Indirect Tax

-

Tax Transparency in Latin America: A 2024 Breakthrough Against Evasion and Illicit Flows

How Regional Cooperation and Exchange of Information (EOI) are Driving…

-

Egypt Opens Doors to Digital Growth — Foreign Platforms Must Register Under Clear VAT Rules

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT…

-

Key Priorities of the European Commission in Taxation

Focus on Green Transition, Addressing the VAT gap, and Commitment…

-

Italian Authorities Investigate Amazon Over Alleged €1.2 Billion VAT Fraud

The investigation, led by the Milan Prosecutor’s Office, could impact…

-

US Weighs Tariff Response to Foreign Digital Services Taxes

DSTs imposed by France, Austria, Italy, Spain, Turkey, the UK,…

-

India Unveils Union Budget 2025 with Tax Reforms reinforcing ambition to become a global investment and financial hub

New Income Tax Bill on the horizon, push for certainty…

-

Belgium: Circular Letter Provides Guidance on “VAT Chain” Reform

Important Changes to Belgian VAT Filing and Payment Rules

-

Egypt’s New Tax Incentive Law: A Catalyst for SME Growth and Economic Prosperity

A Bold Move Towards a More Dynamic Business Landscape

-

Egypt 2025: Launching the Strategic Committee for Digital Economy and Entrepreneurship

A Pivotal Step Towards Enhancing Innovation and Economic Growth in…

-

Overview of China’s Value-Added Tax (VAT) Law

VAT Law is Available to Download in English Here!

-

China’s New VAT Law is Set to Take Effect January 1, 2026

Adopted end of December 2024, it aims aligning China´s VAT…

-

Global VAT Changes for 2025: What You Need to Know at the start of the New Year

From new tax rates to mandatory e-invoicing and digital economy…

-

European Union: Council Introduces Electronic VAT Exemption Certificate

Modernizing Tax Procedures, replacing paper VAT exemption certificates for Embassies,…

-

OECD Tax Revenue Trends and Insights for 2023

Recent OECD reports show average tax-to-GDP ratio among OECD countries…

-

Egypt: Enhanced VAT Compliance Measures for Digital Services

Egypt enforces stricter VAT rules for non-resident digital service providers,…

-

EU VAT: new ruling on EV charging – key insights for CPOs and eMSPs

CJEU ruling clarifies EU VAT treatment for EV charging value…

-

Australia: Insights on Tax Settlements and Compliance in 2023–24 for Public and Multinational Businesses

Litigation resulted in favorable outcome for ATO in 53% of…

-

Breaking News: European Union Finally Adopts VIDA Package to Modernize VAT System

