Transfer Pricing

-

UK Launches Open Consultation on Transfer Pricing, Permanent Establishment and Diverted Profits Tax

Stakeholders are invited to review the draft legislation and submit…

-

Turkey Decides Not to Implement OECD’s Amount B for Now

Amount B will not be applied to transactions involving distributors,…

-

Council Reaches Political Agreement on DAC9

MNEs will be required to submit their first top-up tax…

-

Pillar One Amount B: Key Update on Marketing and Distribution Activities

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B…

-

India Unveils Union Budget 2025 with Tax Reforms reinforcing ambition to become a global investment and financial hub

New Income Tax Bill on the horizon, push for certainty…

-

Accenture Secures Landmark Victory in the Danish Supreme Court

First Ruling Favoring a Taxpayer in a Transfer Pricing Case

-

US: IRS Outlines Plans on Simplified Approach for Pricing Controlled Transactions Involving Marketing and Distribution activities

Notice 2025-4 Aligns with OECD Report on Amount B of…

-

Transfer Pricing and Tax Compliance in Morocco: Navigating the Evolving Landscape

An In-depth Exploration of Morocco’s Transfer Pricing Regulations, OECD Alignment,…

-

UAE Implements Domestic Minimum Top Up Tax

Ministry of Finance Announces Updates to Corporate Tax Law Affecting…

-

Germany’s New Transfer Pricing Compliance Rules for 2025

Stricter deadlines, higher penalties effective January 1, 2015

-

OECD 2023 MAP & APA Awards: Discover the Fastest, Most Efficient amongst OECD Countries

Announced at the 2024 OECD Tax Certainty Day, celebrating jurisdictions…

-

Navigating the ESG Landscape: Transfer Pricing in a Sustainable World

Exploring how ESG principles are reshaping business practices and financial…

-

Australia: Insights on Tax Settlements and Compliance in 2023–24 for Public and Multinational Businesses

Litigation resulted in favorable outcome for ATO in 53% of…

-

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

Australia: Changes to Country-by-Country Local File Reporting

Effective from 1 January 2025, most significant change to CbC …

-

EU Reaffirms Commitment to Inclusive and Effective International Tax Cooperation

EU has approved its official position concerning UN Framework Convention…

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

US IRS Updates on Transfer Pricing Penalties

Stricter Enforcement and Documentation Standards

-

Apple Case: Ireland´s reaction to getting 13 bln EUR richer

Transferring the assets in the Escrow Fund to Ireland will…

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and…

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

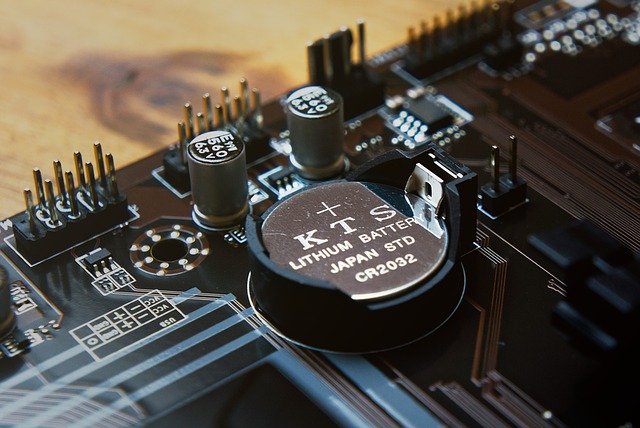

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

Coca-Cola to Pursue Appeal Following Tax Court Decision

$16 billion of Potential Incremental Tax and Interest Liabilities

-

European Union: Draft Regulation on Corporate Income Tax Reporting establishes Common Template and Electronic Formats

New regulation aims to enhance tax transparency and comparability across…

-

Renewal of Qualified Maquiladora Approach Agreement Between U.S. and Mexico in 2024

This is the second renewal of the agreement, preserving the…

-

European Court of Justice: Upholding the EU Directive on Tax Reporting Obligations

CJEU upholds EU directive on tax reporting for cross-border arrangements.…

-

European Union: Evaluation of the Anti-Tax Avoidance Directive In Progress

Have Your Say on the Directive aimed to fight aggressive…

-

Constitutional Court Rules Mandatory Disclosure Rules (MDR) Unconstitutional

What a month for Mandatory Disclosure Rules (MDR) in Poland!

-

Belgium: Administrative Tolerance for 2024 Moves Registration Requirement under Pillar 2 Regulations

Only applicable to groups that will not make Belgian advance…

-

New Transfer Pricing Framework Introduced in Brazil

Aligned with OECD Guidelines

-

Australia: Public Country-by-Country Reporting Legislation Introduced to the Parliament

If approved, public CbC reporting will be effective for reporting…

-

US Efforts to Preserve Global Corporate Tax Deal Face Challenges

Pillar 1 encounters roadblocks

-

Inclusive Framework on BEPS Targets Multilateral Convention Signature by End of June

Advancing towards a final agreement on Pillar One, the anticipated…

-

EU Council Decision to Open Negotiations for amendment of the Agreements concerning the automatic exchange of financial account information to improve international tax compliance

Concerns negotiations between European Union and the Swiss Confederation, the…

-

Belgium: Pillar Two Mandatory Notification for MNEs and Large Domestic Groups

On May 21, 2024, the Belgian tax administration released new…

-

Belgian Parliament Adopts New Pillar Two Law with Key Modifications

Rectification of prior legislative oversights identified in the original December…

-

OECD publishes 334 pages Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023)

Tax Challenges Arising from the Digitalisation of the Economy.

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

European Union: Proposal on Transfer Pricing Adjustments: Understanding Primary, Corresponding, and Compensating Adjustments

Explanatory Memorandum on the Proposal of Council Directive on Transfer…

-

Enhancing Tax Transparency: Australia’s New Requirements for Disclosure of Subsidiaries in Financial Reports

Aiming at greater transparency and accountability in corporate tax matters

-

India’s Advance Pricing Agreement (APA) Programme: The Comprehensive Procedural Framework

A structured and proactive approach to transfer pricing certainty

-

European Union: Progress on the EU Council Directive on Transfer Pricing

The directive should apply from 1 January 2025 (instead of…