Latest News

-

OECD Examines Tax Arbitrage in Closely Held Businesses

OECD Taxation Working Papers No 70 Released

-

Australia´s Administrative Review Tribunal Begins Operations

New Pathway for Taxation Disputes

-

Deloitte Reports FY2024 Revenue of $67.2 Billion, Expands Workforce to 460,000

Tax & Legal achieved the fastest growth benefiting from Changing…

-

China Imposes Tariffs on European Brandy

A levy of up to 39% in Response to EU´s…

-

EY US Partners Face Deferred Compensation

Financial Struggles and Leadership Criticism

-

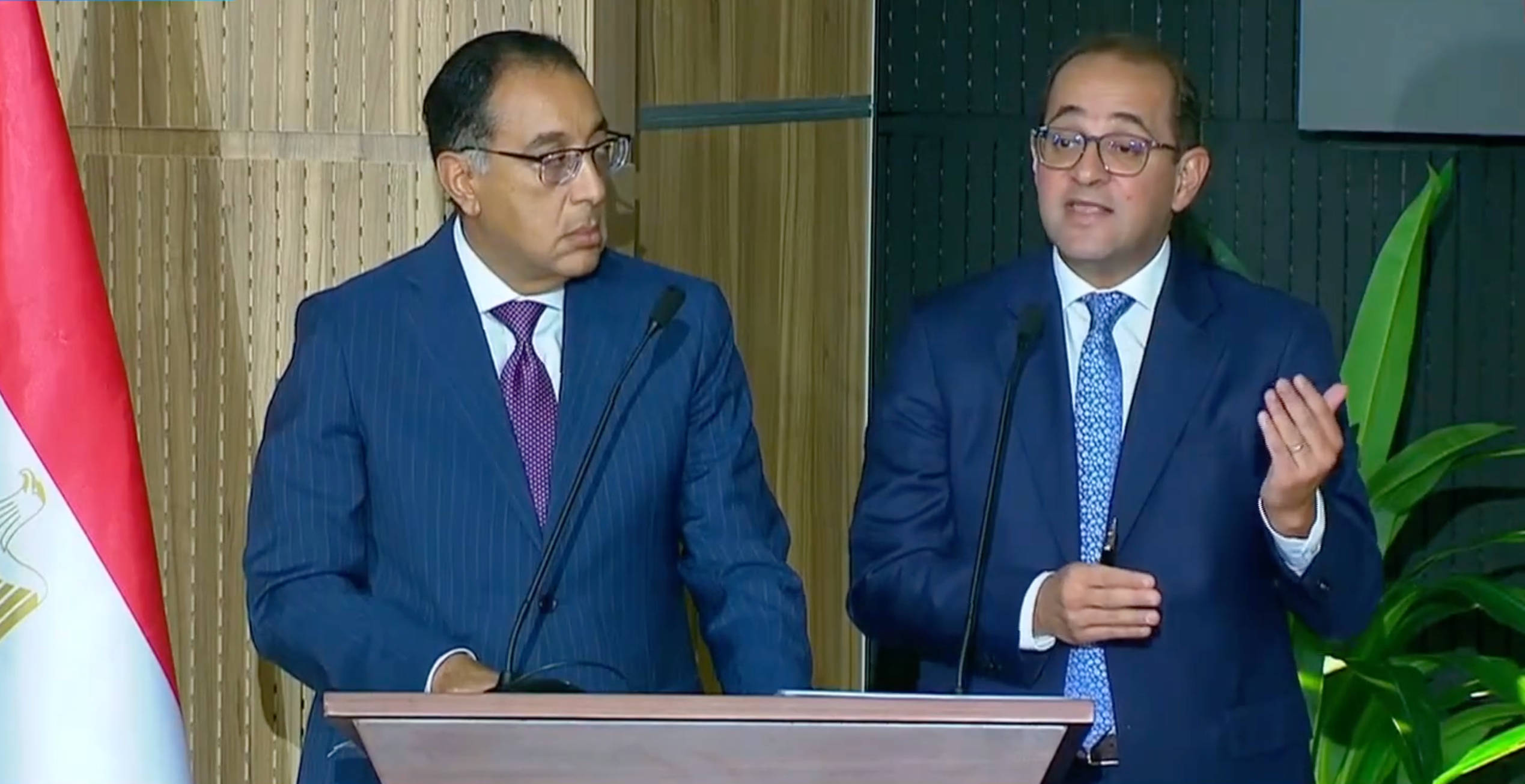

Egypt introduces the First Package of Tax Reforms aimed at Driving Economic Transformation and Attracting Investment

