EMEA

-

European Union: Judgement on VAT Fixed Establishment ECJ case Adient C-533/22

The ECJ provides clarification on the concept of a VAT…

-

European Union: ECJ Judgement In Case C-696/22, C SPRL

VAT Liability does not necessarily require actually receiving remuneration

-

Poland: E-invoicing Officially Postponed to 2026

President Signs Bill Postponing Mandatory KSeF Implementation

-

-

Inclusive Framework on BEPS Targets Multilateral Convention Signature by End of June

Advancing towards a final agreement on Pillar One, the anticipated…

-

Spanish E-Invoicing: Expected Delay

Rumor has it Spanish e-invoicing will be deferred to mid…

-

EU Council Decision to Open Negotiations for amendment of the Agreements concerning the automatic exchange of financial account information to improve international tax compliance

Concerns negotiations between European Union and the Swiss Confederation, the…

-

Italy: PLASTIC TAX postponed to July 1st, 2026!

Postponed again!

-

Latvia e-invoicing: Draft law Published, Public Consultation Opened

E-invoicing is planned to become mandatory January of 2026 for…

-

The Netherlands: New Coalition Government Unveils Ambitious Tax Plans

Tax Plans concern mainly VAT, Fly Tax, Plastic Packaging Tax

-

Belgium: Practicalities on Notification Requirement for In-Scope Groups Under Belgian Pillar Two Rules

Registration to obtain number from the Belgian Trade Register

-

Belgian Parliament Adopts New Pillar Two Law with Key Modifications

Rectification of prior legislative oversights identified in the original December…

-

Sneak Peak to Revised ViDA draft up for Vote May 14, 2024

Digital Reporting Requirements, Platforms, Single VAT Registration

-

European Union – New Zealand Free Trade Agreement Came into Effect on May 1, 2024

