Direct Tax

-

Tax Transparency in Latin America: A 2024 Breakthrough Against Evasion and Illicit Flows

How Regional Cooperation and Exchange of Information (EOI) are Driving…

-

Key Priorities of the European Commission in Taxation

Focus on Green Transition, Addressing the VAT gap, and Commitment…

-

India Unveils Union Budget 2025 with Tax Reforms reinforcing ambition to become a global investment and financial hub

New Income Tax Bill on the horizon, push for certainty…

-

Prominent US Lawmakers Back Automated Tax Filings Saving $11 Billion Annually and Disrupting Tax Preparation Industry

US Lawmakers Advocate for Expansion of IRS Direct File Program…

-

Egypt’s New Tax Incentive Law: A Catalyst for SME Growth and Economic Prosperity

A Bold Move Towards a More Dynamic Business Landscape

-

European Union: FASTER Directive Published in the EU Official Journal

Digital Tax Certificates, Fast-Track Refund Systems, and New Financial Intermediary…

-

Egypt 2025: Launching the Strategic Committee for Digital Economy and Entrepreneurship

A Pivotal Step Towards Enhancing Innovation and Economic Growth in…

-

European Union: Council Adopts New Withholding Tax Procedures via FASTER Directive

New rules take effect from January 1, 2030: Introducing Digital…

-

UAE Implements Domestic Minimum Top Up Tax

Ministry of Finance Announces Updates to Corporate Tax Law Affecting…

-

OECD Tax Revenue Trends and Insights for 2023

Recent OECD reports show average tax-to-GDP ratio among OECD countries…

-

European Commission Refers Germany to Court of Justice Over Discriminatory Tax Treatment

November Infringement Package contains discriminatory tax practices related to reinvested…

-

UK Companies to Receive £700 Million Windfall After European Court of Justice Reverses Tax Ruling

Repayment obligation on the UK government at a time of…

-

Navigating the ESG Landscape: Transfer Pricing in a Sustainable World

Exploring how ESG principles are reshaping business practices and financial…

-

Australia: Insights on Tax Settlements and Compliance in 2023–24 for Public and Multinational Businesses

