Tax Technology

-

The EY 2024 Tax and Finance Operations Survey: Managing Transformation Amid Cost Pressures and Talent Shortages, with GenAI Still Underutilized

Companies struggle with “Doing More with Less” in Ever More…

-

HMRC Issues New VAT Compliance Guidelines

HMRC’s expectations around VAT accounting

-

Poland: Rules for the Digitization of Accounting Documentation in CIT

Mandating the use of structured electronic formats for accounting records

-

UK: Reporting Rules for Digital Platforms

HMRC published Rules for Digital platforms that let users sell…

-

Vertex, Inc. Acquires ecosio to Enhance E-Invoicing and Compliance Solutions

Adding EDI and E-invoicing Capabilities

-

KPMG LLP Forms Strategic Alliances with Cryptio, Dataiku, and Avalara to Enhance Digital Capabilities

Increased focus on AI adoption, Crypto asset accounting and tax…

-

EY Announces $1 Billion Investment to Elevate Early Career Opportunities in Accounting

Increasing early career compensation and development, Integrating AI in Tax…

-

Poland: E-invoicing Officially Postponed to 2026

President Signs Bill Postponing Mandatory KSeF Implementation

-

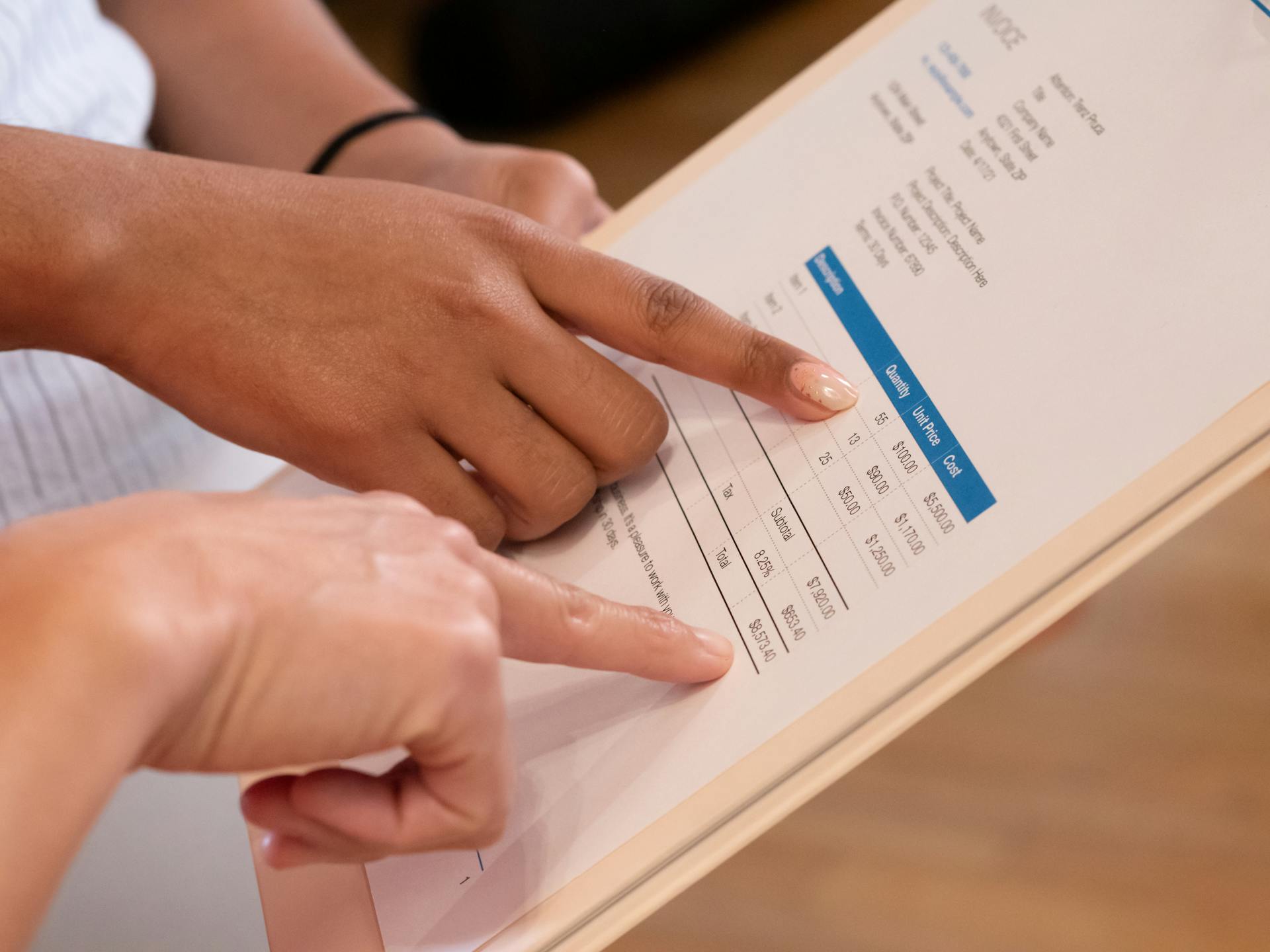

Vertex Acquires AI Capabilities from Ryan, LLC

Aims at Enhancing Tax Technology Solutions and Accelerating AI Innovation

-

France: Update on E-invoicing

Technical specifications expected June 19, 2024, Go Live deadlines maintained

-

Spanish E-Invoicing: Expected Delay

Rumor has it Spanish e-invoicing will be deferred to mid…

-

European Union: ViDA and Withholding Taxes Take a Central Stage in the Upcoming ECOFIN Meeting Agenda

ECOFIN Council Meeting of May 14, 2024 has 2 Tax…

-

Sneak Peak to Revised ViDA draft up for Vote May 14, 2024

Digital Reporting Requirements, Platforms, Single VAT Registration

-

European Union: ViDA is priority for the Belgian Presidency, expectations of reaching an agreement potentially in May or June

Latest update from VAT Expert Group discussions

-

Germany: E-Invoicing Approved

Parliament Approves Legislation Introducing E-Invoicing Mandate