Economic Growth

-

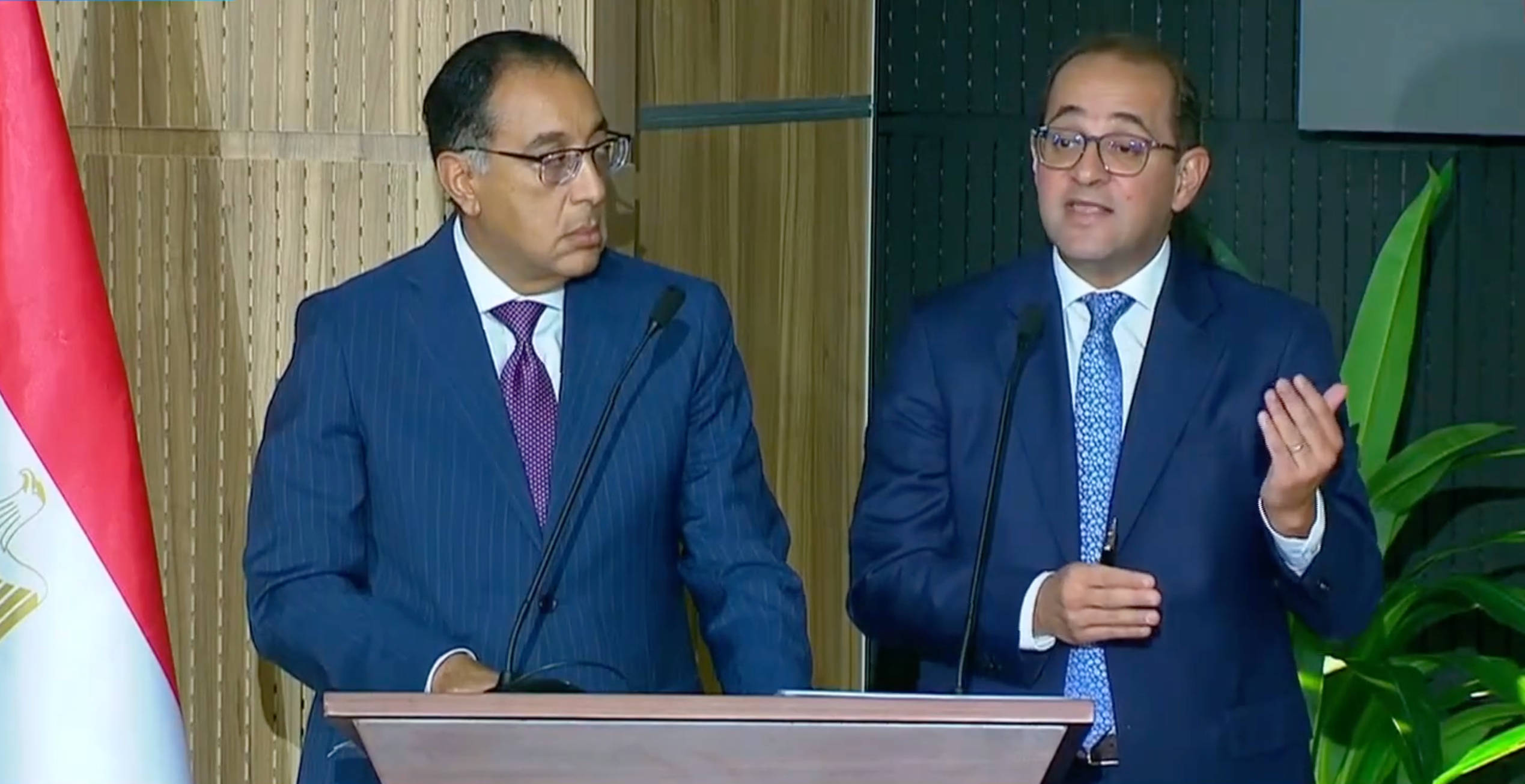

Egypt 2025: Launching the Strategic Committee for Digital Economy and Entrepreneurship

A Pivotal Step Towards Enhancing Innovation and Economic Growth in…

-

Egypt And The Sultanate Of Oman Convention For The Elimination Of Double Taxation And The Prevention Of Tax Evasion With Respect To Taxes On Income.

Ensuring Tax Fairness and Promoting Stronger Economic Ties Between the…

-

China’s New VAT Law is Set to Take Effect January 1, 2026

Adopted end of December 2024, it aims aligning China´s VAT…

-

Egypt introduces the First Package of Tax Reforms aimed at Driving Economic Transformation and Attracting Investment

20 Key Measures to Build Trust with Taxpayers and Streamline…

-

Highly anticipated US Presidential Debate started with Taxes

Taxes at the Forefront of the US Presidential Elections with…

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

Finland Aims to Boost Revenue with Sweeping Tax Changes in 2025 Budget Proposal

Ministry of Finance proposes VAT hikes, small business relief, and…

-

OECD Participates in G20 Finance Ministers and Central Bank Governors Meeting in Rio de Janeiro

Key reports on international tax cooperation, digital economy challenges, and…

-

UK Under Labor Government: Expected Renewed Focus on Large Business and Wealthy Individuals

A Review of Labour Party’s Manifesto on Taxation

-