Litigation resulted in favorable outcome for ATO in 53% of…

-

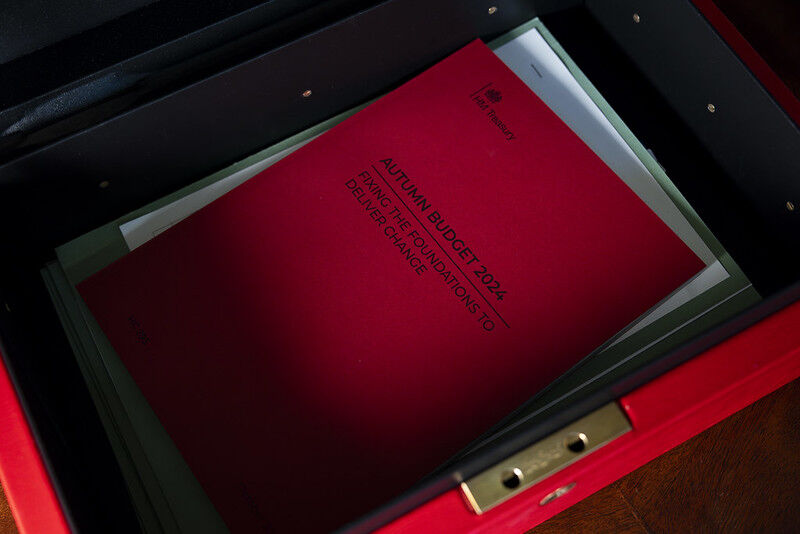

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

European Commission Takes Legal Action on Taxation Matters Across Member States

October Infringements Package on Taxation and Customs Union: Hungary, Malta,…

-

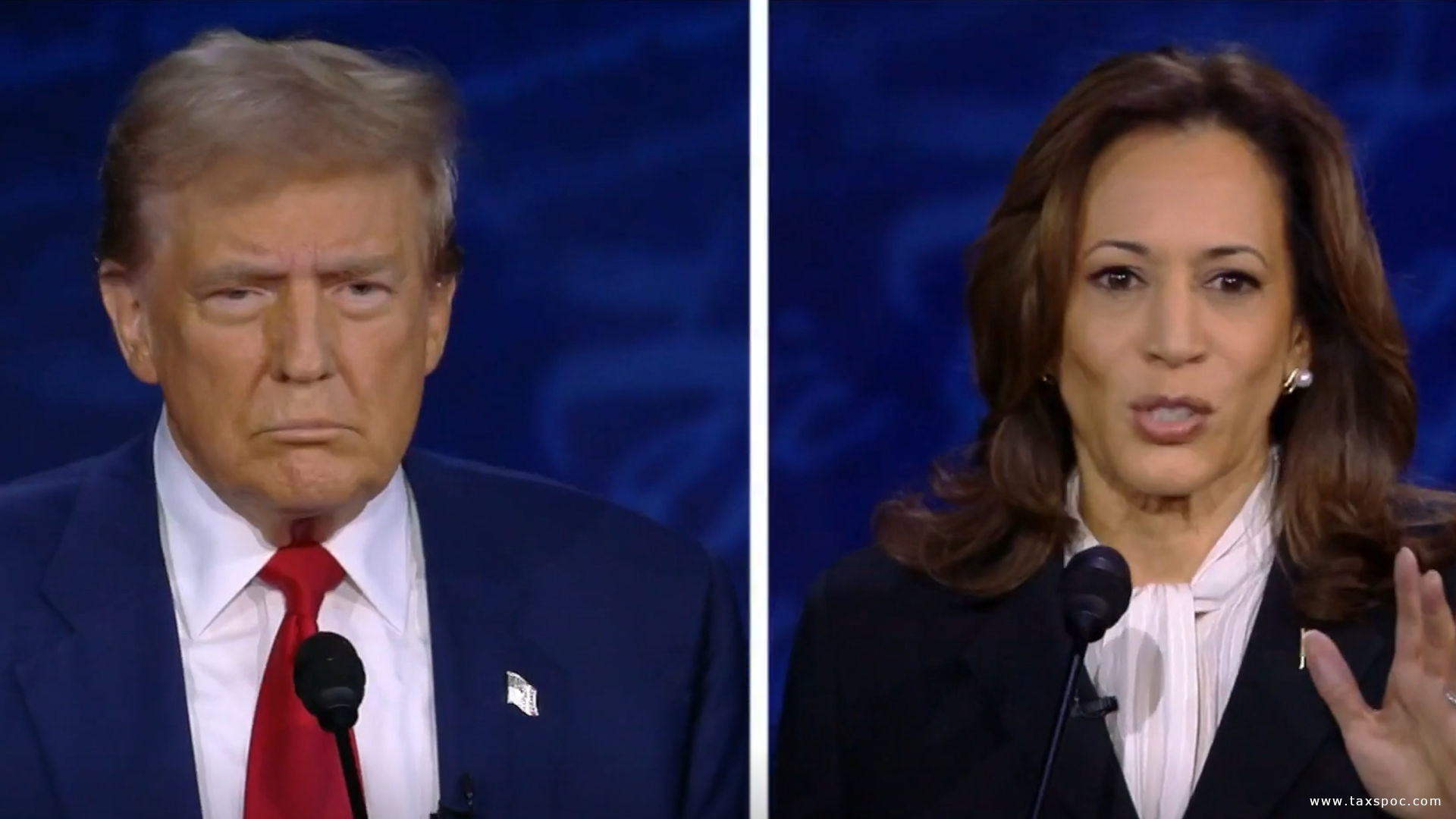

US International Tax Policy Update: Harris Supports Biden Reforms while Trump Proposes Tariff Changes

Democrats are drafting legislation in case Harris wins, Trump proclaims…

-

The Netherlands: Budget Day 2025 and Tax Changes Announced

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

-

Colombian 2024 Tax Reform Bill Submitted to Congress

Impact on Corporate and Capital Gains Rates

-

US IRS: September 16 Deadline for Third-Quarter Estimated Tax Payments

Millions of taxpayers across the U.S. are reminded to make…

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will…

-

US: IRS Recovers $172 Million from 21,000 Non-Filing Wealthy Taxpayers in First Six Months of New Initiative

This initiative marks a turning point in IRS enforcement, as…

-

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

European Union: ECJ rules Ireland to recover 13 bln EUR granted to Apple!

Overturns General Court Decision on Apple’s Tax Rulings in Ireland

-

Apple Tax Case: A Look Back at the Decade of Dispute

as ECJ Gives Final Judgement in the Matter

-

Argentina’s Implementation of the Large-Investment Regime Bill

Decree 749/2024 Aims at Attracting Investors

-

South Africa: Highlights from the 2024 Draft Taxation Laws and Draft Tax Administration Laws Amendment Bills

Available for Public Comment

-

Bahrain Introduces Domestic Minimum Top-up Tax for Multinational Enterprises

The first member of the Gulf Cooperation Council (GCC) to…

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

Kamala Harris Plans Increase of Corporate Tax Rate to 28%

Unveiled during the Democratic National Convention in Chicago

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and…

-

Controversy Surrounds Biden’s Billionaire Tax Rate Assertion

President’s 8.2% tax rate claim for billionaires sparks debate among…

-

European Union: Draft Regulation on Corporate Income Tax Reporting establishes Common Template and Electronic Formats

