Transfer Pricing

-

Pillar One Amount B: Key Update on Marketing and Distribution Activities

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B…

-

Accenture Secures Landmark Victory in the Danish Supreme Court

First Ruling Favoring a Taxpayer in a Transfer Pricing Case

-

US: IRS Outlines Plans on Simplified Approach for Pricing Controlled Transactions Involving Marketing and Distribution activities

Notice 2025-4 Aligns with OECD Report on Amount B of…

-

Germany’s New Transfer Pricing Compliance Rules for 2025

Stricter deadlines, higher penalties effective January 1, 2015

-

OECD 2023 MAP & APA Awards: Discover the Fastest, Most Efficient amongst OECD Countries

Announced at the 2024 OECD Tax Certainty Day, celebrating jurisdictions…

-

Navigating the ESG Landscape: Transfer Pricing in a Sustainable World

Exploring how ESG principles are reshaping business practices and financial…

-

Australia: Insights on Tax Settlements and Compliance in 2023–24 for Public and Multinational Businesses

Litigation resulted in favorable outcome for ATO in 53% of…

-

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer Pricing

Direct Tax | E-Invoicing and E-Reporting | Indirect Tax | Latest News | Tax Policy | Transfer PricingDeep Dive into Tax Measures from UK´s Autumn 2024 Budget

Alongside the many announced changes, key highlights include efforts to…

-

US IRS Updates on Transfer Pricing Penalties

Stricter Enforcement and Documentation Standards

-

UK´s HMRC Published Guidelines for Transfer Pricing Compliance for UK Businesses

Best practice approaches to Transfer Pricing to lower risk and…

-

Brazil: Key Tax and Regulatory Changes Announced

Multiple Tax developments in Brazil by the end of August:

-

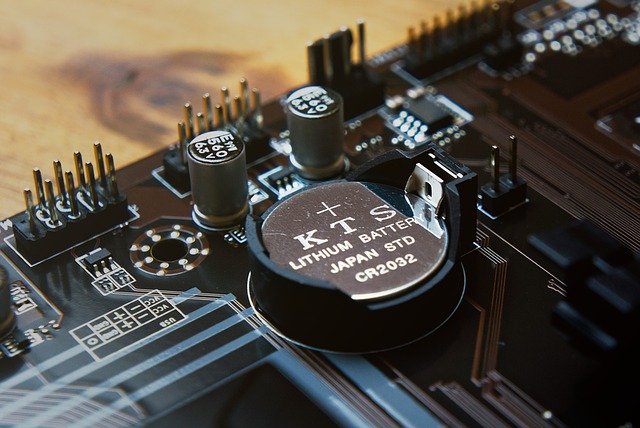

OECD Publishes Transfer Pricing Framework for Lithium

Essential for ensuring that developing countries can tax lithium exports…

-

Coca-Cola to Pursue Appeal Following Tax Court Decision

$16 billion of Potential Incremental Tax and Interest Liabilities

-

Renewal of Qualified Maquiladora Approach Agreement Between U.S. and Mexico in 2024

This is the second renewal of the agreement, preserving the…

-

New Transfer Pricing Framework Introduced in Brazil

Aligned with OECD Guidelines

-

OECD publishes 334 pages Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023)

Tax Challenges Arising from the Digitalisation of the Economy.

-

OECD/G20 Inclusive Framework on BEPS released the report on Amount B of Pillar One

A simplified approach to applying the arm’s length principle to…

-

European Union: Proposal on Transfer Pricing Adjustments: Understanding Primary, Corresponding, and Compensating Adjustments

Explanatory Memorandum on the Proposal of Council Directive on Transfer…

-

Enhancing Tax Transparency: Australia’s New Requirements for Disclosure of Subsidiaries in Financial Reports

Aiming at greater transparency and accountability in corporate tax matters

-

India’s Advance Pricing Agreement (APA) Programme: The Comprehensive Procedural Framework

A structured and proactive approach to transfer pricing certainty

-

European Union: Progress on the EU Council Directive on Transfer Pricing

The directive should apply from 1 January 2025 (instead of…