, Mexico, and China

President Trump issued Executive Orders imposing new tariffs on imports…

-

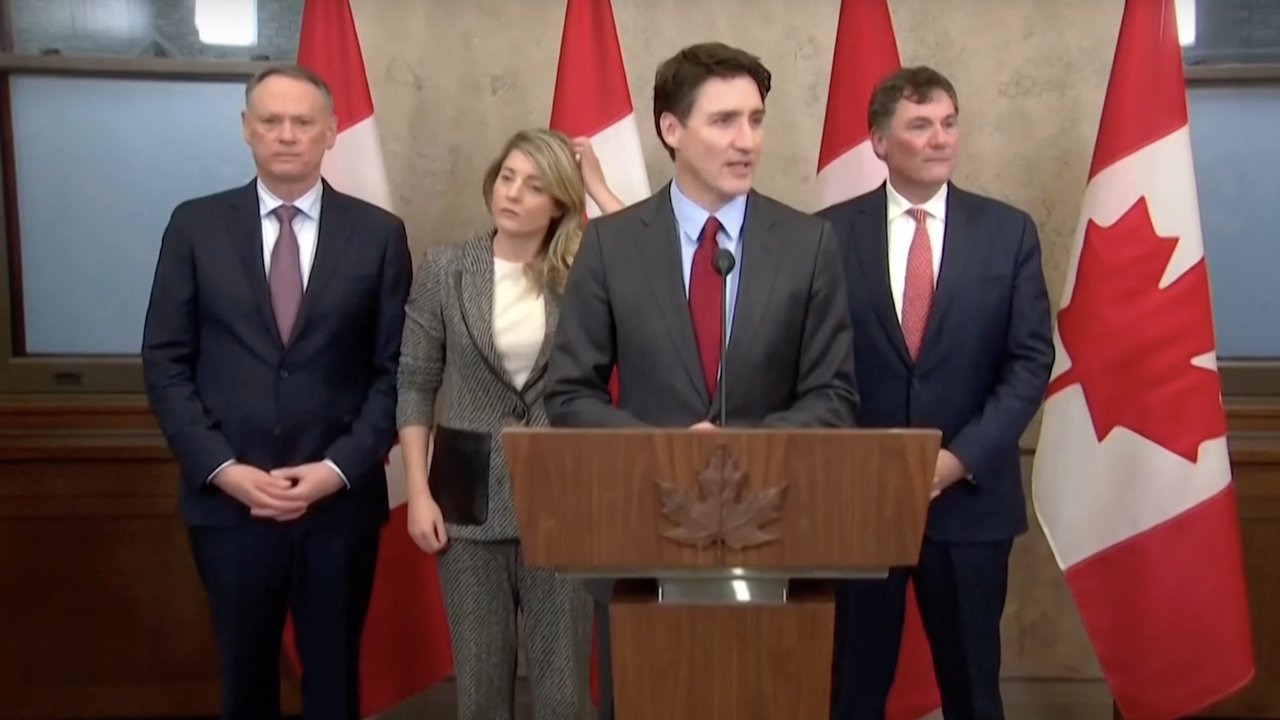

Canada Imposes 25% Tariffs on $30 Billion Worth of U.S. Goods

Access The List!

-

Escalating Trade Tensions: U.S. Tariffs on Canada and Canada’s Retaliatory Measures

Update on the latest U.S. tariff measures against Canada and…

-

U.S. Tariff Threats Force Immigration Agreement with Colombia

Drafted tariffs and sanctions have been placed on hold

-

Uncertainty Looms Over IRS as Trump Speaks about Terminating or Repurposing 88,000 IRS Workers

We’re in the process of developing a plan to either…

-

China’s 2025 Business Climate Survey Highlights Shifting Sentiments Among US Companies in China

As US and Chinese companies prepare for the potential impact…

-

EU Criticizes Trump Administration’s Withdrawal from Global Tax Deal

Highlighting the need for fair taxation and advancing climate initiatives…

-

U.S. Administration Rejects OECD Global Tax Deal to Reassert Sovereignty

Any commitments made by the previous administration regarding the Global…

-

America First Trade Policy: A New Strategy for Economic Growth and Security

White House publishes memorandum that sets deadlines for various investigations…

-

US: IRS Commissioner Resigns on Trump´s Inauguration Date, Democrats Raise Concerns Over IRS Nominee

As IRS Commissioner Danny Werfel steps down, Trump´s Candidate Billy…

-

President-Elect Trump Announces Creation of ‘External Revenue Service’ to Collect Tariffs