New regulation aims to enhance tax transparency and comparability across…

-

European Court of Justice: Upholding the EU Directive on Tax Reporting Obligations

CJEU upholds EU directive on tax reporting for cross-border arrangements.…

-

UAE Publishes Guide on Determination of Taxable Income for Corporate Income Tax

107-page document clarifying key concepts under UAE Corporate Tax Law.…

-

European Union: Evaluation of the Anti-Tax Avoidance Directive In Progress

Have Your Say on the Directive aimed to fight aggressive…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

India: Lower Rates for Foreign Companies, IFSC Concessions, and New Penalties

Union Budget 2024-25 on International Tax

-

India’s Digital Shift: Withdrawal of the E-commerce Levy

Union Budget 2024- 2025

-

US: Anticipated Tax Plan Under Trump

Intentions for a Potential Second Term

-

Constitutional Court Rules Mandatory Disclosure Rules (MDR) Unconstitutional

What a month for Mandatory Disclosure Rules (MDR) in Poland!

-

UK Under Labor Government: Expected Renewed Focus on Large Business and Wealthy Individuals

A Review of Labour Party’s Manifesto on Taxation

-

United States Announces Suspension of 1992 Tax Convention with Russia

Mutual agreement on Suspension

-

The End of the Chevron Doctrine: US Supreme Court’s Loper Bright Decision

Courts will now employ traditional statutory construction tools to interpret…

-

US Treasury and IRS Issue Final Regulations on Excise Tax for Stock Repurchases

Guidance for complying with the new excise tax on stock…

-

Argentina: President Javier Milei Reconfirms Commitment to Tax Reform and Opening up to International Trade

Signature of Historic May Pact, symbolic declaration, centered around Tax.

-

Italy: New Rules on Administrative and Criminal Tax Sanctions

Changes Affect Penalties Regarding Income Tax, VAT, and Withholding Tax…

-

UK: HMRC publishes Tax Gap Analysis for 2022- 2023

Tax Gap Estimated at 39,8 billion GBP for one year

-

Bulgaria: Implementing SAF-T Reporting: Expected Scope, Requirements, SAF-T Format Published

Expected Scope, Requirements, and SAF-T format documentation in English are…

-

Australia: Public Country-by-Country Reporting Legislation Introduced to the Parliament

If approved, public CbC reporting will be effective for reporting…

-

UK: Rishi Sunak´s led UK Conservative Party´s 2024 Manifesto is All About Reducing Taxes

Promises to Lower taxes and calling to vote for Tories…

-

Belgium: Practicalities on Notification Requirement for In-Scope Groups Under Belgian Pillar Two Rules

Registration to obtain number from the Belgian Trade Register

-

Belgium: Pillar Two Mandatory Notification for MNEs and Large Domestic Groups

On May 21, 2024, the Belgian tax administration released new…

-

European Union: ViDA and Withholding Taxes Take a Central Stage in the Upcoming ECOFIN Meeting Agenda

ECOFIN Council Meeting of May 14, 2024 has 2 Tax…

-

UAE CIT Registration: When to Register

CIT Registration Dates are fast approaching

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

Saudi Arabia Guidelines for Regional Headquarters Tax and Zakat Rules

Saudi Arabia unveiled a 30-year tax incentive for multinational companies…

-

Philippines´ Issue Guidelines in the filing of Annual Income Tax Return (AITR) for Calendar Year (CY) 2023

Details on Return filing and payments

-

Enhancing Tax Transparency: Australia’s New Requirements for Disclosure of Subsidiaries in Financial Reports

Aiming at greater transparency and accountability in corporate tax matters

-

Canada´s Budget for 2024 Exclaims Tax Fairness

“The government is asking the wealthiest Canadians to pay their…

-

The US Internal Revenue Service (IRS) has concluded the 2024 tax filing season

Delivers Strong 2024 Tax Filing Season; Expands Services for Millions

-

Oman Automatic Exchange of Information (AEOI) System Update

Automatic Exchange of Information (AEOI) system is now available for…

-

Indian Court’s Ruling on Profit Attribution for Singapore Company’s Indian Operations

No further profit attribution if an associated enterprise is remunerated…

-

Polish Government Adopts DAC7 Bill to Enhance Tax Transparency

The enactment of this act is anticipated to greatly improve…

-

Australia: Changes to Thin Capitalization Rules Finally Pass Both Houses of Parliament

Making Multinationals Pay Their Fair Share—Integrity and Transparency Bill 2023…