Indirect Tax

-

EU VAT: new ruling on EV charging – key insights for CPOs and eMSPs

CJEU ruling clarifies EU VAT treatment for EV charging value…

-

France: Update on E-invoicing

Technical specifications expected June 19, 2024, Go Live deadlines maintained

-

Spanish E-Invoicing: Expected Delay

Rumor has it Spanish e-invoicing will be deferred to mid…

-

Italy: PLASTIC TAX postponed to July 1st, 2026!

Postponed again!

-

The Netherlands: New Coalition Government Unveils Ambitious Tax Plans

Tax Plans concern mainly VAT, Fly Tax, Plastic Packaging Tax

-

European Union: 13th Directive VAT Refund Deadline is fast approaching!

Non- EU business eligible to file VAT refund claim in…

-

European Union: ViDA and Withholding Taxes Take a Central Stage in the Upcoming ECOFIN Meeting Agenda

ECOFIN Council Meeting of May 14, 2024 has 2 Tax…

-

Sneak Peak to Revised ViDA draft up for Vote May 14, 2024

Digital Reporting Requirements, Platforms, Single VAT Registration

-

Proposal for Modernizing VAT Rules in the Digital Age: VIDA Directive

A look at Explanatory Memorandum to the Council Directive amending…

-

Poland: New E-Invoicing Timeline

Detailed Analysis of the KSeF Audit: Unveiling Flaws and Planned…

-

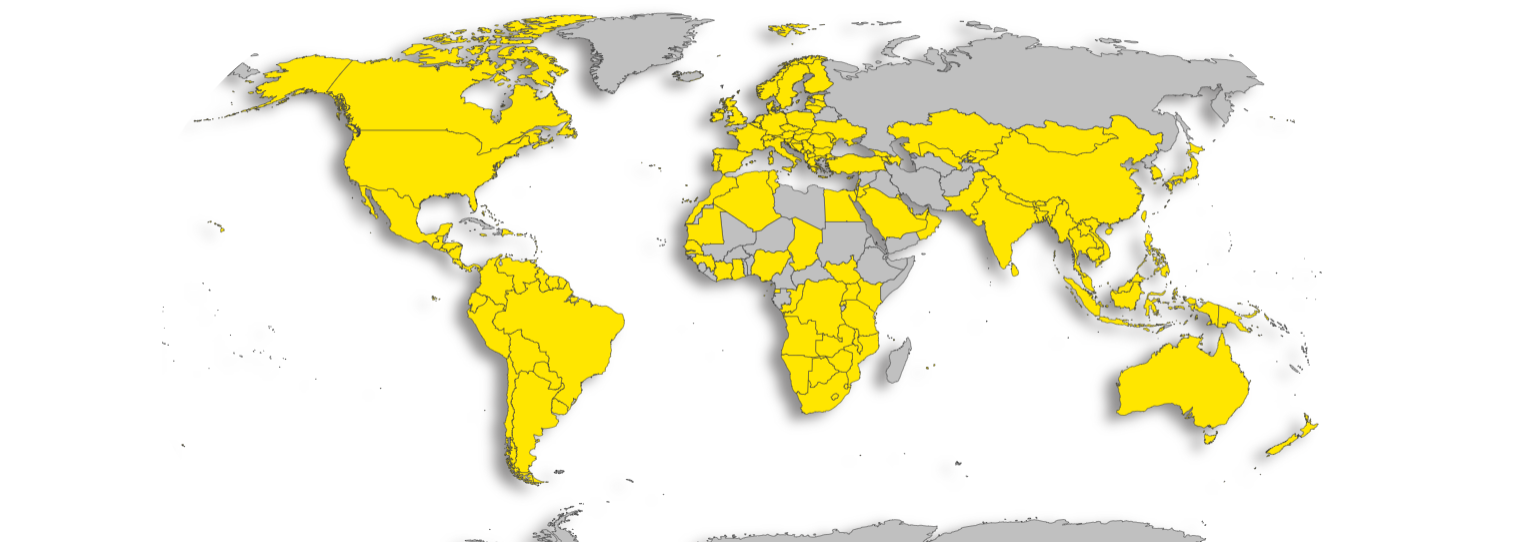

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

-

Brazil: expected VAT Rate Revealed!

First version of Tax Reform Proposal by Brazil´s Finance Minister…

-

Finland: Government will raise VAT to 25.5 percent aiming to collect one billion euros a year more

The government is considering implementing the VAT rise before year…

-

Italy and UK reaches reciprocity Agreement on VAT Refund Claims

The agreement will have retrospective effect from 1 January 2021

-

Implementation of e-Invoice in Malaysia: Frequently Asked Questions (FAQs)

Failure to issue e-Invoice may result in penalties or imprisonment…

-

Singapore E-invoicing: Phased adoption starting November 2025, Peppol standard

Implementation of InvoiceNow for GST-Registered Businesses and Free InvoiceNow Services…

-

European Union: ViDA is priority for the Belgian Presidency, expectations of reaching an agreement potentially in May or June

Latest update from VAT Expert Group discussions

-

European Union: VAT Expert Group Deliberates on Key VAT Policy and Implementation Measures

The VAT Expert Group (VEG) recently convened in Brussels for…

-

Canada: Retroactive Amendments Regarding Software Taxability in British Columbia

Proposed Budget Changes in British Columbia (BC), Canada, contain retroactive…

-

Brazil’s VAT Reform Progress: April 2024

Legislators roll up their sleeves preparing for Brazil´s VAT implementation

-

Italy’s Plastic Tax planned to come into effect on July 1, 2024 expected to be postponed again

Expected postponement for the 7th time until July 1 2026.…