President´s Inauguration date, January 20, 2025 will be the birth…

-

EU Trade Relations with the United States: Facts and Figures

With rising trade uncertainty between the US and its closest…

-

US: IRS Outlines Plans on Simplified Approach for Pricing Controlled Transactions Involving Marketing and Distribution activities

Notice 2025-4 Aligns with OECD Report on Amount B of…

-

Canada Braces for Possible Trump Tariffs with Retaliatory Measures

Expected 25% tariff on all Canada- US imports, Canada is…

-

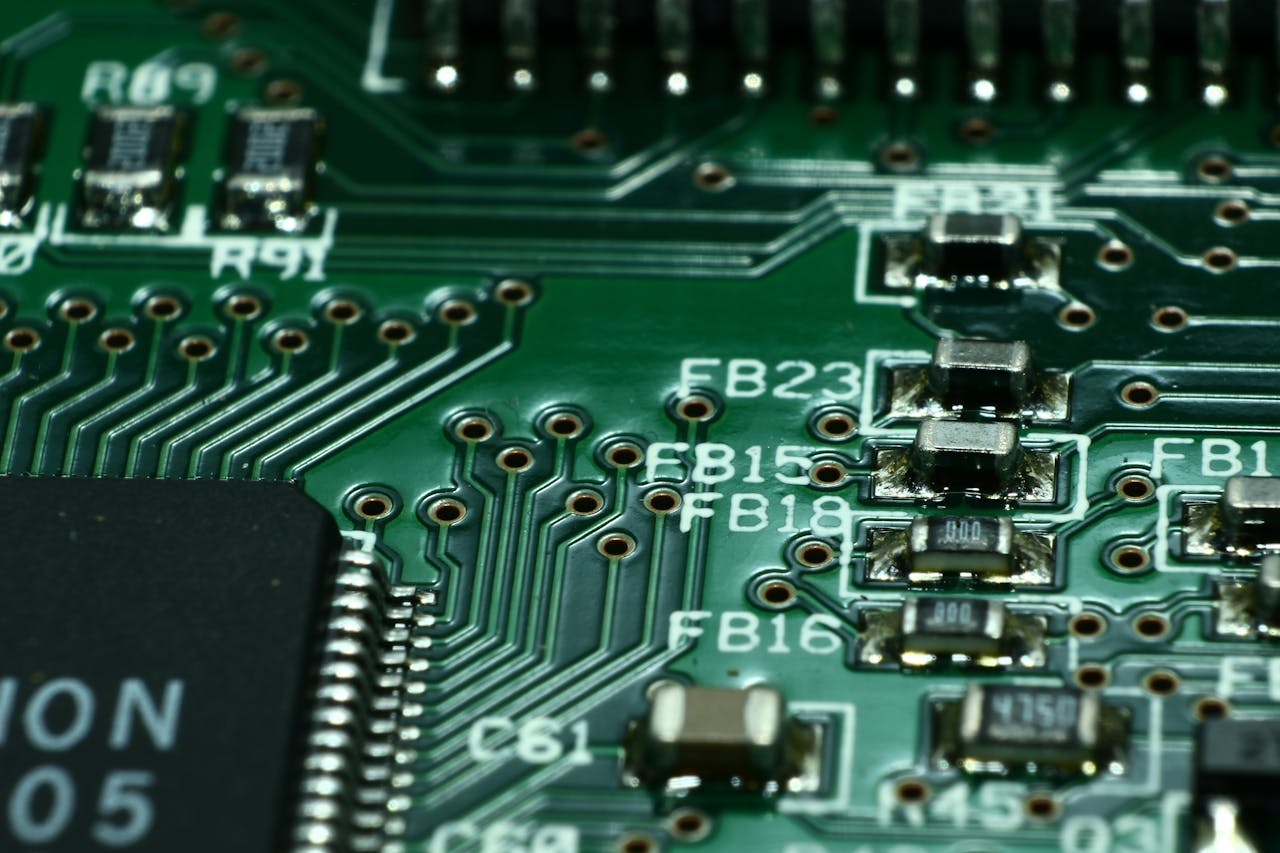

US Tightens Controls to Restrict China’s Access to Advanced Semiconductor Technology

Strategic export controls to “address national security threats”

