Tax Policy

-

Tax Transparency in Latin America: A 2024 Breakthrough Against Evasion and Illicit Flows

How Regional Cooperation and Exchange of Information (EOI) are Driving…

-

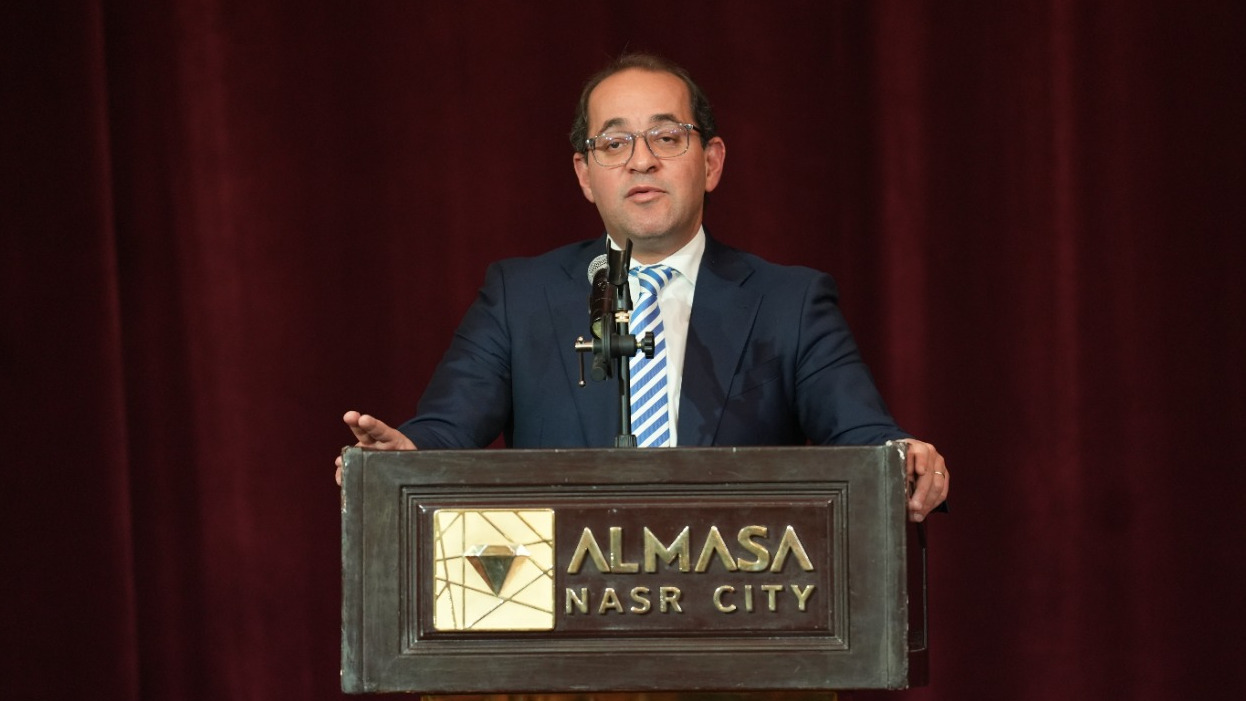

Egyptian Tax Authority Launches New Tax Facilitation Initiative at RiseUp 2025 Summit to Support Digital Entrepreneurs

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages…

-

Key Priorities of the European Commission in Taxation

Focus on Green Transition, Addressing the VAT gap, and Commitment…

-

US: Trump Administration Cuts 6,700 IRS Jobs Amid Tax Season

Many of the eliminated positions are associated with tax compliance…

-

US Weighs Tariff Response to Foreign Digital Services Taxes

DSTs imposed by France, Austria, Italy, Spain, Turkey, the UK,…

-

India Unveils Union Budget 2025 with Tax Reforms reinforcing ambition to become a global investment and financial hub

New Income Tax Bill on the horizon, push for certainty…

-

Egypt’s New Tax Incentive Law: A Catalyst for SME Growth and Economic Prosperity

A Bold Move Towards a More Dynamic Business Landscape

-

Uncertainty Looms Over IRS as Trump Speaks about Terminating or Repurposing 88,000 IRS Workers

We’re in the process of developing a plan to either…

-

China’s 2025 Business Climate Survey Highlights Shifting Sentiments Among US Companies in China

As US and Chinese companies prepare for the potential impact…

-

Egypt 2025: Launching the Strategic Committee for Digital Economy and Entrepreneurship

A Pivotal Step Towards Enhancing Innovation and Economic Growth in…

-

HMRC Under Fire for Poor Customer Service and Widening Tax Gap

UK House of Commons Committee Report Highlights Concerns with HMRC’s…

-

EU Criticizes Trump Administration’s Withdrawal from Global Tax Deal

Highlighting the need for fair taxation and advancing climate initiatives…

-

U.S. Administration Rejects OECD Global Tax Deal to Reassert Sovereignty

Any commitments made by the previous administration regarding the Global…

-

Egypt And The Sultanate Of Oman Convention For The Elimination Of Double Taxation And The Prevention Of Tax Evasion With Respect To Taxes On Income.