20 Key Measures to Build Trust with Taxpayers and Streamline…

-

The EY 2024 Tax and Finance Operations Survey: Managing Transformation Amid Cost Pressures and Talent Shortages, with GenAI Still Underutilized

Companies struggle with “Doing More with Less” in Ever More…

-

EU Approves Tariffs on Chinese Electric Vehicles Following Anti-Subsidy Probe

Additional tariffs on Chinese-made EVs up to 35.3% for five…

-

EU Reaffirms Commitment to Inclusive and Effective International Tax Cooperation

EU has approved its official position concerning UN Framework Convention…

-

Brazil Introduces OECD Pillar Two Rules with Provisional Measure

Translation to English Available to Download Here!

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

UAE Implements Revisions to VAT Executive Regulations

Set to take effect on November 15, 2024

-

US IRS Updates on Transfer Pricing Penalties

Stricter Enforcement and Documentation Standards

-

European Commission Takes Legal Action on Taxation Matters Across Member States

October Infringements Package on Taxation and Customs Union: Hungary, Malta,…

-

New Rules on Jurisdiction Transfer Between the Court of Justice and the General Court Now in Effect

Cases on VAT, excise duties, the Customs Code, tariff classification…

-

US International Tax Policy Update: Harris Supports Biden Reforms while Trump Proposes Tariff Changes

Democrats are drafting legislation in case Harris wins, Trump proclaims…

-

UK´s HMRC is Hiring in Tax in Large Numbers!

HMRC Launches Recruitment Campaigns, 5,000 new compliance staff are expected…

-

European Commission to Register Imports Under Trade Defence Investigations

Further Measures to Combat Unfair Competition

-

Lithuania launches Pilot Program for Real-Time VAT Return Assessments

Real time data comparison between E-Invoicing System and VAT returns…

-

UK: Upcoming Consultation on E-invoicing for B2B and B2G; Digital Transformation Roadmap will be released in Spring 2025

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s…

-

German E-Invoices: Email Inbox Now Sufficient for Receipt

Significant Flexibility on the Requirement to Receive AP Invoices by…

-

European Union: Reminder of the September 30 VAT Refund Deadline

Applicable for EU and Most of Non-EU Businesses Refunds

-

The Netherlands: Budget Day 2025 and Tax Changes Announced

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

-

HMRC Issues New VAT Compliance Guidelines

HMRC’s expectations around VAT accounting

-

New European Commission and the apparent downscaling of Taxation from the priorities

Taxation sits in an unlikely portfolio with Climate, Net Zero,…

-

Colombian 2024 Tax Reform Bill Submitted to Congress

Impact on Corporate and Capital Gains Rates

-

Poland: Rules for the Digitization of Accounting Documentation in CIT

Mandating the use of structured electronic formats for accounting records

-

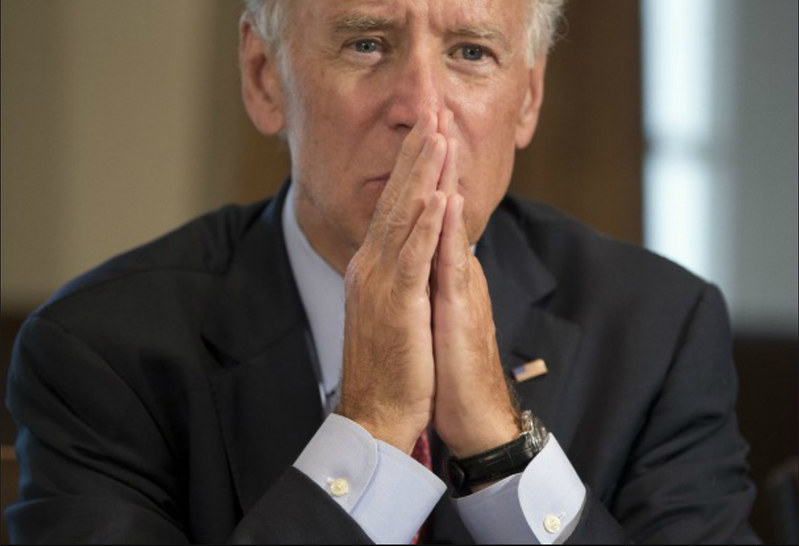

US: Biden-Harris Administration Introduces Measures aimed at E-Commerce

Tackling Unsafe De Minimis Shipments

-

US IRS: September 16 Deadline for Third-Quarter Estimated Tax Payments

Millions of taxpayers across the U.S. are reminded to make…

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will…

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and…

-

PwC China Audit Unit Faces Temporary Ban and Fines Over Evergrande Collapse

The toughest ever penalty received by a Big Four accounting…

-

US: IRS Recovers $172 Million from 21,000 Non-Filing Wealthy Taxpayers in First Six Months of New Initiative