-

Trump’s Tariff Proposals: A Controversial Economic Strategy

Talk of the Town on the Thanksgiving Holiday: Sweeping US…

-

US: Republicans Positioned to Control Congress and Push Tax Cuts

Republicans are Set to Tackle Key Agenda Amid Federal Debt…

-

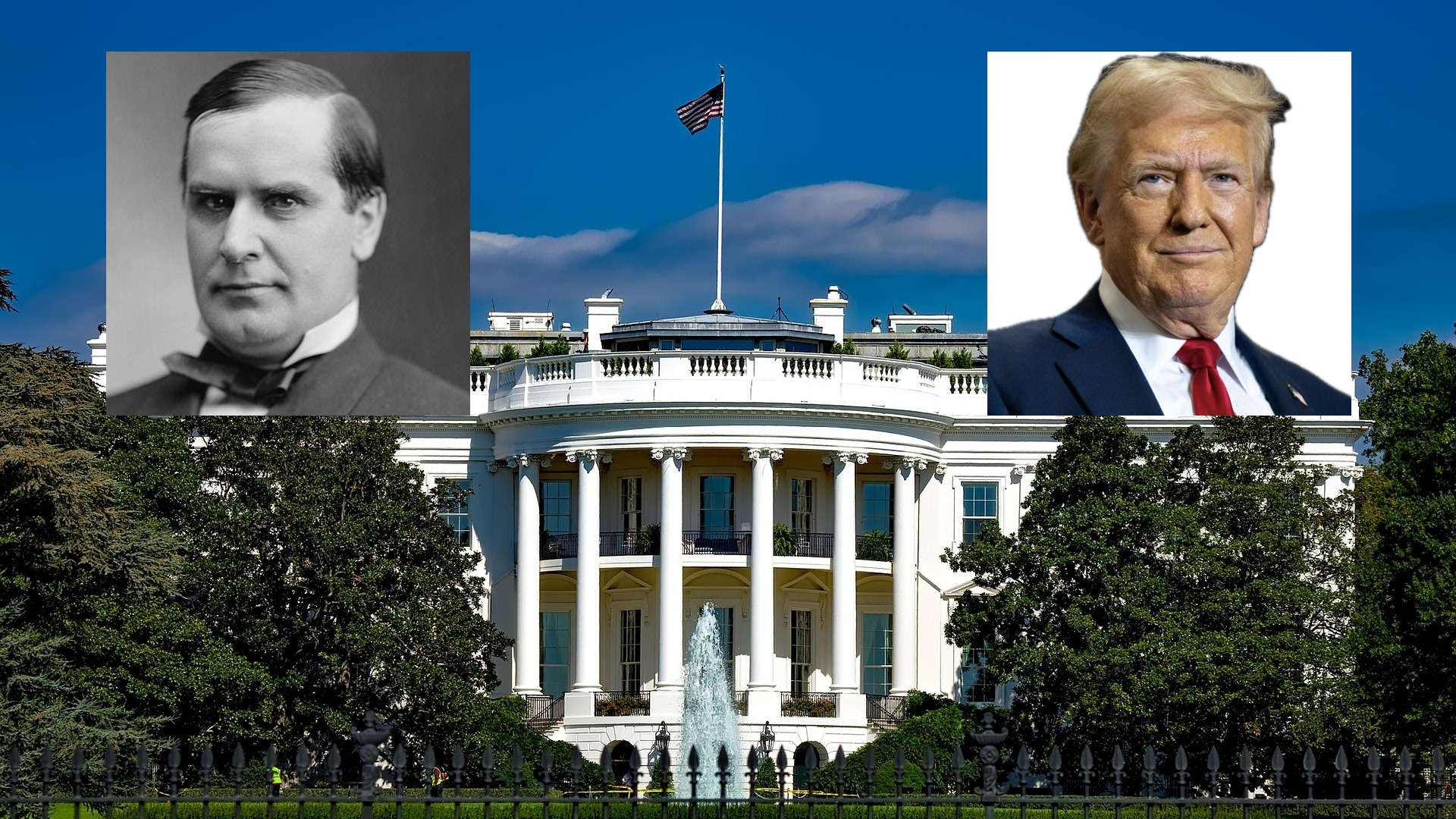

William McKinley’s Economic Policy Evolution: Lessons for Trump’s Second Term

William McKinley began with a strong stance on high tariffs…

-

US IRS Announces Inflation Adjustments for Tax Year 2025

Details on adjustments and modifications to over 60 tax provisions…

-