Most goods will have tariffs removed upon the FTA’s commencement

-

Proposal for Modernizing VAT Rules in the Digital Age: VIDA Directive

A look at Explanatory Memorandum to the Council Directive amending…

-

Poland: New E-Invoicing Timeline

Detailed Analysis of the KSeF Audit: Unveiling Flaws and Planned…

-

UAE CIT Registration: When to Register

CIT Registration Dates are fast approaching

-

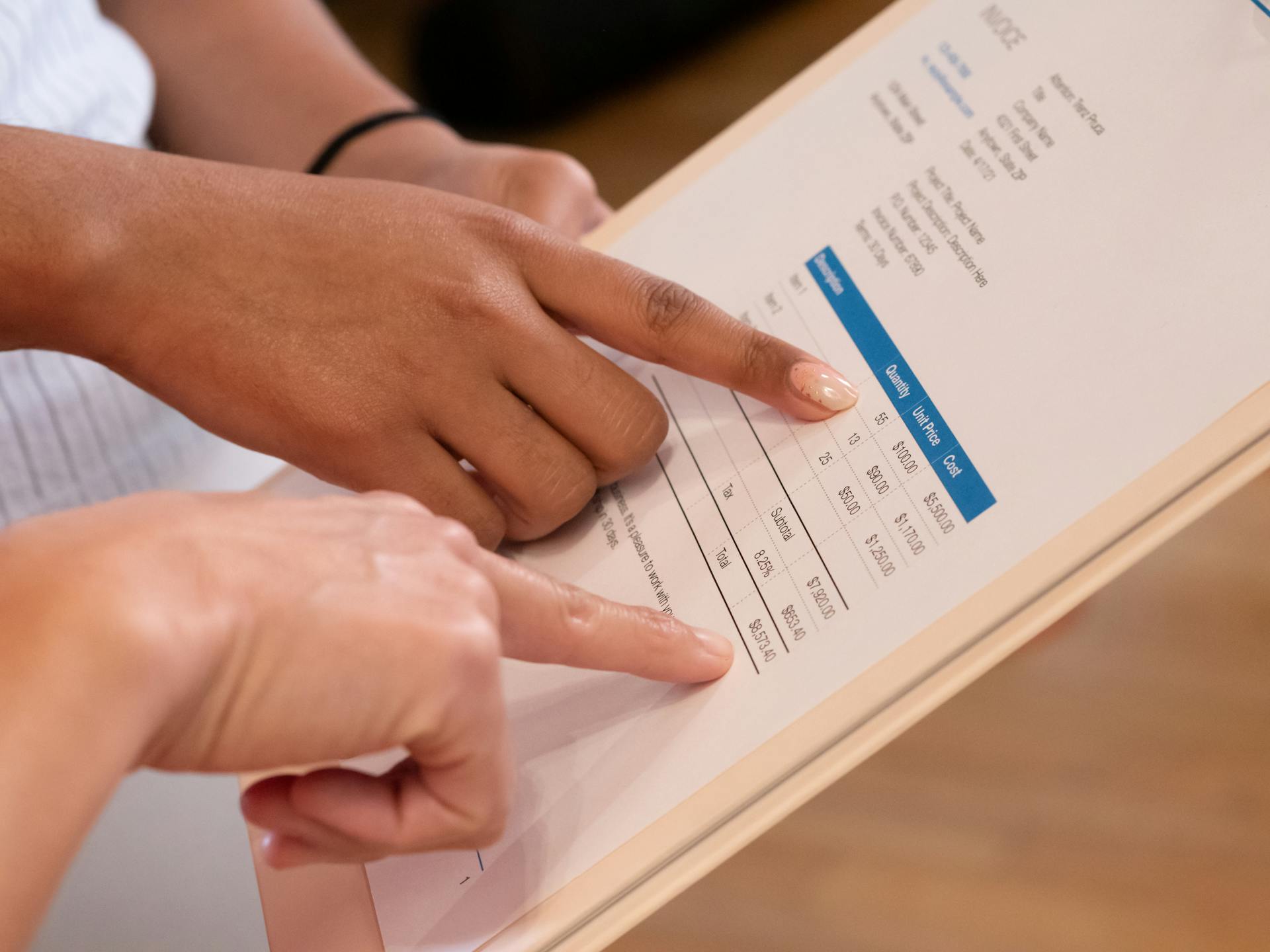

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

Spain Priorities: Football it is!