Ensuring Tax Fairness and Promoting Stronger Economic Ties Between the…

-

US: IRS Commissioner Resigns on Trump´s Inauguration Date, Democrats Raise Concerns Over IRS Nominee

As IRS Commissioner Danny Werfel steps down, Trump´s Candidate Billy…

-

The EU has ABSTAINED in the vote on UN Resolution on Tax Cooperation

EU Released Statement calling out “serious outstanding reservations” on UN General…

-

OECD Tax Revenue Trends and Insights for 2023

Recent OECD reports show average tax-to-GDP ratio among OECD countries…

-

OECD 2023 MAP & APA Awards: Discover the Fastest, Most Efficient amongst OECD Countries

Announced at the 2024 OECD Tax Certainty Day, celebrating jurisdictions…

-

China’s $1.4 Trillion Debt Plan and Trump’s Return

China’s Economic Stimulus Amid Rising Global Tensions

-

Germany: How the end of Governing Coalition impacts Tax

While Numerous Legislative Projects are Expected to be delayed, Minority…

-

US: Republicans Positioned to Control Congress and Push Tax Cuts

Republicans are Set to Tackle Key Agenda Amid Federal Debt…

-

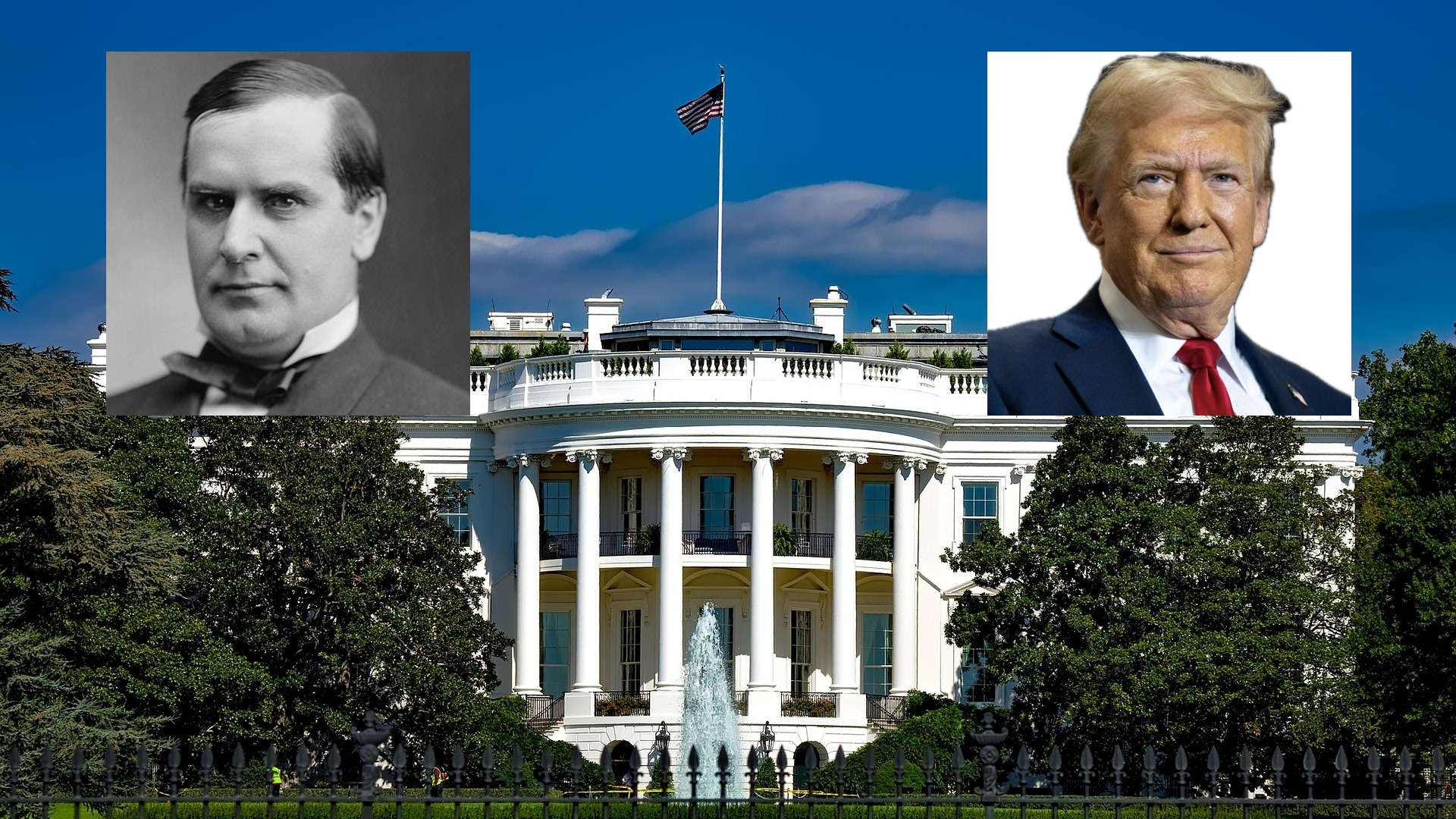

William McKinley’s Economic Policy Evolution: Lessons for Trump’s Second Term

William McKinley began with a strong stance on high tariffs…

-

Breaking News: European Union Finally Adopts VIDA Package to Modernize VAT System