OECD Examines Tax Arbitrage in Closely Held Businesses

OECD Taxation Working Papers No 70 Released

-

Deloitte Reports FY2024 Revenue of $67.2 Billion, Expands Workforce to 460,000

Tax & Legal achieved the fastest growth benefiting from Changing…

-

EY US Partners Face Deferred Compensation

Financial Struggles and Leadership Criticism

-

US IRS Updates on Transfer Pricing Penalties

Stricter Enforcement and Documentation Standards

-

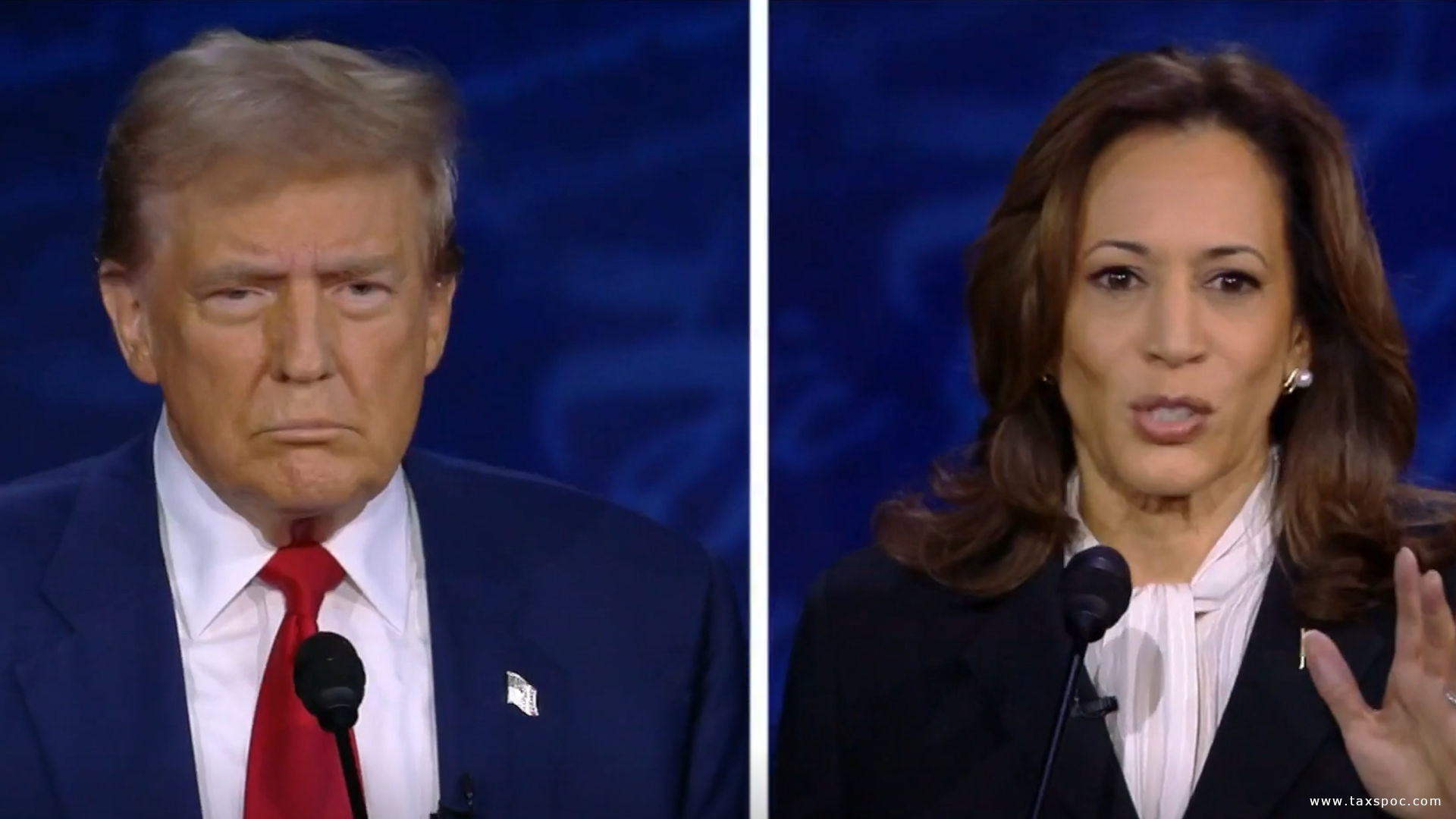

US International Tax Policy Update: Harris Supports Biden Reforms while Trump Proposes Tariff Changes

