Tax Policy

-

US: Trump Administration Cuts 6,700 IRS Jobs Amid Tax Season

Many of the eliminated positions are associated with tax compliance…

-

China’s New VAT Law is Set to Take Effect January 1, 2026

Adopted end of December 2024, it aims aligning China´s VAT…

-

European Union: Council Introduces Electronic VAT Exemption Certificate

Modernizing Tax Procedures, replacing paper VAT exemption certificates for Embassies,…

-

OECD 2023 MAP & APA Awards: Discover the Fastest, Most Efficient amongst OECD Countries

Announced at the 2024 OECD Tax Certainty Day, celebrating jurisdictions…

-

UK Companies to Receive £700 Million Windfall After European Court of Justice Reverses Tax Ruling

Repayment obligation on the UK government at a time of…

-

EU Court Confirms Legality of Dutch Law Limiting Interest Deduction on Intra-Group Loans

Judgment of the Court of Justice of the European Union…

-

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax Policy

Corporate Income Tax | Direct Tax | European Court of Justice | European Union | Latest News | Tax PolicyUK Wins EU Dispute on CFC Rules at the Court of Justice

EU’s Legal Setback and Britain’s Win Reinforce Sovereignty Over Tax…

-

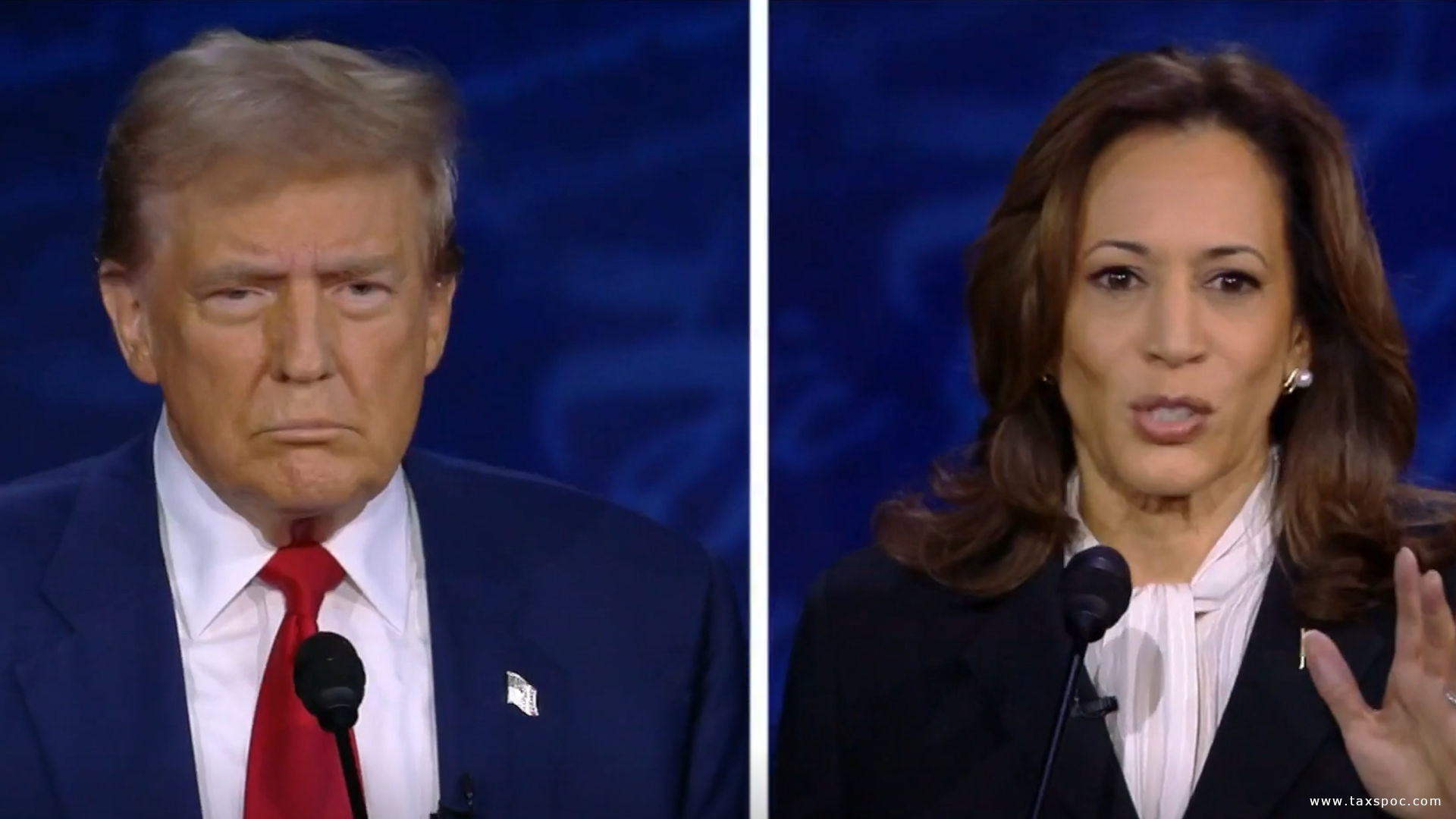

US International Tax Policy Update: Harris Supports Biden Reforms while Trump Proposes Tariff Changes

Democrats are drafting legislation in case Harris wins, Trump proclaims…

-

Latest OECD publications on the outcomes of the implementation of BEPS Action 13 and Action 14

Latest BEPS Developments

-

US Presidential Debate Transcript on Tax and Tariffs

Trump and Harris in their own words at the US…

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

Australian Taxation Office Releases Annual Corporate Plan

Focus on new high-risk tax areas for multinationals, Improvement of…

-

UK Prime Minister Keir Starmer Unveils Plans to “Fix the UK’s Foundations”

Starmer’s ambitious plan targets UK’s fiscal challenges, hinting at tough…

-

UN Tax Framework Convention: the final text of the Terms of Reference (TOR) adopted with notable votes against or abstention

A path to a universally accepted and effective international tax…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

HM Treasury Update: Key Tax Reforms Announced Ahead of Budget under Labor

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC…

-

Oman Set to Introduce Personal Income Tax

A Gulf First, Expected to be in Single Digits. What…

-

US Treasury and IRS Issue Final Regulations on Excise Tax for Stock Repurchases

Guidance for complying with the new excise tax on stock…

-

Global Corporate Tax Rates Stabilize, OECD Reports

The OECD’s latest report provides extensive data on over 160…

-

Italy: New Rules on Administrative and Criminal Tax Sanctions

Changes Affect Penalties Regarding Income Tax, VAT, and Withholding Tax…

-

Stalemate at the ECOFIN Meeting: Estonia Blocks ViDA Initiative

Stalemate at the ECOFIN Meeting: Estonia Blocks ViDA Initiative

-

UK: HMRC publishes Tax Gap Analysis for 2022- 2023

Tax Gap Estimated at 39,8 billion GBP for one year