Real-Time Digital Reporting and E-Invoicing will become mandatory in the…

-

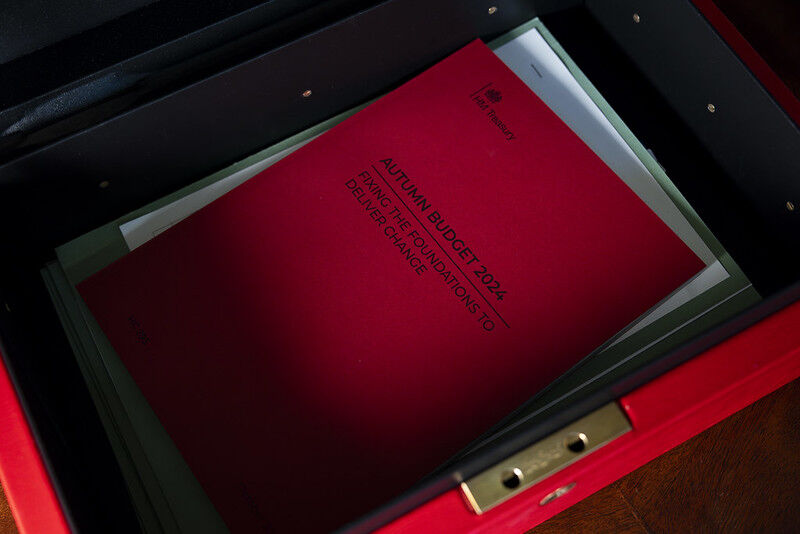

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

US IRS Announces Inflation Adjustments for Tax Year 2025

Details on adjustments and modifications to over 60 tax provisions…

-

UK Prime Minister’s Definition of “Working People” Sparks Debate as Labour Faces Scrutiny Over Upcoming Budget

Awaiting for Labour´s First UK Budget in 14 years, to…

-

EU Commission Proposes DAC9 to Simplify Compliance for Businesses under Pillar 2 Directive

Enhanced Administrative Cooperation in Taxation: update is aimed at simplifying…

-

Argentina Announces Dissolution of Federal Tax Authority (AFIP) and Creation of New Agency

Collections and Customs Control Agency (ARCA) will be established with…

-

France’s 2025 Budget: Tax Hikes targeting the Rich and Spending Cuts to Address Deficit

2025 Budget Plan: €20 billion is expected to be sourced…

-

Australia´s Administrative Review Tribunal Begins Operations

New Pathway for Taxation Disputes

-

OECD Examines Tax Arbitrage in Closely Held Businesses

OECD Taxation Working Papers No 70 Released

-

Egypt introduces the First Package of Tax Reforms aimed at Driving Economic Transformation and Attracting Investment