Democrats are drafting legislation in case Harris wins, Trump proclaims…

-

US IRS: September 16 Deadline for Third-Quarter Estimated Tax Payments

Millions of taxpayers across the U.S. are reminded to make…

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

US: Biden-Harris Administration Introduces Measures aimed at E-Commerce

Tackling Unsafe De Minimis Shipments

-

US: IRS Recovers $172 Million from 21,000 Non-Filing Wealthy Taxpayers in First Six Months of New Initiative

This initiative marks a turning point in IRS enforcement, as…

-

PwC US to Lay Off 1,800 Employees in First Major Cuts Since 2009

New leadership continues restructuring at the US Firm

-

Highly anticipated US Presidential Debate started with Taxes

Taxes at the Forefront of the US Presidential Elections with…

-

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

-

The Anticipation of Donald Trump’s Latest Tax Returns

So far, deviating from the practice followed by other major…

-

Kamala Harris Plans Increase of Corporate Tax Rate to 28%

Unveiled during the Democratic National Convention in Chicago

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Controversy Surrounds Biden’s Billionaire Tax Rate Assertion

President’s 8.2% tax rate claim for billionaires sparks debate among…

-

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

Coca-Cola to Pursue Appeal Following Tax Court Decision

$16 billion of Potential Incremental Tax and Interest Liabilities

-

United Nations Framework Convention on International Tax Cooperation, The Second Session is in progress

US Feedback on the Zero Draft Terms of Reference for…

-

Vertex, Inc. Acquires ecosio to Enhance E-Invoicing and Compliance Solutions

Adding EDI and E-invoicing Capabilities

-

Transparency and Reporting tops as currently having the most impact on Tax Leaders Worldwide

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals…

-

KPMG LLP Forms Strategic Alliances with Cryptio, Dataiku, and Avalara to Enhance Digital Capabilities

Increased focus on AI adoption, Crypto asset accounting and tax…

-

Renewal of Qualified Maquiladora Approach Agreement Between U.S. and Mexico in 2024

This is the second renewal of the agreement, preserving the…

-

G20 Rio de Janeiro Ministerial Declaration on International Tax Cooperation

Historic declaration on international tax cooperation

-

OECD Participates in G20 Finance Ministers and Central Bank Governors Meeting in Rio de Janeiro

Key reports on international tax cooperation, digital economy challenges, and…

-

US: Anticipated Tax Plan Under Trump

Intentions for a Potential Second Term

-

Kamala Harris Tax Returns

Candidate for US President has a history of Transparency

-

United States Announces Suspension of 1992 Tax Convention with Russia

Mutual agreement on Suspension

-

The End of the Chevron Doctrine: US Supreme Court’s Loper Bright Decision

Courts will now employ traditional statutory construction tools to interpret…

-

US Treasury and IRS Issue Final Regulations on Excise Tax for Stock Repurchases

Guidance for complying with the new excise tax on stock…

-

Vertex Acquires AI Capabilities from Ryan, LLC

Aims at Enhancing Tax Technology Solutions and Accelerating AI Innovation

-

EY Announces $1 Billion Investment to Elevate Early Career Opportunities in Accounting

Increasing early career compensation and development, Integrating AI in Tax…

-

US: Direct File Pilot for Federal Tax Returns from the IRS

After the successful pilot, IRS plans to make Direct File…

-

US Efforts to Preserve Global Corporate Tax Deal Face Challenges

Pillar 1 encounters roadblocks

-

Inclusive Framework on BEPS Targets Multilateral Convention Signature by End of June

Advancing towards a final agreement on Pillar One, the anticipated…

-

OECD Releases Report on Designing a National Strategy Against Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation…

-

OECD Publishes Taxing Wages 2024 Report

Annual publication provides details of taxes paid on wages in…

-

OECD publishes 334 pages Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023)

Tax Challenges Arising from the Digitalisation of the Economy.

-

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

PWC US Sanctioned due to violations related to maintaining independence

PricewaterhouseCoopers LLP (PwC) has been censured by the Public Company…

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

G20 Considers Global Minimum Tax on Billionaires

Brazil and France at the forefront in bringing forward the…

-

Canada´s Budget for 2024 Exclaims Tax Fairness

“The government is asking the wealthiest Canadians to pay their…

-

The US Internal Revenue Service (IRS) has concluded the 2024 tax filing season

Delivers Strong 2024 Tax Filing Season; Expands Services for Millions

-

Canada: Retroactive Amendments Regarding Software Taxability in British Columbia

Proposed Budget Changes in British Columbia (BC), Canada, contain retroactive…