”Mbappe Law” follows a precedent set by Real Madrid with…

-

Saudi Arabia Guidelines for Regional Headquarters Tax and Zakat Rules

Saudi Arabia unveiled a 30-year tax incentive for multinational companies…

-

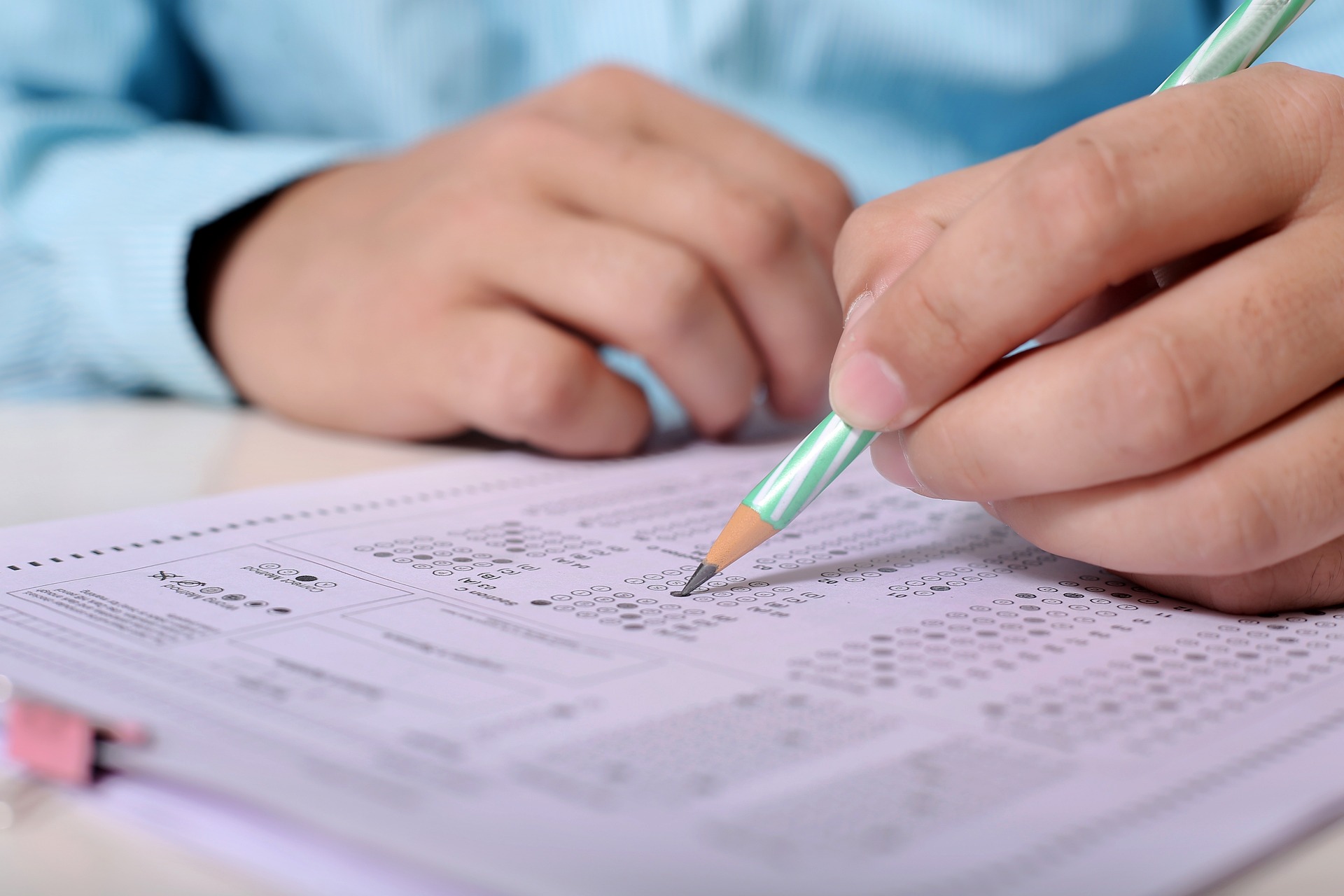

KPMG’s Record Penalty for Exam Cheating Scandal

Historic $25 million fine on KPMG Netherlands for pervasive cheating…

-

G20 Considers Global Minimum Tax on Billionaires

Brazil and France at the forefront in bringing forward the…

-

Finland: Government will raise VAT to 25.5 percent aiming to collect one billion euros a year more

The government is considering implementing the VAT rise before year…

-

Italy and UK reaches reciprocity Agreement on VAT Refund Claims

The agreement will have retrospective effect from 1 January 2021

-

Oman Automatic Exchange of Information (AEOI) System Update

Automatic Exchange of Information (AEOI) system is now available for…

-

European Union: VAT Expert Group Deliberates on Key VAT Policy and Implementation Measures

The VAT Expert Group (VEG) recently convened in Brussels for…

-

European Union: ViDA is priority for the Belgian Presidency, expectations of reaching an agreement potentially in May or June

Latest update from VAT Expert Group discussions

-

European Union: Progress on the EU Council Directive on Transfer Pricing

The directive should apply from 1 January 2025 (instead of…

-

Saudi Arabia: VAT Refund Procedures for Non-Residents

A reminder of the key points regarding the VAT refund…

-

Polish Government Adopts DAC7 Bill to Enhance Tax Transparency

The enactment of this act is anticipated to greatly improve…

-

Italy’s Plastic Tax planned to come into effect on July 1, 2024 expected to be postponed again

Expected postponement for the 7th time until July 1 2026.…

-

Germany: E-Invoicing Approved

Parliament Approves Legislation Introducing E-Invoicing Mandate