This initiative marks a turning point in IRS enforcement, as…

-

PwC US to Lay Off 1,800 Employees in First Major Cuts Since 2009

New leadership continues restructuring at the US Firm

-

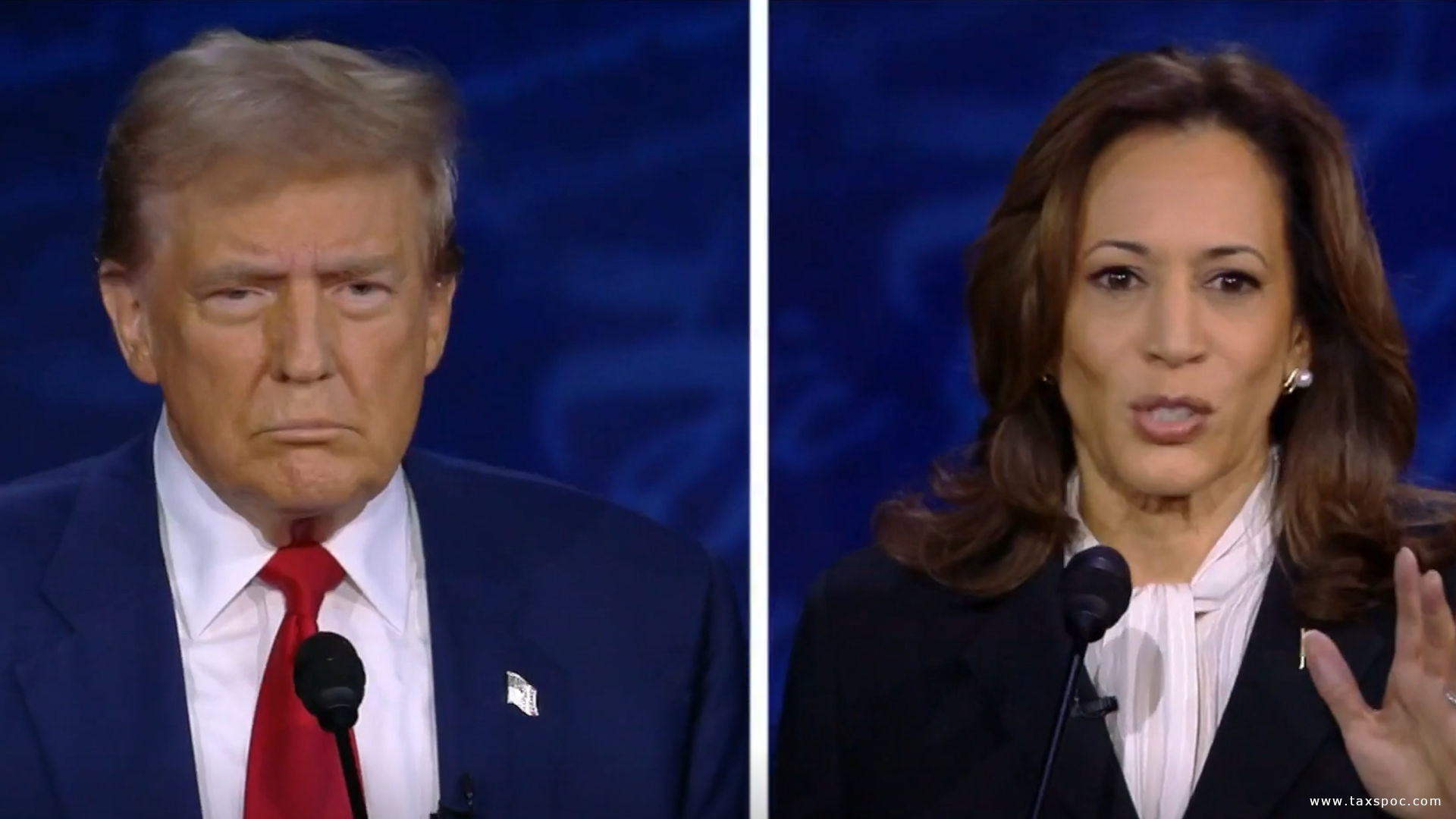

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

Highly anticipated US Presidential Debate started with Taxes

Taxes at the Forefront of the US Presidential Elections with…

-

European Union: ECJ rules Ireland to recover 13 bln EUR granted to Apple!