20 Key Measures to Build Trust with Taxpayers and Streamline…

-

EU Reaffirms Commitment to Inclusive and Effective International Tax Cooperation

EU has approved its official position concerning UN Framework Convention…

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

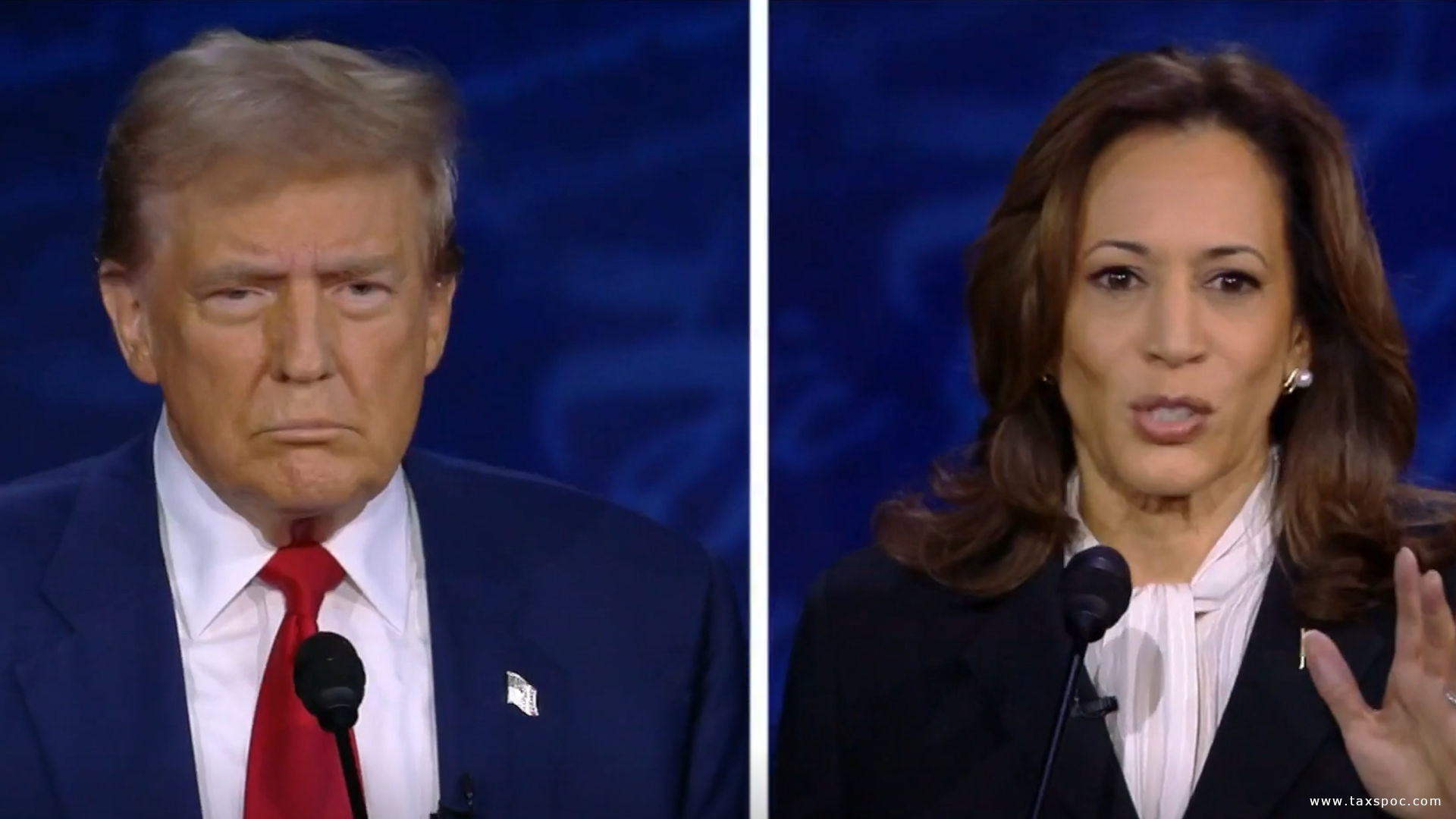

US International Tax Policy Update: Harris Supports Biden Reforms while Trump Proposes Tariff Changes

Democrats are drafting legislation in case Harris wins, Trump proclaims…

-

UK´s HMRC is Hiring in Tax in Large Numbers!

HMRC Launches Recruitment Campaigns, 5,000 new compliance staff are expected…

-

UK: Upcoming Consultation on E-invoicing for B2B and B2G; Digital Transformation Roadmap will be released in Spring 2025

UK´s Chancellor Unveils Series of Measures to Deliver on Government’s…

-

The Netherlands: Budget Day 2025 and Tax Changes Announced

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

-

New European Commission and the apparent downscaling of Taxation from the priorities

Taxation sits in an unlikely portfolio with Climate, Net Zero,…

-

Colombian 2024 Tax Reform Bill Submitted to Congress

Impact on Corporate and Capital Gains Rates

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will…

-

US: IRS Recovers $172 Million from 21,000 Non-Filing Wealthy Taxpayers in First Six Months of New Initiative

This initiative marks a turning point in IRS enforcement, as…

-

Highly anticipated US Presidential Debate started with Taxes

Taxes at the Forefront of the US Presidential Elections with…

-

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

South Africa: Highlights from the 2024 Draft Taxation Laws and Draft Tax Administration Laws Amendment Bills

Available for Public Comment

-

The Anticipation of Donald Trump’s Latest Tax Returns

So far, deviating from the practice followed by other major…

-

Australian Taxation Office Releases Annual Corporate Plan

Focus on new high-risk tax areas for multinationals, Improvement of…

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

Kamala Harris Plans Increase of Corporate Tax Rate to 28%

Unveiled during the Democratic National Convention in Chicago

-

Australia´s New Code to Enhance Professional Standards for Tax Practitioners

Aims to Restore Public Trust in Tax Profession