Real-Time Digital Reporting and E-Invoicing will become mandatory in the…

-

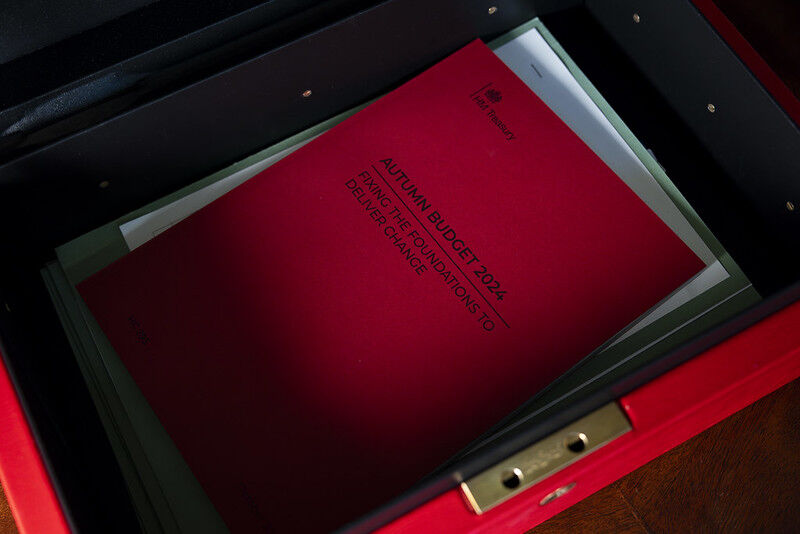

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

UAE Implements Revisions to VAT Executive Regulations

Set to take effect on November 15, 2024

-

Lithuania launches Pilot Program for Real-Time VAT Return Assessments

Real time data comparison between E-Invoicing System and VAT returns…

-

German E-Invoices: Email Inbox Now Sufficient for Receipt

Significant Flexibility on the Requirement to Receive AP Invoices by…

-

European Union: Reminder of the September 30 VAT Refund Deadline

Applicable for EU and Most of Non-EU Businesses Refunds

-

The Netherlands: Budget Day 2025 and Tax Changes Announced

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

-

HMRC Issues New VAT Compliance Guidelines

HMRC’s expectations around VAT accounting

-

Colombian 2024 Tax Reform Bill Submitted to Congress

Impact on Corporate and Capital Gains Rates

-

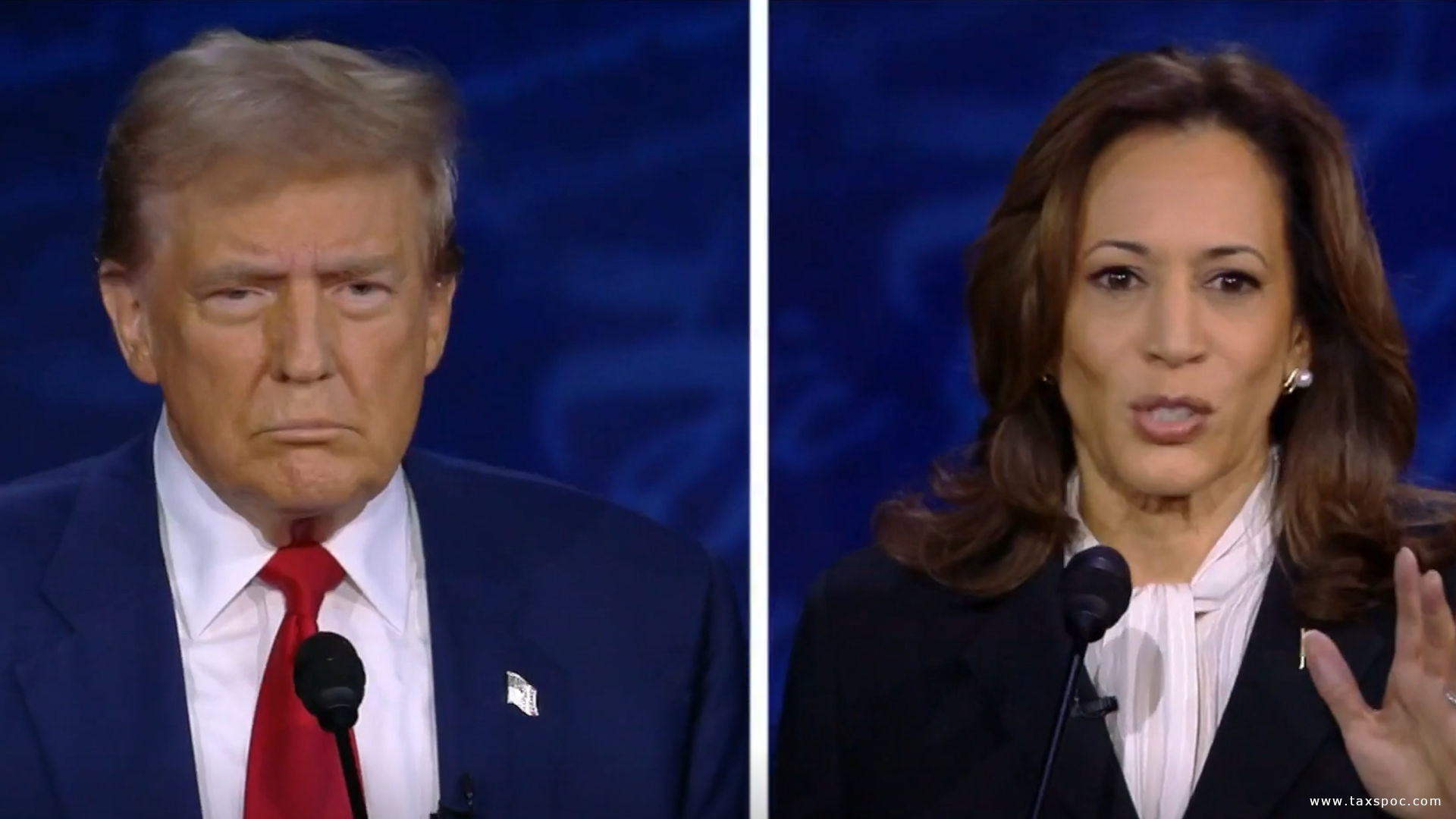

Highly anticipated US Presidential Debate started with Taxes

Taxes at the Forefront of the US Presidential Elections with…

-

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

Argentina’s Implementation of the Large-Investment Regime Bill

Decree 749/2024 Aims at Attracting Investors

-

South Africa: Highlights from the 2024 Draft Taxation Laws and Draft Tax Administration Laws Amendment Bills

Available for Public Comment

-

Swiss Federal Council Adopts Partial Revision of Swiss VAT Ordinance

Swiss VAT updates to streamline compliance and tax calculations, effective…

-

Introduction of Dual VAT in Brazil: A VAT Law!

Draft VAT Law is available to download here!

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and…

-

Chile´s Government Proposes New Amendments to the Tax Compliance Bill

Fine-tuning the bill with further amendments expected

-

Vertex, Inc. Acquires ecosio to Enhance E-Invoicing and Compliance Solutions

Adding EDI and E-invoicing Capabilities

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

Finland’s VAT Rate Increase: Comprehensive Guide to the 2024 Tax Change

Key details and practical implications for various business scenarios under…

-

India: Lower Rates for Foreign Companies, IFSC Concessions, and New Penalties

Union Budget 2024-25 on International Tax

-

-

UK Under Labor Government: Expected Renewed Focus on Large Business and Wealthy Individuals

A Review of Labour Party’s Manifesto on Taxation

-

Argentina: President Javier Milei Reconfirms Commitment to Tax Reform and Opening up to International Trade

Signature of Historic May Pact, symbolic declaration, centered around Tax.