Overturns General Court Decision on Apple’s Tax Rulings in Ireland

-

Apple Tax Case: A Look Back at the Decade of Dispute

as ECJ Gives Final Judgement in the Matter

-

Argentina’s Implementation of the Large-Investment Regime Bill

Decree 749/2024 Aims at Attracting Investors

-

PwC UK Will Track In- Office Presence

Adjusts Hybrid Work Model Increasing In-Person Expectations

-

-

South Africa: Highlights from the 2024 Draft Taxation Laws and Draft Tax Administration Laws Amendment Bills

Available for Public Comment

-

EY Reduces Pay Rises and Bonuses for UK Staff Amid Market Challenges

Impact on Tax Advisory Division

-

The Anticipation of Donald Trump’s Latest Tax Returns

So far, deviating from the practice followed by other major…

-

Bahrain Introduces Domestic Minimum Top-up Tax for Multinational Enterprises

The first member of the Gulf Cooperation Council (GCC) to…

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

Australian Taxation Office Releases Annual Corporate Plan

Focus on new high-risk tax areas for multinationals, Improvement of…

-

Introduction of Dual VAT in Brazil: A VAT Law!

Draft VAT Law is available to download here!

-

Swiss Federal Council Adopts Partial Revision of Swiss VAT Ordinance

Swiss VAT updates to streamline compliance and tax calculations, effective…

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

Kamala Harris Plans Increase of Corporate Tax Rate to 28%

Unveiled during the Democratic National Convention in Chicago

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and…

-

Controversy Surrounds Biden’s Billionaire Tax Rate Assertion

President’s 8.2% tax rate claim for billionaires sparks debate among…

-

Chile´s Government Proposes New Amendments to the Tax Compliance Bill

Fine-tuning the bill with further amendments expected

-

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

UK: Reporting Rules for Digital Platforms

HMRC published Rules for Digital platforms that let users sell…

-

United Nations Framework Convention on International Tax Cooperation, The Second Session is in progress

US Feedback on the Zero Draft Terms of Reference for…

-

Vertex, Inc. Acquires ecosio to Enhance E-Invoicing and Compliance Solutions

Adding EDI and E-invoicing Capabilities

-

Coca-Cola to Pursue Appeal Following Tax Court Decision

$16 billion of Potential Incremental Tax and Interest Liabilities

-

Transparency and Reporting tops as currently having the most impact on Tax Leaders Worldwide

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals…

-

KPMG LLP Forms Strategic Alliances with Cryptio, Dataiku, and Avalara to Enhance Digital Capabilities

Increased focus on AI adoption, Crypto asset accounting and tax…

-

European Union: Draft Regulation on Corporate Income Tax Reporting establishes Common Template and Electronic Formats

New regulation aims to enhance tax transparency and comparability across…

-

UK Update on Corporate Criminal Offences Legislation to Combat Tax Evasion

HMRC reports 11 active probes, 28 cases under review. Aims…

-

Renewal of Qualified Maquiladora Approach Agreement Between U.S. and Mexico in 2024

This is the second renewal of the agreement, preserving the…

-

European Court of Justice: Upholding the EU Directive on Tax Reporting Obligations

CJEU upholds EU directive on tax reporting for cross-border arrangements.…

-

UAE Publishes Guide on Determination of Taxable Income for Corporate Income Tax

107-page document clarifying key concepts under UAE Corporate Tax Law.…

-

European Union: Evaluation of the Anti-Tax Avoidance Directive In Progress

Have Your Say on the Directive aimed to fight aggressive…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

Finland’s VAT Rate Increase: Comprehensive Guide to the 2024 Tax Change

Key details and practical implications for various business scenarios under…

-

G20 Rio de Janeiro Ministerial Declaration on International Tax Cooperation

Historic declaration on international tax cooperation

-

OECD Participates in G20 Finance Ministers and Central Bank Governors Meeting in Rio de Janeiro

Key reports on international tax cooperation, digital economy challenges, and…

-

India: Lower Rates for Foreign Companies, IFSC Concessions, and New Penalties

Union Budget 2024-25 on International Tax

-

PwC Faces Major Overhaul in China Amid Evergrande Fallout

Leaving Clients, Staff reductions, Pay cuts, Fines

-

India’s Digital Shift: Withdrawal of the E-commerce Levy

Union Budget 2024- 2025