-

Italy: New Rules on Administrative and Criminal Tax Sanctions

Changes Affect Penalties Regarding Income Tax, VAT, and Withholding Tax…

-

Saudi Arabia Extends Tax Amnesty Initiative to End of 2024

Additional time to correct any discrepancies in their tax records…

-

UK: HMRC publishes Tax Gap Analysis for 2022- 2023

Tax Gap Estimated at 39,8 billion GBP for one year

-

Bulgaria: Implementing SAF-T Reporting: Expected Scope, Requirements, SAF-T Format Published

Expected Scope, Requirements, and SAF-T format documentation in English are…

-

Germany: Draft Administrative Guidelines on E-Invoicing made available by the Germany Tax Authorities

Our Article Includes an English translation of Guidelines Available to…

-

European Union: Judgement on VAT Fixed Establishment ECJ case Adient C-533/22

The ECJ provides clarification on the concept of a VAT…

-

European Union: ECJ Judgement In Case C-696/22, C SPRL

VAT Liability does not necessarily require actually receiving remuneration

-

UK: Rishi Sunak´s led UK Conservative Party´s 2024 Manifesto is All About Reducing Taxes

Promises to Lower taxes and calling to vote for Tories…

-

Saudi Arabia: ZATCA Extends Tax Amnesty until end of June

Initiative, originally set to end on December 31, 2023, will…

-

-

France: Update on E-invoicing

Technical specifications expected June 19, 2024, Go Live deadlines maintained

-

Spanish E-Invoicing: Expected Delay

Rumor has it Spanish e-invoicing will be deferred to mid…

-

Italy: PLASTIC TAX postponed to July 1st, 2026!

Postponed again!

-

The Netherlands: New Coalition Government Unveils Ambitious Tax Plans

Tax Plans concern mainly VAT, Fly Tax, Plastic Packaging Tax

-

European Union: 13th Directive VAT Refund Deadline is fast approaching!

Non- EU business eligible to file VAT refund claim in…

-

European Union: ViDA and Withholding Taxes Take a Central Stage in the Upcoming ECOFIN Meeting Agenda

ECOFIN Council Meeting of May 14, 2024 has 2 Tax…

-

Sneak Peak to Revised ViDA draft up for Vote May 14, 2024

Digital Reporting Requirements, Platforms, Single VAT Registration

-

Proposal for Modernizing VAT Rules in the Digital Age: VIDA Directive

A look at Explanatory Memorandum to the Council Directive amending…

-

Poland: New E-Invoicing Timeline

Detailed Analysis of the KSeF Audit: Unveiling Flaws and Planned…

-

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

Brazil: expected VAT Rate Revealed!

First version of Tax Reform Proposal by Brazil´s Finance Minister…

-

Saudi Arabia Guidelines for Regional Headquarters Tax and Zakat Rules

Saudi Arabia unveiled a 30-year tax incentive for multinational companies…

-

Finland: Government will raise VAT to 25.5 percent aiming to collect one billion euros a year more

The government is considering implementing the VAT rise before year…

-

Italy and UK reaches reciprocity Agreement on VAT Refund Claims

The agreement will have retrospective effect from 1 January 2021

-

Implementation of e-Invoice in Malaysia: Frequently Asked Questions (FAQs)

Failure to issue e-Invoice may result in penalties or imprisonment…

-

Singapore E-invoicing: Phased adoption starting November 2025, Peppol standard

Implementation of InvoiceNow for GST-Registered Businesses and Free InvoiceNow Services…

-

European Union: ViDA is priority for the Belgian Presidency, expectations of reaching an agreement potentially in May or June

Latest update from VAT Expert Group discussions

-

Indian Tribunal’s Decision on Physical Presence Requirement for Service PE

Physical presence of employees in India is indeed a prerequisite…

-

European Union: VAT Expert Group Deliberates on Key VAT Policy and Implementation Measures

The VAT Expert Group (VEG) recently convened in Brussels for…

-

Impact of India’s Goods and Services Tax (GST) on Intragroup Guarantees

The imposition of GST on intragroup guarantees represents a significant…

-

Saudi Arabia: VAT Refund Procedures for Non-Residents

A reminder of the key points regarding the VAT refund…

-

Polish Government Adopts DAC7 Bill to Enhance Tax Transparency

The enactment of this act is anticipated to greatly improve…

-

Canada: Retroactive Amendments Regarding Software Taxability in British Columbia

Proposed Budget Changes in British Columbia (BC), Canada, contain retroactive…

-

Brazil’s VAT Reform Progress: April 2024

Legislators roll up their sleeves preparing for Brazil´s VAT implementation

-

Italy’s Plastic Tax planned to come into effect on July 1, 2024 expected to be postponed again

Expected postponement for the 7th time until July 1 2026.…

-

Germany: E-Invoicing Approved

Parliament Approves Legislation Introducing E-Invoicing Mandate